One of the highlights of the Q3 financial results was Mobile World Investment Corporation (MWG) . Specifically, MWG’s net revenue reached VND 34,147 billion, a 13% increase compared to the same period last year. After deducting capital expenses, gross profit increased by 21% to VND 6,892 billion, corresponding to a slight improvement in the gross profit margin to 20%.

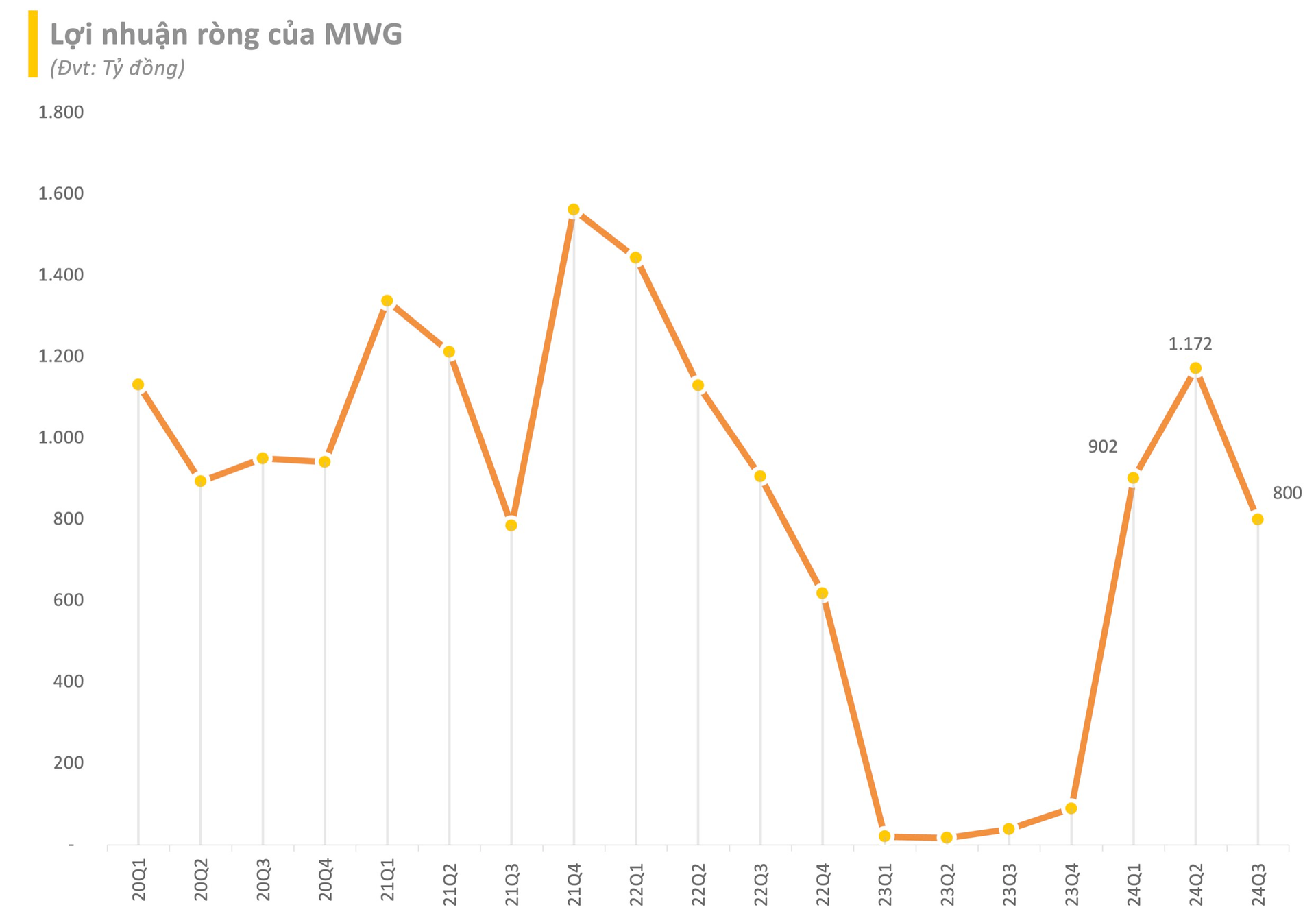

As a result, MWG reported a Q3 after-tax profit of nearly VND 806 billion, almost 21 times higher than the low base of the same period last year. The after-tax profit attributable to the parent company’s shareholders exceeded VND 800 billion, also nearly 21 times higher.

Accumulated in the first nine months of the year, the after-tax profit was VND 2,881 billion, more than 37 times higher than the same period last year, thereby exceeding the year’s profit target by 20%.

According to explanations from MWG, the significant increase in nine-month net income was due to three main reasons: a 15% rise in net revenue, a 28% improvement in gross profit, and optimized expenses following the restructuring strategy set out at the beginning of the year.

Specifically, for the thegioididong.com and Dien May Xanh chains, despite operating with 12% fewer stores than the previous year, MWG still maintained a 7% growth in revenue. This growth came from most of the main product categories, such as phones and appliances, thanks to advantages in diverse product portfolios, attractive promotions, and financial support solutions. This reflects the company’s efforts to consolidate and expand market share, alongside improvements in gross profit and optimized store operating costs.

For the Bach Hoa Xanh supermarket chain, revenue grew by nearly 36% year-on-year, mainly due to increased sales in existing stores. The chain focused on boosting sales of fresh food and fast-moving consumer goods, providing quality products at competitive prices, along with optimizing expenses such as store operating costs, warehousing, and logistics to maintain sustainable profits.

Regarding the parent company’s profit of over VND 132 billion in the first nine months, as stated in the separate financial statements, MWG attributed this significant improvement to dividend income, a considerable increase from the loss of nearly VND 81 billion in the same period last year.

In the market, MWG shares closed at VND 66,000/share on October 30. Most recently, these shares officially returned to the VNDiamond index basket for the October 2024 period. Accordingly, an estimated total of more than 25 million MWG shares will be “hunted” by five ETFs with a total scale of VND 14,000 billion in this restructuring.

The Rise of the Securities Companies: Can Masan Reach its Audacious Target of 2,000 Billion VND Net Profit?

In the first nine months of 2024, Masan achieved a remarkable profit of 1.308 trillion Vietnamese dong after allocation of minority interests, surpassing its initial plans by a significant margin. With this impressive performance, the company is well on its way to achieving its ambitious full-year net profit target of 2 trillion Vietnamese dong, as per the positive scenario laid out.

The Unexpected Profit Surge: Novaland’s Astonishing 2,000% Rise

Novaland’s Q3 2024 profits soared to over VND 2,950 billion, an astonishing 2,000% surge compared to the same period last year. The company’s net revenue from sales reached nearly VND 3,739 billion, reflecting a 64% increase.