I. MARKET ANALYSIS OF THE STOCK MARKET BASED ON DATA FROM OCTOBER 31, 2024

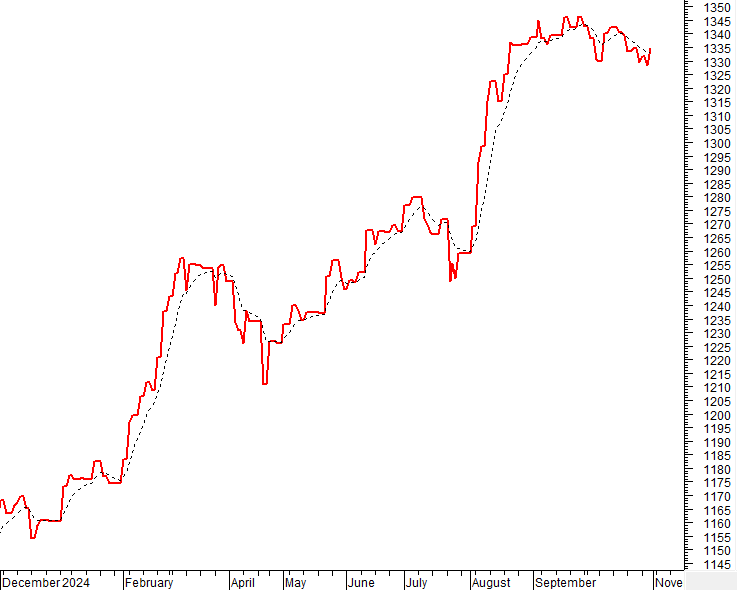

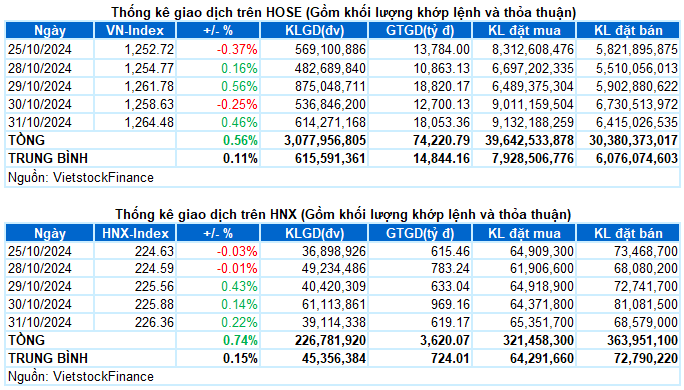

– The main indices gained points during the trading session on October 31. The VN-Index closed up 0.46% at 1,264.48 points, while the HNX-Index reached 226.36 points, a 0.22% increase compared to the previous session.

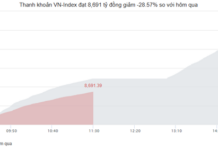

– The matching volume on the HOSE reached over 469 million units, a slight decrease of 1.3% compared to the previous session. Meanwhile, the matching volume on the HNX decreased by 11.1%, reaching over 36 million units.

