Bỏ qua đoạn văn bản này

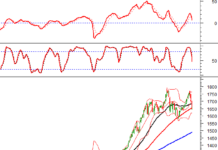

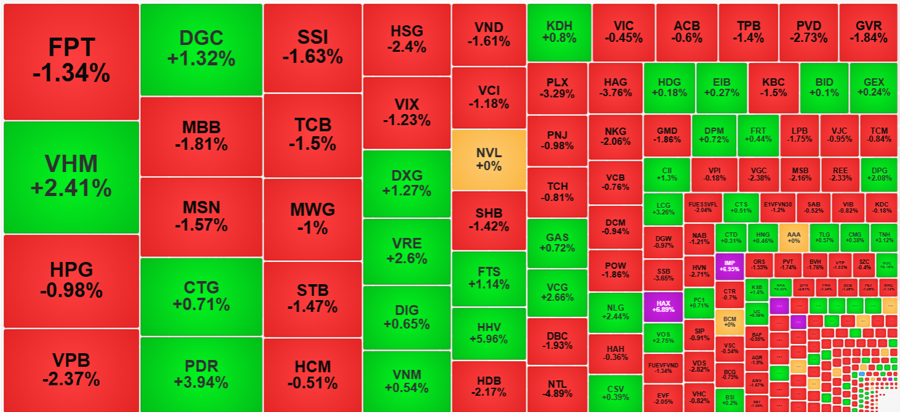

Selling pressure this afternoon showed signs of cooling down, while improved demand helped push prices up gradually. However, the overall recovery range was very small, but some real estate and investment stocks broke through quite impressively in the context of red still dominating.

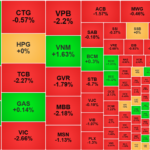

HoSE’s matching liquidity this afternoon decreased by nearly 4% compared to the morning session, of which VN30 trading decreased by 9%. However, many blue-chips in this basket have rebounded. VN30-Index ended the session down 1.04% with 6 gainers/23 losers, while the morning session fell 1.3% with 4 gainers/25 losers.

The breadth did not reflect the full change in the price of the blue-chip basket. However, statistics show that up to 19/30 stocks closed higher than the morning reference price, only 7 codes fell deeper. The most notable improvement was VRE when in the first 15 minutes of the afternoon session, it rose 1.82% compared to the morning reference. By the end of the session, VRE was up 2.6%. CTG also impressed, although the overall increase was only 0.71% compared to the reference price. The reason is that at the end of the morning session, this stock was too bad, down 1.57%, which means CTG has lost a lot of time to climb before breaking through the reference price. In the afternoon session alone, CTG changed to +2.32%. VHM spent most of the afternoon session inching up, but in the ATC period, liquidity of nearly 1.46 million shares pushed the price up 2.41% at the close. VHM was up only 1.33% at the end of the morning session.

In general, the leading large-cap stocks this afternoon improved in price to some extent, but the recovery was not enough to change the color. VCB, VIC, TCB, HPG, GAS, FPT, and VNM were the large-cap stocks that rose compared to the morning session and belonged to the pillar group. This helped the VN-Index close down only 8.07 points (-0.63%) compared to the drop of 12.91 points (-1.01%) in the morning.

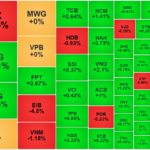

The overall breadth of the HoSE also improved but was not clear. At the end of the morning session, there were 60 gainers/342 losers, and at the close, there were 117 gainers/313 losers. The mid- and small-cap group showed signs of price recovery faster, with the investment group performing well from the morning and becoming even more prominent: HHV rose 5.96% with a liquidity of 150.1 billion VND; LCG rose 3.26% with 50.6 billion VND; VCG rose 2.66% with 111.5 billion VND, CII rose 1.3%… In addition, some real estate and construction stocks also performed well, such as HBC up 5.21%, FCN up 4.74%, PDR up 3.94%, NLG up 2.44%, and DXG up 1.27%… However, the real estate group still had dozens of red codes, and in terms of quantity, there were still more gainers than losers.

Among the 117 HoSE stocks that went against the trend today, 50 rose by more than 1%, except for FTS, and the rest were all real estate, investment, construction, and attractively-priced stocks. In addition, the DPG, HAX, VOS, TNH, IMP, and KSB groups also rose quite steadily with liquidity from 20 billion VND or more.

The declining group still saw many stocks under strong selling pressure, pushing liquidity up and prices continuing to fall sharply. Although, in theory, price recovery reflects bottom-fishing, but if the price only recovers slightly, buyers are still very cautious. VPB, MBB, MSN, SSI, TCB, STB, HSG, VCI, SHB, PVD… are representatives of the hundreds of stocks that only recovered 1-2 price steps compared to the lowest price of the session. The liquidity of this group was in the hundreds of billions of VND each.

The only positive point this afternoon was that the selling pressure showed signs of easing. The liquidity of the two exchanges was lower than in the morning, and as stock prices edged up, it showed that bottom-fishers had started to push up prices slightly. The recovery movement, although very light, was also different from the continuous downward trend in the morning session. In addition, foreign investors also reduced pressure, net selling only VND 192.4 billion on HoSE, after net selling VND 582.3 billion in the morning session.

Currently, the domestic market has no special information, but the psychological pressure is still influenced by external factors. If the global stock market stabilizes soon, the domestic market will also stabilize.

The VN-Index Plunges to a 12-Week Low: A Bold Move to Cut Losses and Look to the Future

The market suffered a brutal sell-off in the afternoon, with trading liquidity on both exchanges doubling from the morning session, and stocks plunging across the board. The VN-Index evaporated 1.06% (-13.49 points) and broke through the short-term bottom at the beginning of October, falling to 1257.41 points.

“Stock Liquidity Hits 18-Month Low, Shares Stage a Surprise Comeback”

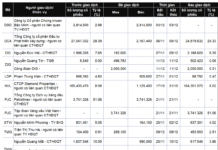

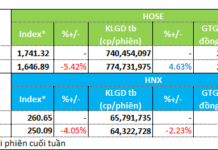

The combined trading value of the Ho Chi Minh Stock Exchange (HoSE) and Hanoi Stock Exchange (HNX) reached VND 9,782 billion today, hitting an 18-month low since May 9, 2023. During this period, there have only been three instances of trading values falling below the VND 10,000 billion mark. The extremely low trading value indicates a significant decrease in selling pressure, allowing buying forces to drive prices upwards quite favorably towards the end of the session.

The Savvy Investor: Navigating the Low-Liquidity Turnaround

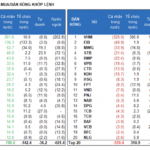

Individual investors today bought a net of VND 370.2 billion, of which they net bought VND 351.5 billion in matched orders.