**Hanoi Stock Exchange (HNX) Announces Hai Phat Invest’s Results from Early Bond Repurchase**

The Hanoi Stock Exchange (HNX) has published a document from Hai Phat Investment Joint Stock Company (Hai Phat Invest, code: HPX) disclosing the results of its early bond repurchase.

On October 25, 2024, Hai Phat Invest repurchased bonds worth over VND 53.8 billion of the HPXH2123008 issue, bringing the issue’s outstanding value to VND 100 billion.

The bond issue, initially launched on October 28, 2021, had a tenor of 36 months and an issuance value of VND 250 billion.

According to Hai Phat Invest’s consolidated financial statements for Q3 2024, the company’s total bond debt as of September 30, 2024, exceeded VND 1,200 billion. After accounting for the repurchase of VND 53.8 billion of the aforementioned HPXH2123008 bonds on October 25, 2024, Hai Phat Invest’s outstanding bond debt stood at over VND 1,146 billion.

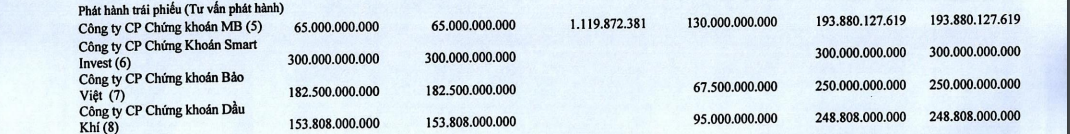

Source: Hai Phat Invest’s Consolidated Financial Statements for Q3 2024

This outstanding debt comprises the following bond issues: HPX122018, HPXH2125007, HPXH2123008, HPXH2124009, and HPXH2124001, with a total issuance value of VND 1,950 billion.

Turning to the company’s financial performance, as per the aforementioned consolidated financial statements for Q3 2024, Hai Phat Invest recorded revenue of VND 428.7 billion, a 42% increase compared to the same period last year. Gross profit for the period surged by 136% to VND 150.9 billion.

Financial income for the period amounted to VND 11.3 billion, a significant improvement from the loss of VND 623 million in the previous year. Meanwhile, financial expenses increased by 164% to VND 105.5 billion, and selling and management expenses stood at VND 27.5 billion and VND 13.3 billion, respectively. As a result, Hai Phat Invest reported a post-tax profit of nearly VND 12 billion, marking a 177% increase year-over-year.

For the nine months ended September 30, 2024, the company recognized revenue and post-tax profit of VND 1,083.8 billion and VND 59.1 billion, respectively, representing decreases of 9.4% and 4.1% compared to the same period in 2023.

As of September 30, 2024, Hai Phat Invest’s total assets were nearly VND 8,104.9 billion, a 2.3% decrease from the beginning of the year. Short-term receivables accounted for the largest proportion of the asset structure, amounting to VND 3,588.7 billion. Inventories decreased by 10% to VND 2,671 billion.

On the liabilities side, the company’s total liabilities as of the same date were VND 4,470.8 billion, a 5% decrease from the beginning of the year. Short-term debt accounted for over VND 3,499 billion of this total.

“Steady Credit Growth, VPBank’s 9-Month Profit Surges 67% Year-on-Year”

As of the third quarter of 2024, VPBank has recorded a remarkable performance with a consolidated pre-tax profit increase of over 67% year-on-year, thanks to the contributions of its comprehensive ecosystem. The bank has maintained stable credit growth, enhanced debt recovery activities, and continued to tightly control asset quality.

The Pennies-for-Dollars Stock List

As of the market close on 11/10/2024, the VN-Index stood at 1,288 points, marking a notable 14% increase since the beginning of the year, equivalent to a rise of 157 points. However, not all stocks have fared equally well. Some have plummeted or stagnated over the past year, lingering in the notoriously low-priced “tea and chat” zone.

The Power of Persuasion: Crafting Compelling Copy for a Successful Business

“Ailing Power Company Raises $38 Million in “3-No” Bonds Despite $216 Million Losses”

Despite recording a net loss of over VND 500 billion in the first half of this year, a power company has surprisingly raised nearly VND 900 billion in “three-no” bonds with a three-year maturity.