On October 4, 2024, the State Securities Commission (SSC) granted a public fund establishment registration certificate numbered 130/GCN-UBCK to the Successful Growth Investment Fund (TCGF) after its initial public offering of fund certificates.

Consequently, the first trading day for the open-ended TCGF fund was Thursday, October 31, 2024. With the official launch of the TCGF fund, investors now have an additional investment option that is safe, low-risk, profitable, and sustainable. Investors can trade and buy TCGF fund certificates on the TCAM Wealth phone application or through TCGF fund distributors.

The TCGF fund is an equity fund that invests in the stocks of enterprises with high growth potential and industry leaders. The fund’s strategy is to seek long-term profits, diversify its portfolio to minimize risks, and persistently aim for superior investment performance.

Image: Illustrating the growth and success of the TCGF fund

The TCGF fund is managed and operated by the Successful Asset Management Company (TCAM) and supervised by the Bank for Investment and Development of Vietnam (BIDV) – Nam Ky Khoi Nghia Branch. The fund’s investment team comprises well-versed experts with extensive experience in domestic and international financial markets. Their stock selection is based on a professional analysis system and their practical experience.

Mr. Vo Trung Cuong, Director of Fund Management at TCAM, shared that with the establishment of the open-ended TCGF fund, investors, especially those with a medium to long-term investment horizon, now have a new option. The primary goal of the TCGF fund is to create an investment channel capable of providing stable profits for those who want to profit from the stock market but lack the time, knowledge, and experience.

“With TCAM’s average investment performance of 20%-25% per year, we expect TCGF’s profitability to reach at least 15% per year,” said Mr. Vo Trung Cuong about the fund’s expectations.

Image: Highlighting the benefits and supervision of the TCGF fund

The TCGF fund operates with the consistent goal of protecting investors’ interests and enhancing the value of fund certificates. Its strategy includes (1) Focusing on value and selecting stocks of companies with competitive advantages and long-term growth potential; (2) Adopting a cautious strategy and flexibly allocating assets depending on market conditions and investment opportunities at a given time; (3) Diversifying the portfolio across important sectors that positively contribute to economic growth, including banking, finance, consumer goods, retail, logistics, real estate, etc.; (4) Carefully selecting and valuing stocks to ensure efficient investment.

The fund’s money and assets are closely monitored by the supervisory bank BIDV, independent auditors, and transparently managed by the State Securities Commission.

Image: Showcasing the team behind the TCGF fund’s success

The TCGF fund presents a favorable opportunity for investors in the Vietnamese stock market, fulfilling requirements for portfolio diversification, stable long-term profits, safety, high liquidity, and professional management by experienced fund managers.

The Successful Asset Management Company (TCAM) operates in two fields: Investment Portfolio Management and Investment Fund Management. TCAM is a member of TCSC, one of the most reputable securities companies with over 16 years of experience in the Vietnamese market. As a result, TCAM enjoys competitive advantages due to its strong financial backing from TCSC and the Saigon3 Group ecosystem.

With the motto, “Quality Makes Difference,” and a team of experienced experts in financial investment and fund management, TCAM continuously strives for sustainable development and brings prosperity to its clients.

The Stock Market Optimist: Can We Expect a Revival in Liquidity?

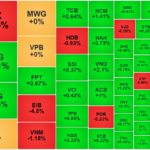

The VN-Index rallied and retested the 100-day SMA. A decisive move above this level, coupled with trading volume surpassing the 20-day average, would reinforce the bullish momentum. Notably, the Stochastic Oscillator has provided a buy signal within the oversold region. If this buy signal persists and the index climbs out of this oversold territory in upcoming sessions, the outlook will turn even more positive.

“Stock Liquidity Hits 18-Month Low, Shares Stage a Surprise Comeback”

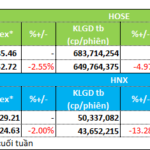

The combined trading value of the Ho Chi Minh Stock Exchange (HoSE) and Hanoi Stock Exchange (HNX) reached VND 9,782 billion today, hitting an 18-month low since May 9, 2023. During this period, there have only been three instances of trading values falling below the VND 10,000 billion mark. The extremely low trading value indicates a significant decrease in selling pressure, allowing buying forces to drive prices upwards quite favorably towards the end of the session.