The highlight of today’s session was the rapid rise of the banking and real estate sectors in the afternoon session.

In the banking sector, a number of stocks witnessed notable gains, including STB which increased by 1.15%, CTG by 2.73%, LPB by 1.23%, and VCB by 2.07%. As for the real estate sector, VHM rose by 0.85%, VIC by 1.34%, DXG by 0.3%, and KBC by 0.19%. These two sectors, with their large market capitalization, had a significant impact on the market’s performance.

The top 10 stocks that positively influenced the VN-Index were mostly from the banking and real estate sectors, with VCB leading the way, contributing 2.6 points to the index, followed by CTG with nearly 1.3 points and VIC with over 0.5 points.

In recent days, several large banks and real estate companies have announced positive third-quarter financial results for 2024. Notable examples include banks such as VCB, which reported an 18% increase in profits, CTG with a 35% rise, and BIDV with a 10% gain. In the real estate sector, companies like NVL reported a remarkable profit of over 3,000 billion VND, while KBC saw its profits increase tenfold.

The market’s liquidity was recorded at more than 19,269 billion VND, almost equal to the previous session on October 30th. The trading scenario indicated a rapid increase during the afternoon session.

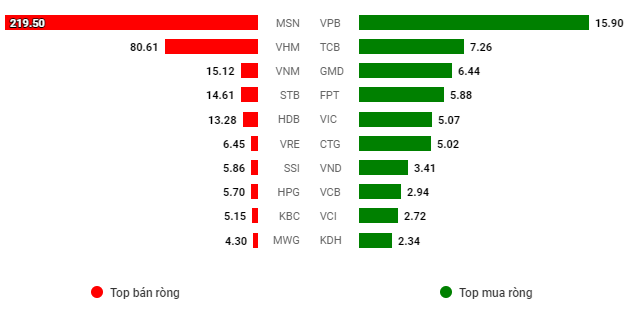

Foreign investors continued their strong net selling, offloading more than 1,635 billion VND worth of shares. The main stock that witnessed net selling was MSN, with over 1,332 billion VND, followed by VHM at nearly 203 billion VND. On the net buying side, efforts were noted in VPB with nearly 88 billion VND and CTG with almost 43 billion VND, but these were not significant enough to offset the overall net selling.

With today’s net selling, foreign investors have now recorded net selling for the 15th consecutive session, which seemed unexpected to investors not long ago when many signals indicated a reversal to a net buying trend.

14:00: Banks surprise with a surge, market “boosted”

Picking up from the recovery in the latter half of the morning session, the VN-Index continued to accelerate in the early afternoon session, with banks acting as the “boosting engine.”

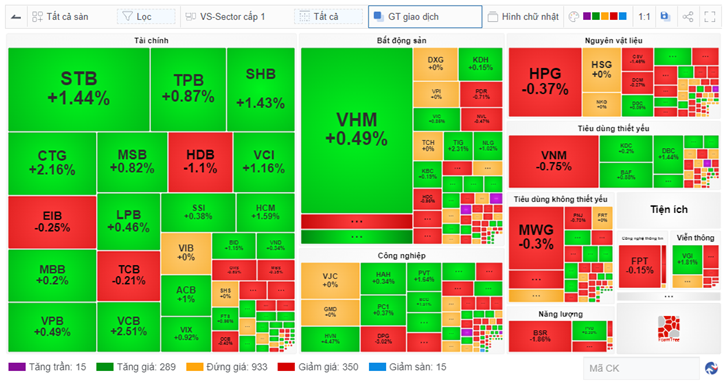

Looking at the market landscape, it’s evident that green dominated, especially in the banking sector, with stocks like STB surging 1.44%, CTG climbing 2.16%, SHB rising 1.43%, and VCB gaining 2.51%…

At present, VCB is leading the VN-Index in terms of point contribution, adding nearly 3.2 points, followed by a series of large banks such as CTG, BID, STB, and ACB. The top 10 stocks positively impacting the index contributed more than 6.9 points to the VN-Index, outweighing the nearly 1.5 points lost on the opposite side.

As a result, the indices climbed to higher levels, with the VN-Index rising 5.7 points to 1,264.33 and the HNX-Index climbing 0.21 points to 226.08. Meanwhile, the UPCoM-Index fell 0.33 points to 92.13.

|

Banking stocks drive the market higher

Source: VietstockFinance

|

In terms of foreign trading activities, the trio of banks VPB, CTG, and SHB witnessed the highest net buying, with respective values of nearly 58 billion VND, almost 33 billion VND, and close to 21 billion VND. However, net selling pressure remained concentrated on MSN, even intensifying to surpass 1,300 billion VND, causing the overall net selling value in the market to continue rising compared to the morning session.

Morning session: Efforts before lunch break bring the index near the reference level

The market faced pressure in the middle of the morning session and dipped below the 1,256-point level several times, but it quickly recovered to near the reference level before the lunch break.

Source: VietstockFinance

|

At the end of the morning session, the VN-Index edged slightly lower by 0.05 points to 1,258.58, while the UPCoM-Index also dipped marginally by 0.26 points to 92.20. The HNX-Index managed a slight gain of 0.02 points to reach 225.9.