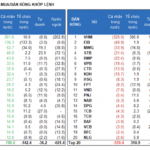

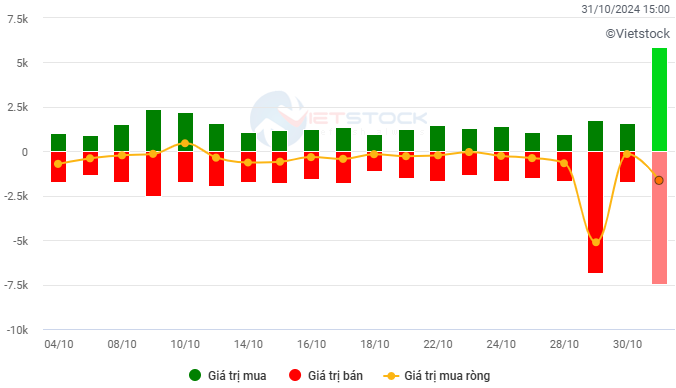

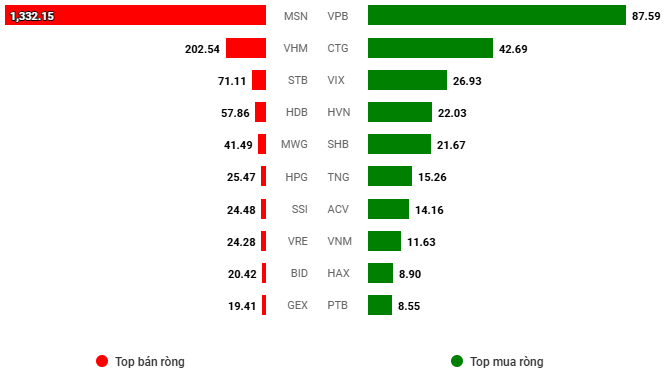

– Foreign investors net sold on the HOSE with a value of nearly VND 1,669 billion and net bought over VND 18 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM. Unit: VND billion

Net trading value by stock code. Unit: VND billion

– After facing mild selling pressure in the first half of the morning session, low-price demand started to increase, pulling the index back to balance before the mid-session break. In the afternoon session, buyers continued to accelerate, especially in the groups of pillar stocks, helping the index expand its gains strongly. However, this positive development was not accompanied by an increase in liquidity as the trading volume continued to remain below the 20-session average. At the end of the last trading session of October, the VN-Index gained 5.85 points to close at 1,264.48.

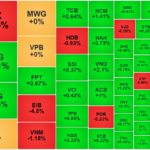

– In terms of contribution, VCB and CTG contributed the most to today’s gains, helping the VN-Index increase by 2.6 and 1.3 points, respectively. On the other hand, MSN, HDB, VRE, and TCB were the biggest drags on the index, causing a decrease of about 1 point each.

– The VN30-Index closed up 0.36% at 1,338.6 points. The market breadth was positive with 18 gainers, 10 losers, and 2 unchanged stocks. Among them, CTG and VCB led the gains with increases of over 2%. In contrast, VRE, MSN, and HDB faced significant selling pressure, falling by more than 1% each.

The financial group was a bright spot today, leading the market with a 0.87% gain. Notable performers included CTG (+2.73%), VCB (+2.07%), BAB (+1.68%), LPB (+1.23%), ACB (+1.2%), STB (+1.15%), SBS (+2%), HCM (+1.59%), and PSI (+1.41%), among others.

The real estate group also made a significant contribution to the overall index thanks to the gains in VIC (+1.34%), VHM (+0.85%), BCM (+1.05%), SNZ (+3.03%), IDC (+1.45%), NLG (+1.14%), and CKG (+6.4%).

As demand was concentrated in pillar stocks, more than half of the industry groups were dominated by red colors despite the positive performance of the VN-Index. The telecommunications and energy sectors ranked at the bottom with a decrease of 0.88%. This was mainly due to the performance of VGI (-0.69%), FOX (-2.06%), CTR (-0.86%), YEG (-2.34%), and BSR (-1.4%).

The essential consumer goods sector witnessed a clear divergence, with most codes trading around the reference price. However, MSN stock attracted significant attention with a decrease of 1.92% as foreign investors net sold this stock with a value of over VND 1,332 billion. The strong selling pressure on this stock was the main reason for the high net selling value of foreign investors in today’s session.

