Masan Surpasses Expectations with Impressive Growth

Vietcap and BVSC, leading securities companies, have used the phrase “beyond expectations” to describe Masan Group’s (HoSE: MSN) financial report for Q3/2024. This report has sparked excitement among investors and analysts alike.

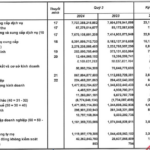

According to the Q3/2024 financial report, Masan achieved remarkable results with a net revenue of VND 21,487 billion, a 6.6% increase compared to the previous year. Even more impressive was the after-tax profit, which reached VND 701 billion, an astounding surge of nearly 1,350% year-on-year. This profit was not only driven by the growth in consumer retail businesses but also by a reduction in net interest expenses and the absence of foreign exchange rate fluctuations.

Masan Consumer Corporation (MCH) played a pivotal role in this success, generating a revenue of VND 7,987 billion, reflecting a 10.4% increase compared to the same period last year. MCH consistently maintained a high gross profit margin of 46.8%, outperforming the 46.6% margin achieved in Q3/2023.

Masan’s impressive growth in Q3/2024

WinCommerce (WCM), Masan’s retail arm, also witnessed a 9.1% year-on-year revenue growth, reaching VND 8,603 billion. This achievement is attributed to the success of its new store models, WiN and WinMart+ Rural, which cater to the diverse needs of urban and rural shoppers, respectively. Notably, WCM recorded a positive after-tax profit of VND 20 billion in Q3, marking the first time it turned a profit since the COVID-19 pandemic.

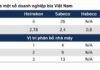

Masan MEATLife (MML) also contributed significantly to the group’s performance, with an increase in EBIT of VND 43 billion year-on-year and a surge in after-tax profit before minority allocation of VND 105 billion. These impressive results were driven by the growth in processed meat sales and favorable market prices for chicken and pork.

Masan MEATLife’s impressive performance

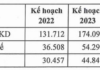

Phúc Long Heritage (PLH), Masan’s beverage and restaurant business, experienced a 12.8% year-on-year revenue increase, reaching VND 425 billion. PLH currently operates 174 outlets nationwide.

For the first nine months of the year, Masan achieved a consolidated pre-minority after-tax profit of VND 2,726 billion and a consolidated after-tax profit of VND 1,308 billion. With these impressive results, Masan has already surpassed its pre-minority after-tax profit plan by 130.8% and is well on its way to achieving its ambitious after-tax profit target of VND 2,000 billion for the year.

Dr. Nguyen Dang Quang, Chairman of Masan Group, affirmed that the company is on track to meet its optimistic after-tax profit scenario of VND 2,000 billion. “We have been and will continue to focus on integrating our entire consumer retail platform, aiming for double-digit growth in revenue and profit for 2025,” said Dr. Quang.

In the final quarter of the year, Masan will concentrate on expanding the profit of its core consumer retail business by optimizing the WIN membership program, reducing debt to enhance its balance sheet, and lowering financial expenses.

Masan’s strategy for Q4/2024

Vietcap Securities analysts noted that due to Masan’s impressive after-tax profit for the first nine months of 2024, they foresee an upward revision in the company’s after-tax profit forecast. For the full year 2024, Vietcap projects Masan’s total net revenue to reach VND 85,185 billion, with an after-tax profit of VND 4,609 billion.

Similarly, BVSC provided an optimistic assessment, stating that Masan’s Q3 performance exceeded their expectations. With an after-tax profit of VND 701 billion, higher than BVSC’s previous estimate of VND 650 billion, they have revised their projections. BVSC now forecasts Masan’s full-year net revenue to reach VND 86,840 billion, an 11% increase, and its after-tax profit to reach VND 2,766 billion, including extraordinary items in Q4, surpassing Masan’s optimistic scenario.

Masan’s Golden Eggs: Unlocking the Secrets of Their Success

Masan’s consumer goods (Masan Consumer – MCH) and retail (WinCommerce – WCM) segments are the powerhouse duos, contributing nearly 80% of the group’s revenue and profit. As of September 2024, WCM operated 3,733 stores, adding 60 new stores since Q2/2024. By offering a 20% discount on MEATDeli pork and chicken, as well as WinEco vegetables, to Winmart members, WCM has created a significant point of differentiation. This strategy has enhanced the competitiveness of its products compared to other retail chains such as Bach Hoa Xanh, Co.opmart, and AEON.

Masan Consumer – A Core Business Segment

MCH, on the other hand, has consistently maintained high gross profit margins, with a recorded after-tax profit margin of 25.9%, a 90 basis point increase compared to the previous year. MCH is on track for its IPO in 2025, and Masan is simultaneously bolstering its Go Global strategy, introducing Vietnamese flavors to consumers worldwide.

In the realm of mining, Masan High-Tech Materials (MHT) has been focused on selling its copper inventory, with Q4/2024 sales expected to surpass the total sales of the first nine months of the year. Additionally, the sale of H.C. Starck to Mitsubishi Materials Corporation for a purchase price of USD 134.5 million is anticipated to conclude by the end of 2024, positioning MHT to benefit from a long-term increase in after-tax profits of USD 20-30 million.

Masan’s recent Memorandum of Understanding (MOU) with Export Development Canada (EDC), Canada’s export credit agency, is expected to bolster its Go Global strategy. With EDC’s extensive international network and long-term financial resources, Masan’s ecosystem of businesses, particularly in tungsten exploration and processing, is poised for significant growth.

On the stock market, MSN shares are trading at around VND 77,000 per share, reflecting a 15% increase since the beginning of the year, with a market capitalization of over VND 110,750 billion. Nguyen Yen Linh, the daughter of Mr. Nguyen Dang Quang, Chairman of Masan’s Board of Directors, has recently registered to purchase 10 million MSN shares to increase her ownership stake. The transaction is expected to take place through matching and/or negotiation from October 29 to November 18, 2024. If successful, the daughter of billionaire Nguyen Dang Quang will increase her ownership in Masan to 0.66% of the charter capital.

“Overcoming ‘Breathalyzer’ Challenges, Sabeco, the Beer Industry Giant, Reports Profitable Q3 Growth with 70% of Assets in Cash”

For the first nine months of the year, Sabeco recorded net revenue of VND 22,940 billion and a remarkable after-tax profit of VND 3,504 billion, reflecting a 5% and nearly 7% increase, respectively, compared to the same period last year.

The Rise of Digiworld: Unlocking Growth and Profitability Across Industries

In the first nine months of the year, Digiworld witnessed impressive growth with a revenue of VND 16,219 billion and an after-tax profit of VND 302 billion, reflecting a 16% and 11% increase respectively compared to the same period in 2023.