MARKET REVIEW FOR THE WEEK OF 21-25/10/2024

During the week of 21-25/10/2024, the VN-Index ended the week with a significant decline, forming a Black Marubozu candlestick pattern while breaking below the Middle line of the Bollinger Bands. This indicates a growing pessimism in the market.

On the other hand, trading volume remained below the 20-day average, suggesting that investor caution continues to increase.

Currently, the MACD indicator is heading downwards after issuing a sell signal. This suggests that the risk of a short-term correction remains.

TECHNICAL ANALYSIS

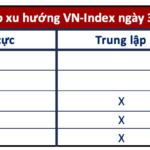

Trend and Price Oscillation Analysis

VN-Index – Breaking Down from the Neckline of a Double Top Pattern

On 25/10/2024, the VN-Index declined, forming a candlestick pattern resembling a Black Marubozu, and continued to hug the Lower Band of the Bollinger Bands, indicating a rather pessimistic short-term outlook.

Additionally, the index broke down below the neckline of a Double Top pattern, while the MACD continued its downward trajectory and remained below the zero line after issuing a sell signal. Therefore, the correction scenario is likely to persist, and the potential price target for the VN-Index is the 1,220-1,235 point region.

HNX-Index – Stochastic Oscillator Deep in Oversold Territory

On 25/10/2024, the HNX-Index witnessed a slight decline, forming a candlestick pattern similar to a Doji, while trading volume remained below the 20-day average, indicating investor indecision.

Meanwhile, the index is testing the old lows of April and August 2024 (corresponding to the 220-224 point region) while the Stochastic Oscillator has ventured deep into oversold territory. If the indicator provides a buy signal and manages to climb out of this region, the HNX-Index could be poised for a recovery in the coming period.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index indicator for the VN-Index has crossed below the EMA 20 line. If this condition persists in the next session, the risk of a sudden thrust down will increase.

Foreign Money Flow Variation: Foreign investors continued to sell on 25/10/2024. If foreign investors maintain this action in the coming sessions, the situation will become even more pessimistic.

Technical Analysis Department, Vietstock Consulting

The Beat of the Market on 10/28: Indecision Looms, Telecom Services Shine Brightly

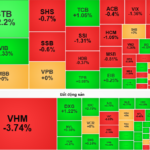

At the end of the trading session, the VN-Index rose 2.05 points (+0.16%) to 1,254.77, while the HNX-Index dipped 0.03 points (-0.01%) to 224.59. The market breadth tilted towards gainers with 389 advancers and 283 decliners. The large-cap stocks also witnessed a sea of green, as reflected in the VN30-Index, with 15 gainers, 9 losers, and 6 stocks holding steady.

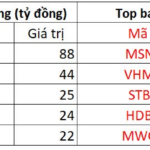

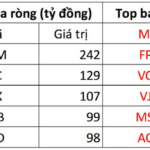

The Foreigners’ Sell-Off: Unraveling the 1.3 Trillion VND Trade in Blue-Chip Stocks

The foreign transactions went against the positive trend of the market session, as they offloaded a net sell value of VND 1,631 billion across the market.