II. TREND AND PRICE MOVEMENT ANALYSIS

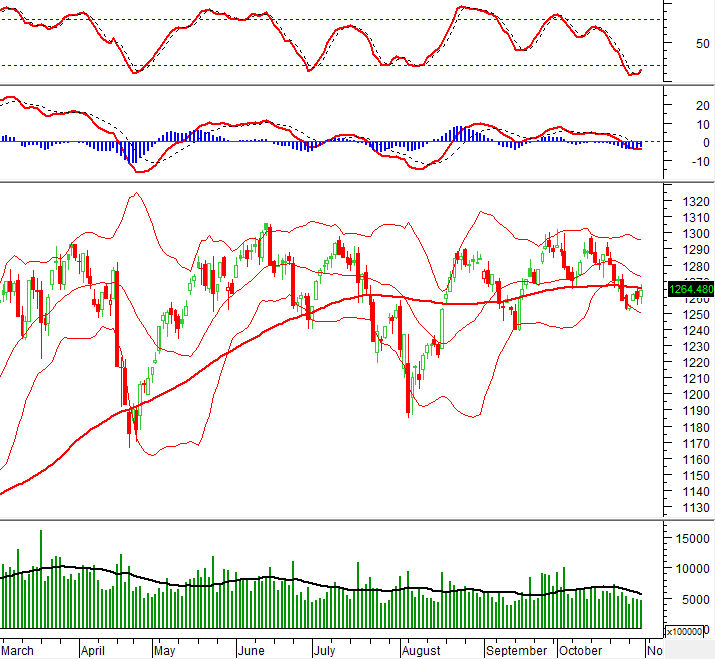

VN-Index – Re-testing the SMA 100-day moving average

The VN-Index gained points and re-tested the SMA 100-day moving average. If the index surpasses this level with trading volume exceeding the 20-day average, the uptrend will be reinforced.

Currently, the Stochastic Oscillator indicator has given a buy signal within the oversold region. If this buy signal is maintained and the index moves out of this region in the next sessions, the situation will become more positive.

HNX-Index – Stochastic Oscillator indicator gives a buy signal

The HNX-Index has been continuously increasing for three consecutive sessions recently, while the trading volume remains below the 20-day average. This indicates that investors are still cautious. However, the Stochastic Oscillator indicator has given a buy signal and is likely to move out of the oversold region. If the MACD indicator also gives a similar buy signal in the next sessions, the short-term outlook will remain optimistic.

Analysis of Capital Flows

Changes in Smart Money Flows: The Negative Volume Index indicator of the VN-Index has cut above the EMA 20-day moving average. If this state continues in the next session, the risk of a sudden downturn (thrust down) will be limited.

Changes in Foreign Capital Flows: Foreign investors continued to net sell in the trading session on October 31, 2024. If foreign investors maintain this action in the coming sessions, the situation will become less optimistic.

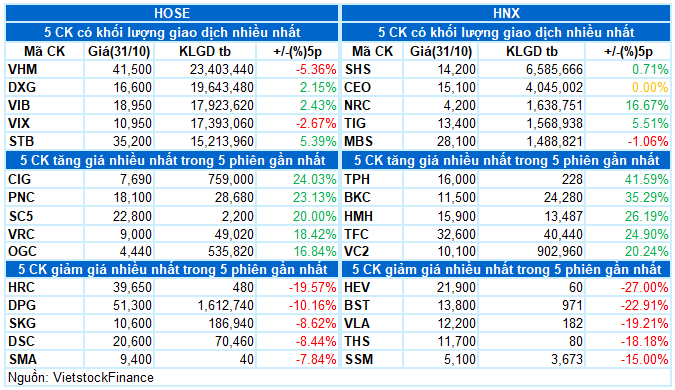

III. MARKET STATISTICS FOR OCTOBER 31, 2024

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

The Cautious Sentiment Persists

The VN-Index showed promising gains despite trading volume remaining below the 20-day average. This indicates a persistent cautious sentiment among investors. For the upward momentum to be sustained, an improvement in trading volume is necessary in the coming days. The Stochastic Oscillator is currently dipping into oversold territory, and a buy signal from this indicator, coupled with a volume boost, would reinforce a more positive short-term outlook.

“Stock Liquidity Hits 18-Month Low, Shares Stage a Surprise Comeback”

The combined trading value of the Ho Chi Minh Stock Exchange (HoSE) and Hanoi Stock Exchange (HNX) reached VND 9,782 billion today, hitting an 18-month low since May 9, 2023. During this period, there have only been three instances of trading values falling below the VND 10,000 billion mark. The extremely low trading value indicates a significant decrease in selling pressure, allowing buying forces to drive prices upwards quite favorably towards the end of the session.

The Savvy Investor: Navigating the Low-Liquidity Turnaround

Individual investors today bought a net of VND 370.2 billion, of which they net bought VND 351.5 billion in matched orders.