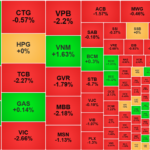

Another flash sale appeared this morning, even “overwhelming” VN-Index in the red price range for most of the trading time. HoSE floor liquidity increased by nearly 11% compared to yesterday morning, and many stocks are rebounding, indicating that bottom-fishing efforts are quite effective.

VN-Index created 2 bottoms, falling more than 3 points, but by the end of the session, it was only down 0.05 points. The broadest index recorded 95 gainers/225 losers, and at the end of the session, there were 132 gainers/212 losers. Thus, many stocks have successfully recovered beyond the reference level. However, the overall market still has a dominant number of losers, and the rebound amplitude is not strong: Only 25.5% of the stocks trading this morning recovered more than 1% compared to the lowest price.

However, it should also be noted that the deepest adjustment amplitude of this morning’s session was not too strong either. Money flow has not yet switched to a highly active state, mostly waiting to buy at low prices. The movement is still the usual tug-of-war when the buying side “gives way” to short-term selling volume.

Some large-cap stocks also had a significant impact on today’s volatile movement. VHM, MSN, and VNM are the 3 stocks that have had a significant impact. VHM had another sharp decline, falling up to 1.7% at one point before rebounding and ending the morning session down 0.97%. MSN surprised with a strong unexpected sell-off, with liquidity reaching VND 415.8 billion, and the price falling by up to 2.68% at one point. By the end of the session, MSN had recovered a bit, down 1.79%. Foreigners net sold VND 467.3 billion in MSN, but mostly through matching transactions that did not directly affect the matched price.

VNM, after the “short-term base breakdown” in October, plunged this morning, falling 1.21% to a 3-month low. In fact, the VN30 basket is not weak, excluding the 3 stocks mentioned above. At the end of the session, there were 12 gainers/14 losers, and the index was down only 0.1%. The liquidity of VHM, MSN, and VNM accounted for up to 41.7% of the total matching value of the basket. In other words, the VN30 basket this morning had very low liquidity and narrow price fluctuations for most stocks.

Among the rising large-cap stocks, there were some notable bank codes. CTG increased by 1.87%, STB by 1.87%, and SHB by 1.43%. In addition, VCB, ACB, TPB, and BID were also in the green. In the group of large-cap banks, MBB, TCB, VIB, HDB, and SSB were in the red, but the decrease was not significant and had little impact on the index. 6/10 of the stocks currently supporting the VN-Index belong to the banking group.

With the broadest index still overwhelmingly in the red at the end of the morning session, the group of stocks that reversed the uptrend was not particularly strong. 40/132 stocks rose more than 1%, but liquidity only accounted for 17.7% of the HoSE floor value. In addition to CTG and STB, not many stocks had good liquidity. Notably, VCI rose 1.02% with a matching value of VND 90.4 billion; DBC increased by 1.62% with VND 50.1 billion; PVT rose 1.64% with VND 41.1 billion; DIG increased by 1.22% with VND 38.7 billion.

On the downside, the pressure was also small and did not create any selling pressure. 54/212 stocks fell by more than 1%, and liquidity accounted for only 16.9% of the floor value. Even if MSN and VNM are excluded, the remaining 52 stocks account for only 3.8% of the total floor transactions. VRE, DPG, PDR, and ORS were the only codes with notable liquidity in the remaining group.

The above statistics show that the market this morning actually fluctuated quite balanced around the reference price. Overall liquidity increased, but it was due to large transactions in VNM, VHM, and MSN, while the liquidity of other stocks decreased sharply. The vast majority of liquidity and stocks are in the group of small- fluctuations reflecting the balance of supply and demand, although the red color still dominates.

Foreign investors this morning recorded a net sell of VND 681.1 billion on the HoSE, mainly due to strong net selling in MSN (-VND 467.3 billion). In addition, there were VHM -VND 107.1 billion, STB -VND 30.9 billion, and HDB -VND 28.1 billion. On the buying side, only VPB’s net buy of VND 29.9 billion was notable.

The VN-Index Plunges to a 12-Week Low: A Bold Move to Cut Losses and Look to the Future

The market suffered a brutal sell-off in the afternoon, with trading liquidity on both exchanges doubling from the morning session, and stocks plunging across the board. The VN-Index evaporated 1.06% (-13.49 points) and broke through the short-term bottom at the beginning of October, falling to 1257.41 points.

The Prime Minister Invites the UAE’s Top Four Conglomerates to Invest in Strategic Sectors

On the afternoon of October 27, during his official visit to the United Arab Emirates (UAE), Prime Minister Pham Minh Chinh met with leaders of prominent UAE-based corporations, including Abu Dhabi Ports Group, NDMC Group, and Emirates Motor Company.