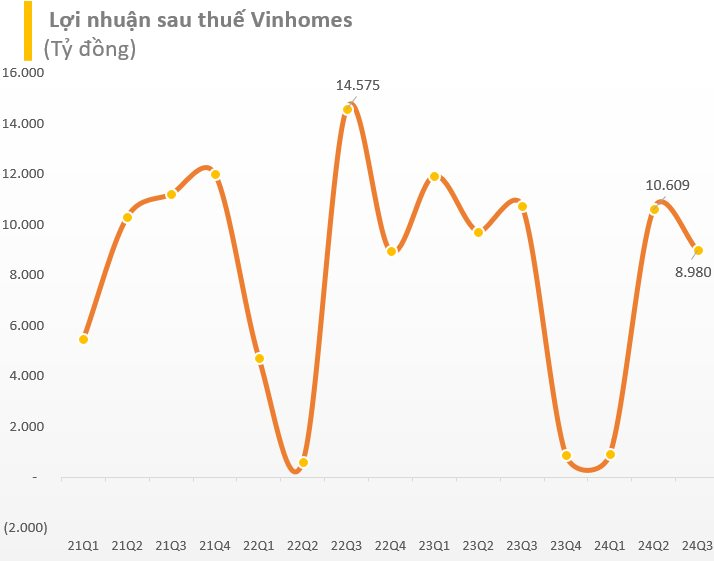

Vingroup Joint Stock Company (VHM: HOSE) has announced its Q3 2024 financial results, with net revenue reaching VND 33,323 billion, a slight increase of nearly 2% compared to the same period last year.

In addition, financial revenue tripled year-on-year, bringing in nearly VND 5,498 billion, while financial expenses amounted to over VND 1,555 billion, up 63% from Q3 2023.

After deducting various expenses, Vinhomes reported a Q3 2024 after-tax profit of over VND 8,980 billion.

For the first nine months of the year, Vinhomes recorded consolidated net revenue of VND 69,910 billion and consolidated net revenue, including revenue from Vinhomes’ operations and joint venture contracts, of VND 90,923 billion. The company’s consolidated after-tax profit reached VND 20,600 billion.

Sales revenue for the nine-month period stood at VND 89,586 billion, while unrecorded revenue amounted to VND 123,038 billion as of the end of Q3 2024.

For the full year 2024, the company set a business plan with a total revenue target of VND 120,000 billion and an after-tax profit of VND 35,000 billion, representing increases of 16% and over 4%, respectively, compared to 2023. Thus, Vinhomes has achieved 76% of its revenue target and 59% of its profit target in the first nine months.

As of September 30, 2024, Vinhomes reported total assets and equity of VND 524,684 billion and VND 215,966 billion, respectively, increases of 18% and 18.3% compared to December 31, 2023. Of this, cash, cash equivalents, and bank deposits totaled VND 22,055 billion (~USD 0.9 billion).

In a related development, Vinhomes plans to repurchase up to 370 million treasury shares from October 23 to November 21, 2024. As of the close of October 29, 2024, Vinhomes (VHM) had purchased a total of over 57 million treasury shares, representing 15.43% of the registered amount. This figure increased by more than 8.8 million units compared to the previous trading session on October 28.

In terms of sales activities, in Q3 2024, Vinhomes continued to launch new subdivisions in its mega-projects as the real estate market showed signs of recovery. Specifically, Vinhomes Royal Island (Vu Yen, Hai Phong) introduced Hoang Gia and Dao Vua, two subdivisions boasting impressive architecture.

Moreover, Vinhomes Royal Island set a record by officially handing over more than 500 commercial shop and shophouse units in the Tai Loc subdivision. In Hanoi, the Vinhomes Global Gate project also received positive market attention due to its strategic location at the northeastern gateway to the capital and its superior amenities.

In Southern Vietnam, the apartment subdivision The Opus One (Vinhomes Grand Park, Thu Duc City), developed by Vinhomes in collaboration with its Japanese partner Samty, was launched on August 28, 2024, contributing to the region’s apartment supply.

The Controller’s Wife Wants to Sell Her EIB Shares

Mrs. Tran Thi Thanh Nha, the wife of Mr. Ngo Tony, an American citizen and the Head of the Supervisory Board of Eximbank, plans to sell her entire stake in the bank. The sale, which will take place between October 30 and November 8, involves 123,298 shares, representing 0.006% of the bank’s capital. Mrs. Nha aims to recover her investment through this divestment.

The Retail Investors Return to Net Buying on October 24th

The proprietary trading arms of securities companies recorded a net buy value of VND 55 billion across the market.