The Vietnamese stock market opened in the green on October 30, riding on the momentum of the previous session’s gains. However, investor caution caused the VN-Index to turn negative and hover below the reference mark throughout the session. At the close, the VN-Index fell 3.15 points to 1,258.63. Trading liquidity on HoSE remained low, with a total trading value of 12,700 billion dong.

In terms of foreign investment, foreign investors continued to offload Vietnamese stocks, with a net sell-off of more than 144 billion dong across the market:

Foreign investors net sold 142 billion dong on HoSE

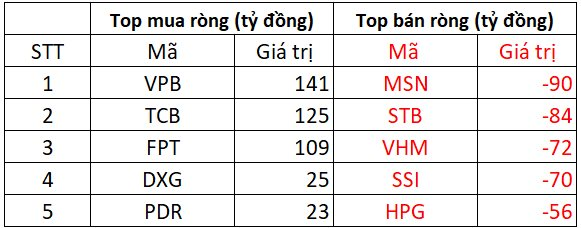

On the selling side, MSN faced the strongest selling pressure from foreign investors, with a net sell-off of 90 billion dong. STB also witnessed a significant net sell-off of around 84 billion dong, while VHM, SSI, and HPG experienced net selling between 56 and 72 billion dong.

Conversely, VPB, TCB, and FPT were the top three stocks favored by foreign investors on the HOSE, with a total net buy value of 375 billion dong. Foreign investors also net bought two real estate stocks, DXG and PDR, with values ranging from 23 to 25 billion dong.

Foreign investors net sold approximately 17 billion dong on HNX

TNG was the most bought stock on the exchange, with a net buy value of 7 billion dong. BVS, DTD, SLS, and VGS followed, with net purchases ranging from 1 to 2 billion dong.

On the selling side, IDC faced a net sell-off of 13 billion dong, while PVS saw a net sell-off of 7 billion dong by foreign investors. CEO, HUT, and SHS were also offloaded by foreign investors, with each stock witnessing a net sell-off of 1 billion dong.

Foreign investors net bought around 9 billion dong on UPCOM

MCH was the most purchased stock, with a net buy value of 6 billion dong. ACV, MPC, and ABI also attracted net buying interest, ranging from a few hundred million to a few billion dong.

Conversely, BSR faced a net sell-off of 3 billion dong, followed by VAB, OIL, IFS, and DGT, which were net sold by a few hundred million dong.

The Market Beat: When Diversification is Key

The market closed with the VN-Index down 3.15 points (-0.25%) to 1,258.63, while the HNX-Index bucked the trend, rising 0.32 points (+0.14%) to 225.88. The market breadth tilted towards decliners with 368 losers and 324 gainers. The large-cap stocks in the VN30-Index basket painted a similar picture, with 17 stocks in the red, 8 in the green, and 5 unchanged.

The Momentum of Declines Persists

The VN-Index ended the week on a bearish note, forming a Black Marubozu candlestick pattern while slicing through the middle Bollinger Band. This reinforces the increasingly pessimistic outlook. Moreover, trading volume remaining below the 20-day average underscores the growing investor caution. The MACD indicator continues its downward trajectory, reinforcing the sell signal. This suggests that the risk of short-term corrections persists.

The Wolf of Wall Street: Brokers’ Prop Trading Losses Mount in Market Rout

The proprietary trading arms of securities companies recorded net selling with a value of VND 94 billion across the entire market.