Market liquidity exceeded 8,036 billion VND, increasing rapidly in the latter half of the morning session and slightly surpassing the previous session’s volume, as well as the 5-day average.

Out of the 24 sectors, 16 witnessed declines, with some sectors experiencing sharp drops, such as semiconductors (4.45%) and household and personal products (2.39%). Additionally, sectors like transportation, energy, and healthcare fell by over 1%.

On the upside, the telecommunications sector was the only one to rise by more than 1%, thanks to the momentum from VGI, which climbed 2.5%, and SGT, which gained 1.68%.

Looking at some of the large-cap sectors, there was a mixed performance among banking and real estate stocks, while the majority of leading stocks in the consumer staples sector declined.

Foreign investors continued to increase their net selling, with MSN leading the way with more than 467 billion VND, followed by VHM with over 107 billion VND. These two stocks alone created a significant disparity compared to the rest of the market, pushing the net selling value in the morning session to over 677 billion VND, pointing toward the 15th consecutive net selling session if there are no surprises in the afternoon session.

10:40: Many pillar stocks create pressure, MSN among top net sold

After a relatively calm start and a slight increase, the VN-Index turned downward, dipping below the 1,256-point level. The underperformance of several pillar stocks was a key factor contributing to the index’s struggle.

It’s evident that the declines in pillar stocks like VHM, which fell by 1.09%, MSN dropping 2.3%, VNM losing 1.21%, HPG slipping 0.37%, and banks such as LPB decreasing by 0.15%, MBB falling 0.6%, HDB dropping 0.37%, and EIB declining by 0.5%, had a notable impact on the market’s performance.

Among these stocks, MSN is currently facing net selling pressure from foreign investors, ranking among the top net sold stocks in the market, with a net selling value of nearly 220 billion VND. This development is not surprising, given that MSN has consistently been among the top net sold stocks in recent days, with a net selling value of over 900 billion VND in the past week.

|

MSN continues to be among the top net sold stocks

Unit: Billion VND

Source: VietstockFinance

|

The net selling pressure on MSN has also pushed the overall net selling value in the market to nearly 400 billion VND so far today. Notably, foreign investors have been net sellers for 14 consecutive sessions, excluding today.

The resumption of strong net selling by foreign investors can be attributed to the recent sharp rise in exchange rates. In response to this situation, the State Bank has had to absorb money back through bills.

Opening: A gentle start to the last trading day of the month

On the last trading day of October, Vietnam’s stock market witnessed mild fluctuations.

As of 9:25 am, the VN-Index rose 1.47 points to 1,260.10, the HNX-Index climbed 0.02 points to 225.9, while the UPCoM Index slipped 0.02 points to 92.44. Market liquidity reached over 941 billion VND.

The market started off gently on the last trading day of October, with a fragmented performance, showing no significant disparity between the number of advancing and declining stocks. Specifically, there were 206 gainers (8 of which hit the ceiling price) and 169 losers (4 of which touched the floor price), while 1,231 stocks remained unchanged.

Currently, VIC is the stock contributing the most points to the VN-Index, adding nearly 0.5 points, while MSN is taking away the most points, also with nearly 0.5 points.

Globally, Asian markets displayed mixed performances, with the Hang Seng and Shanghai Composite rising 0.64% and 0.48%, respectively, while the Nikkei 225 and Singapore Straits Times fell 0.5% and 0.88%, respectively…

On Wall Street, stocks declined as investors digested a string of earnings reports from major tech companies.

Specifically, on October 30, the S&P 500 lost 0.33% to 5,813.67, the Dow Jones fell 91.51 points (or 0.22%) to 42,141.54, and the Nasdaq Composite dropped 0.56% to 18,607.93 after hitting a record high earlier in the session.

The Stock Market Optimist: Can We Expect a Revival in Liquidity?

The VN-Index rallied and retested the 100-day SMA. A decisive move above this level, coupled with trading volume surpassing the 20-day average, would reinforce the bullish momentum. Notably, the Stochastic Oscillator has provided a buy signal within the oversold region. If this buy signal persists and the index climbs out of this oversold territory in upcoming sessions, the outlook will turn even more positive.

“Technical Analysis for the Afternoon Session on October 29th: A Glimmer of Hope Emerges”

The VN-Index and HNX-Index both climbed, with a slight uptick in trading volume in the morning session, indicating an improvement in investor sentiment.

The Cautious Sentiment Persists

The VN-Index showed promising gains despite trading volume remaining below the 20-day average. This indicates a persistent cautious sentiment among investors. For the upward momentum to be sustained, an improvement in trading volume is necessary in the coming days. The Stochastic Oscillator is currently dipping into oversold territory, and a buy signal from this indicator, coupled with a volume boost, would reinforce a more positive short-term outlook.

The Power Players: Institutional and Proprietary Traders on a Spending Spree, Shelling Out $60 Million on Real Estate and Bank Stocks

Foreign investors net bought 678.1 billion VND, of which matched orders accounted for 541.2 billion VND. Domestic institutional investors also net bought 727.9 billion VND, with matched orders accounting for 761.8 billion VND.