|

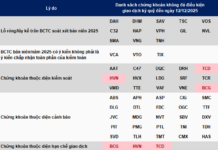

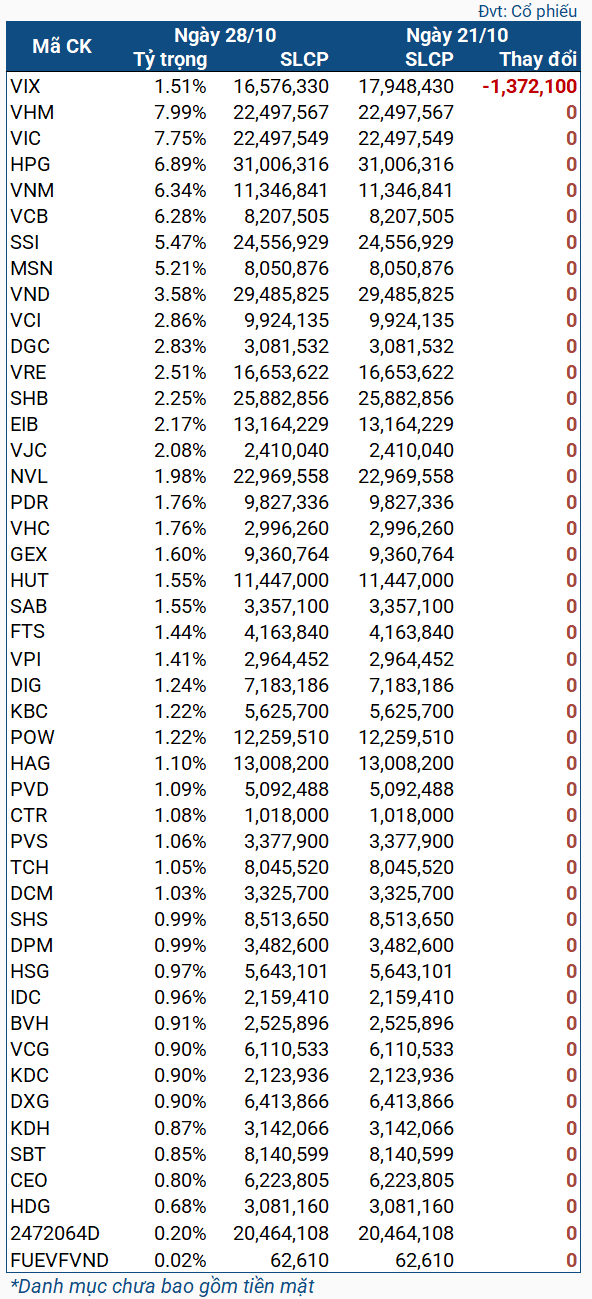

VNM ETF Stock Changes During the 21-28/10 Phase

|

Specifically, the foreign ETF fund sold nearly 1.4 million VIX shares during the above period, which was also the only code with transactions. In fact, in the trading weeks after the review results for Q3 were announced (early morning of 14/09), VIX was also the code that was sold off the most. According to the review results, VIX was the second code expected to be sold off in value.

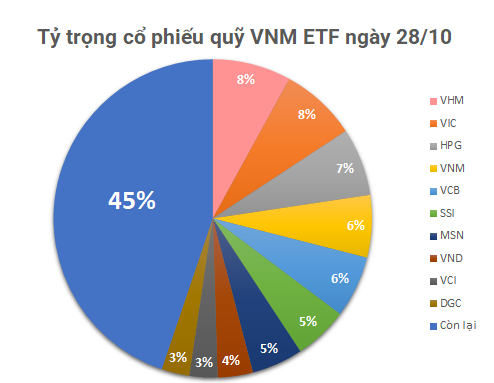

As of October 28, the net asset value of VNM ETF reached over $474 million, down from nearly $485 million recorded on October 21. The top weights belonged to VHM (7.99%), VIC (7.75%), HPG (6.89%), VNM (6.34%), and VCB (6.28%).

Chau An

The Astonishing Number of Vinhomes Shares Bought on the First Day of the Biggest Deal in Vietnam’s Stock Market History

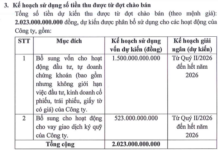

Vinhomes is committed to purchasing a minimum of 11.1 million shares daily and will acquire up to 37 million shares during the trading period, as per the regulations.

The Market Beat: VN-Index Struggles at the 1,270-Point Mark

The market closed with slight losses, as the VN-Index dipped by 0.67 points (-0.05%) to finish at 1,269.93, while the HNX-Index fell by 0.2 points (-0.09%) to 232.47. The market breadth was relatively balanced, with 330 decliners against 322 advancers. The large-cap VN30-Index painted a similar picture, with 16 stocks in the red, 11 in the green, and 3 unchanged.

Market Beat: Buyers Return in Afternoon Trade, VN-Index Surges Over 9 Points

The market ended the session on a positive note, with the VN-Index climbing 9.87 points (0.78%) to reach 1,281.85, while the HNX-Index gained 0.25 points (0.11%), closing at 231.77. The market breadth tilted in favor of the bulls, as evident from the advance-decline ratio of 411:256. A similar trend was observed in the VN30 basket, with 22 stocks advancing, 6 declining, and 1 remaining unchanged, resulting in a sea of green on the screen.

The Market Beat: The Tug-of-War Continues

As of the market close, the VN-Index dipped 1.06 points (-0.08%), settling at 1,285.46, while the HNX-Index witnessed a decline of 0.91 points (-0.4%), closing at 229.21. The market breadth tilted towards decliners, with 364 stocks falling against 315 advancing stocks. The VN30-Index basket saw a relatively balanced performance, with 13 stocks in the red, 12 in the green, and 5 unchanged.