Novaland (Novaland JSC, stock code: NVL) recently released its third-quarter financial report for 2024, showcasing significant improvements across several key indicators.

Specifically, the company recorded a remarkable 87% year-on-year increase in net revenue, reaching VND 2,010 billion. Despite a doubling of cost of goods sold to VND 1,465 billion, gross profit still climbed from VND 342 billion to VND 545 billion.

Notably, financial revenue surged to VND 3,898 billion, a 2.4-fold increase compared to the same period last year. Attributing this spike, Novaland explained that the primary driver was a semi-annual financial revenue adjustment made by the auditing firm in the reviewed report (VND 3,046 billion). As NVL fully received this amount during the third quarter of 2024, it was duly recognized in the current report.

Financial expenses witnessed a substantial 75% decline to VND 319 billion, of which VND 83 billion comprised interest expenses. Conversely, selling expenses and administrative expenses rose by 66.7% and 35.5%, respectively, totaling VND 104.4 billion and VND 354.8 billion.

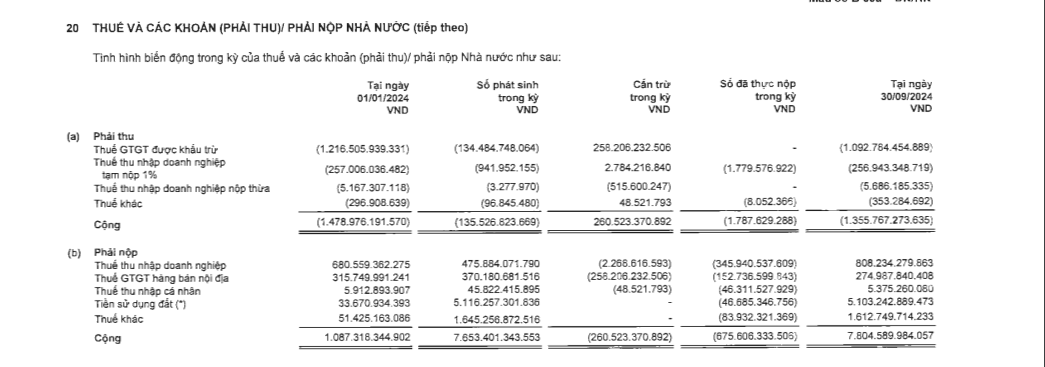

During this quarter, NVL acknowledged land use taxes and other state payable amounts totaling over VND 5,116 billion, a significant increase from the less than VND 34 billion recorded at the beginning of the year. Other taxes also witnessed a sharp increase, soaring from over VND 51 billion to VND 1,645 billion.

Source: NVL’s Q3 2024 Financial Report

Explaining the sudden surge in land use taxes, NVL attributed it to a difference in land valuation timing for a 30.1-hectare plot in the Lakeview City project between Century 21 International Development JSC (a Novaland subsidiary), Ho Chi Minh City People’s Committee, and Ho Chi Minh City Tax Department.

The Ho Chi Minh City People’s Committee, in its Decision 4777/QD-UBND dated December 29, 2020, approved the land price scheme for this plot, with the valuation dated back to April 2017 when the Committee decided to allow Century 21 to use the land. As per the Ho Chi Minh City Tax Department’s notifications 268/TB-CTTPHCM and 269/TB-CTTPHCM dated January 8, 2021, the total land rent and use fees payable by Century 21 amounted to nearly VND 5,176 billion.

After accounting for various taxes and fees, Novaland reported a net profit of VND 2,950 billion, a nearly 22-fold increase year-on-year. The net profit attributable to parent company shareholders stood at nearly VND 3,120 billion, an 18-fold rise compared to the same period last year.

For the first nine months of 2024, the company recorded net revenue of VND 4,295 billion, a 57% increase year-on-year. However, it posted a net loss of nearly VND 4,377 billion, falling short of the profit target of VND 1,079 billion set at the annual general meeting of shareholders in April 2024.

As of September 30, Novaland’s total assets stood at over VND 232,029 billion, a 4% decrease from the beginning of the year. Short-term receivables decreased by 5% to VND 44,489 billion, while cash and cash equivalents amounted to nearly VND 3,820 billion, and inventory stood at VND 145,006 billion, a 4% increase from the beginning of the year.

On the liabilities side, total liabilities decreased by 2% to VND 191,406 billion. Long-term liabilities from project development cooperation decreased by over 32% to VND 44,200 billion.

Other short-term payables amounted to VND 2,639 billion, including VND 2,527 billion payable to NovaGroup JSC and nearly VND 112 billion to Diamond Properties JSC. Notably, these two companies are related to Chairman Bui Thanh Nhon.

Source: NVL’s Q3 2024 Financial Report

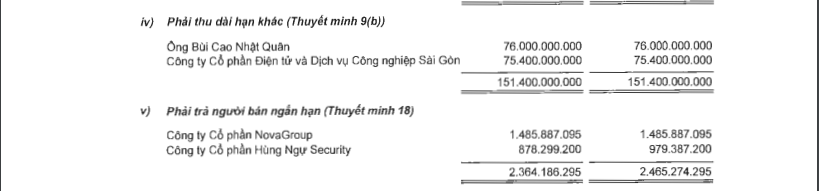

Additionally, according to the Q3 2024 financial report, NVL also had a long-term receivable of VND 76 billion from Bui Cao Nhat Quan, the son of Bui Thanh Nhon.

In a separate development, Novaland submitted a report to the State Securities Commission of Vietnam (SSC), the Ho Chi Minh City Stock Exchange (HoSE), and the Hanoi Stock Exchange (HNX), providing explanations and updates on its efforts to address the issues that led to the warning status of its securities.

The company stated that it had completed the disclosure of its 2024 semi-annual reviewed financial statements and related explanations as required by law on September 26. Additionally, it had disclosed its Q3 2024 financial statements on October 30, in compliance with the regulations on information disclosure in the securities market stipulated in Clause 3, Article 14.3.c of Circular No. 96/2020/TT-BTC.

Novaland affirmed its commitment to adhering to the relevant regulations and regimes regarding information disclosure to safeguard the interests of its investors and maintain transparency.

The company also expressed its hope that the regulatory authorities would facilitate the removal of the warning status on its securities in the near future.

Previously, NVL shares were ineligible for margin trading due to the company’s delay in publishing its 2024 semi-annual reviewed financial statements, which exceeded the deadline by more than five working days.

“The Rise of Quốc Cường Gia Lai: A Turnaround Story”

For the nine-month period, QCG’s net revenue reached VND 244 billion, a decrease of over 12%, while its pre-tax profit reached nearly VND 12 billion, an improvement from the loss of VND 5 billion in the same period last year.

The Rising Cost of Goods and Expenses: Hoa Sen Group Reports Loss for the Quarter

The sharp rise in raw material and operating costs has resulted in Hoa Sen Group posting a post-tax loss of VND 186 billion, a 142% decline compared to the same period last year when they recorded a profit of VND 438 billion. Despite this setback, the company has managed to surpass its annual revenue and profit targets for the financial year.

Unveiling the Income of Novaland, Phat Dat, and Dat Xanh’s Leaders

The real estate company’s Chairman and CEO continue to earn high salaries, despite the challenging market conditions.