OCH’s financial data for the first nine months of 2024 shows that the company recorded a pre-tax profit of nearly VND 160 billion, offsetting the full loss in the first half of the year and turning a profit.

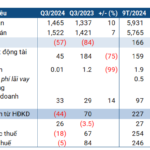

In Q3 2024, the company reported net revenue of VND 577 billion, a slight increase from the same period last year. Thanks to the reduction in cost of goods sold, gross profit for the owner of the Trang Tien Ice Cream brand increased by 4% to VND 344 billion.

Notably, interest expense surged to VND 26 billion, pushing the company’s financial expenses up to VND 36.8 billion, 7.4 times higher than the same period last year. At the same time, the company recognized other income of VND 58 billion, significant compared to VND 41 million in the same period last year, thanks to successful debt negotiation and settlement during the quarter.

After deducting expenses, the company reported a profit of VND 205 billion, up 56% from the same period last year, and this is also the first quarter of the year that the company turned a profit. Cumulatively, in the first nine months, the company achieved net revenue of VND 846 billion, equivalent to the same period last year. However, the loss of nearly VND 70 billion in the first half dragged down OCH’s profit to VND 135 billion, down 17% from the beginning of the year.

Illustrative image

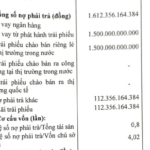

For the full year 2024, the company set a target of VND 1,078 billion in revenue and VND 43 billion in after-tax profit. As of the end of Q3, OCH has completed 78% of its plan and tripled the set target. Thanks to the improved business performance in Q3 2024, OCH’s accumulated loss decreased from VND 627 billion at the beginning of the period to VND 548 billion as of September 30, 2024.

In terms of the company’s financial situation, cash and cash equivalents reached VND 252 billion, up 50% from the beginning of the year. In addition, the company’s hold-to-maturity reserves also decreased by 36% to VND 28 billion.

Moreover, short-term revenue from customers increased sevenfold to VND 108 billion, of which revenue from Mika Trading Joint Stock Company remained the same as at the beginning of the year, while revenue from other customers fluctuated significantly.

M&A Strategy of the Owner of the Trang Tien Ice Cream Brand

According to OCH, the outstanding growth in Q3 2024 resulted from the expansion of borrowings to develop activities, including M&A deals and debt restructuring.

Notably, this orientation was also emphasized by the company at the 2024 Annual General Meeting of Shareholders. Specifically, OCH’s leaders stated that with the current brands and products, the company could achieve stable revenue of over VND 1,000 billion and consolidated profit of VND 180-200 billion, but it would be difficult to achieve a breakthrough growth. Therefore, the management board determined that the best driver for future development would be through mergers and acquisitions (M&A).

Mr. Le Dinh Quang, CEO of OCH, shared at the meeting: “We have met and assessed that with the current food brands and products, OCH will find it challenging to develop.” As a result, to create a momentum for outstanding development, OCH decided to engage in mergers and acquisitions (M&A).

The strategy mentioned by Mr. Quang involves the company acquiring businesses with products and markets that align with OCH’s development orientation.

This statement was made as, at the end of 2023, OCH had approved the acquisition of 100% of the charter capital of JP Good Food Joint Stock Company in 2023-2024.

Earlier, in early December 2023, OCH’s Board of Directors also approved a resolution on the acquisition of nearly 149,800 common shares of Kem Tin Phat with a par value of VND 100,000/share. As a result, OCH will become the parent company of this ice cream manufacturer. The transaction is expected to be completed within 2023-2024.

In Q3 2024, OCH’s Trang Tien Ice Cream brand also launched a new product line called Banh Trang Tien, with the first two products being Banh Com Dua and Phu The, focusing on traditional Vietnamese cakes. As a culinary heritage icon of Hanoi, each Banh Trang Tien cake embodies the essence of the thousand-year-old capital’s culture. The launch of this new product line is expected to contribute positively to OCH’s revenue in 2024.

“Soaring Provisioning Costs, Yet BVBank’s 9-Month Pretax Profit Triples Year-on-Year”

The consolidated financial statements show that despite increasing provisions for risk, BVBank (BVB on UPCoM) reported a remarkable pre-tax profit of nearly VND 182 billion for the first nine months, almost triple that of the same period last year. This impressive performance is attributed to a significant increase in core income from lending activities, showcasing the bank’s resilience and strong positioning in the market.

The Controller’s Wife Wants to Sell Her EIB Shares

Mrs. Tran Thi Thanh Nha, the wife of Mr. Ngo Tony, an American citizen and the Head of the Supervisory Board of Eximbank, plans to sell her entire stake in the bank. The sale, which will take place between October 30 and November 8, involves 123,298 shares, representing 0.006% of the bank’s capital. Mrs. Nha aims to recover her investment through this divestment.