Global gold prices continue to soar to new historic highs ahead of the US presidential election, as investors fear missing out on the gold rush. Gold’s upward trajectory towards the $2,800 per ounce mark remains unwavering despite high US Treasury bond yields and a strong dollar, indicating that debt concerns are a more dominant driving force.

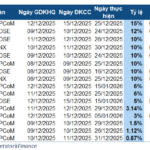

On Wednesday (Oct 30), spot gold prices rose by $10.3 per ounce, or 0.37%, to close at $2,785.9 per ounce on the New York market, according to Kitco exchange data.

As of early Thursday morning Vietnam time, spot gold prices in the Asian market dipped by $0.5 per ounce compared to the previous session, trading at $2,787.6 per ounce. This equates to approximately VND85.5 million per tael if converted using Vietcombank’s selling exchange rate, marking a VND300,000 increase compared to the same period yesterday.

During the US session, spot gold prices momentarily surpassed $2,789 per ounce, reaching an all-time high. Gold prices even flirted with the $2,800 per ounce mark, another record-breaking level.

“The US presidential election is approaching, and the political environment is highly volatile. The Federal Reserve is expected to cut interest rates further, and the war in Russia and Ukraine rages on,” said Daniel Pavilonis, a strategist at RJO Futures, highlighting the factors pushing gold prices upward.

“There are too many reasons for gold prices to climb higher. All this bad news is music to the ears of gold bulls. The next target for gold prices could be $2,850 per ounce,” Pavilonis added.

Gold’s relentless rally has attracted investors to the market despite the elevated price levels, a classic manifestation of FOMO. According to a report released by the World Gold Council (WGC) on October 30, global gold demand reached a record high in Q3 this year, driven primarily by investor demand. “Professional investors and institutions seem to be experiencing FOMO as gold’s surge grabs headlines,” WGC analysts wrote in the report.

Year-to-date, gold prices have climbed 35%, heading towards completing the strongest year since 1979.

Dominik Sperzel, head of trading at Heraeus Metals Germany, forecasts gold prices could reach $3,000 per ounce by 2025 due to factors such as renewed net purchases by gold ETFs and portfolio adjustments post-US elections.

One unusual aspect noted by analysts recently is gold’s relentless rally even as US Treasury bond yields and the dollar index surge, factors that typically exert downward pressure on gold prices.

On Wednesday, the yield on the 10-year US Treasury bond briefly surpassed 4.3%, the highest since July. By the session’s end, the yield on the 10-year note settled at 4.28%, up two basis points from the previous session.

The Dollar Index climbed above 104.4 points this week, a three-month high. On Wednesday, the index closed at 103.99 points, down from 104.32 points in the previous session but still up over 2% for October.

In a conversation with Kitco News, fund manager Ryan McIntyre of Sportt Inc. shed light on gold’s resilience in the face of these adverse factors.

He attributed it not only to the robustness of the US economy but also to the surge in US Treasury bond yields due to concerns about the country’s massive federal debt. This very concern has driven gold prices upward despite higher yields, as investors seek the safe haven of gold to hedge against debt risks.

“The question now is, with the US national debt continuing to rise, how high must yields go to attract new investors? I believe we are in an early phase where investors are starting to feel anxious about America’s debt burden. People are beginning to question whether inflation will rise further and if the money supply will increase even more,” remarked McIntyre.

The Glittering Gold Crash: When the Glitter Fades.

“Gold prices notched their fourth straight monthly gain as risk-averse investors sought safe havens ahead of the U.S. presidential election. The precious metal has been on a stellar run, buoyed by a perfect storm of factors, including a weak dollar, low interest rates, and heightened market uncertainty. This month’s performance adds to a string of impressive gains, solidifying gold’s status as a safe-haven asset in turbulent times.”

The Golden Rush: What’s Behind the Soaring Gold Prices?

In recent days, gold prices have been soaring to record highs. What insights and predictions do experts have about this trend and its potential future trajectory?

Gold Prices Stuck as US Treasury Yields Keep Rising

This week, gold prices could be volatile due to a slew of upcoming U.S. economic data, which is likely to reshape expectations for the Federal Reserve’s interest rate path. With markets closely watching for any insights into the Fed’s future moves, the precious metal’s performance hinges on these critical releases.

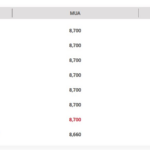

The Golden Opportunity: Unveiling the Latest SJC Gold Prices and Beyond

On the morning of October 22, domestic gold prices continued to surge, shining brighter than ever before.