At the 3rd anniversary of Vietsuccess, Dr. Pham Viet Anh, a sustainable ESG-S advisor, shared insightful perspectives on the aspects of sustainable development, its pitfalls, and how we can navigate them.

The expert led the discussion with two questions about corporate social responsibility. First, should businesses generate more profits for shareholders and then contribute to society, or should they strive for a balance between the 3P pillars (People, Planet, Profit) or ESG (Environmental, Social, Governance) frameworks?

|

Dr. Viet Anh holds a Doctor of Business Administration (DBA) in Sustainable Management and is a PhD researcher in Sustainable Development and Diplomacy (U.N Treaty University). With over 25 years of experience, he has provided consulting services to numerous domestic and international organizations in Vietnam on growth strategies, branding, and sustainable development. |

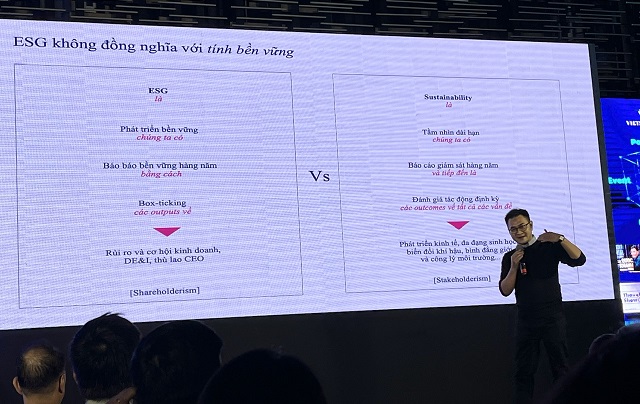

ESG does not equate to sustainability

According to Dr. Viet Anh, both the 3P and ESG frameworks have significant “pitfalls.” He explains that the 3P concept notably omits any mention of Governance. Effective corporate governance is crucial in addressing social issues and can be a powerful tool for driving positive change.

Secondly, ESG lacks a clear implementation strategy and instead focuses on integrating sustainability into business operations without providing specific guidelines on how to achieve this integration effectively, including the appropriate level of commitment required.

“When we talk about sustainability, we are referring to the long term, and even the very long term,” said Dr. Viet Anh, citing the example of global warming, which requires monitoring over 30, 50, or even 100 years to fully understand the regions benefiting from or suffering due to rising temperatures. Therefore, sustainability inherently entails a long-term perspective.

Additionally, the plethora of ESG reporting frameworks, approximately 600, can be overwhelming for businesses trying to determine which one to follow. A genuinely sustainable enterprise should focus on both annual monitoring reports (input-oriented) and periodic impact assessment reports (outcome-oriented). However, very few Vietnamese businesses conduct these impact assessments.

Another critical point is that ESG primarily serves the interests of shareholders, while sustainability encompasses a broader range of stakeholders, including those concerned with biodiversity, climate change, gender equality, and environmental pollution. “Stakeholder and shareholder interests can conflict, so how should businesses navigate this dilemma?” the expert posed.

Photo: Tien Vu

|

Another concept that Dr. Viet Anh considers flawed is the definition of sustainable development provided by the Brundtland Report (Our Common Future) of the United Nations in 1987: “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.”

The problem lies in predicting how societal needs will evolve over the next 50 years and differ across generations, such as Generations Y, Z, and Alpha. Ensuring intergenerational equity is essential, but so is intrgenerational equity, and “no one can provide a definitive answer,” the expert asserted.

Intrgenerational equity, which focuses on fairness and equality within the current generation, takes precedence over intergenerational equity, according to Dr. Viet Anh. “If we fail to address the equality issues of the present, how can we hope to resolve them for future generations?” he questioned.

Embracing a circular economy for sustainable development

As the concept of sustainability evolves to align more closely with reality, Herman E. Daly, the father of ecological economics, offers a thought-provoking perspective: “Development without growth,” suggesting that we can strive for progress without being obsessed with growth metrics.

Dr. Viet Anh elaborated on this idea, explaining that it entails not increasing resource throughput but instead embracing a circular economy. “A circular economy means zero waste and zero emissions,” he said. “And when we talk about a green economy and sustainable development, the focus is often solely on climate change, while energy, a highly profitable industry, is intrinsically linked to this issue.”

Regarding corporate social responsibility, Dr. Viet Anh referenced several renowned global perspectives:

“The social responsibility of business is to increase its profits” – Nobel laureate economist Milton Friedman.

“Profit is to business as breathing is to life” – Management consultant Peter Drucker.

“Finance is the language of business” – Investor and philanthropist Warren Buffett.

“In the long run, we are all dead” – Economist John Maynard Keynes.

Dr. Viet Anh provided examples to illustrate the challenges in aligning business practices with sustainability goals. In October 2023, TSMC reported a 54% increase in profits due to the AI chip boom, which also meant increased greenhouse gas and carbon emissions. Despite such profits, the company has committed to reducing emissions with grand promises.

For four consecutive years, Morgan Stanley Capital International (MSCI) has assigned TSMC an AAA rating, the highest possible. While TSMC has been recognized for its democratic and efficient governance and positive EBITDA, carbon emissions have not been a factor in these evaluations.

BlackRock CEO Larry Fink publicly abandoned the term “ESG” in June 2023 but maintained his stance on sustainability issues. This shift highlights the pressure from market scrutiny and regulations, as well as the need to demonstrate meaningful progress in an organization’s sustainability journey. As social issues become more divisive and even politicized, as seen in the United States, many organizations adopt neutral policies and become more cautious and reserved to avoid offending stakeholders.

In early October 2023, energy giant BP announced that it would abandon its oil production reduction targets and reset its strategy, causing its stock price to surge. In 2001, BP repositioned its brand with the new slogan “Beyond Petroleum” (Landor), signaling a commitment to sustainability. However, BP is now reversing its green transformation and carbon neutrality pledges.

Photo: Tien Vu

|

Dynamic capabilities are key to a sustainable competitive advantage

According to Carroll’s CSR theory, profitability is the primary responsibility of a business. This means that a business must first ensure it is not operating at a loss, as doing so would burden society with its debts and consequences.

Secondly, legal responsibility dictates that profits should be earned through compliance with laws and regulations, without deception or tax evasion.

The third responsibility is ethical, encompassing environmental and social considerations. Businesses must respect fundamental human rights, the right to life for all species, and refrain from destroying natural resources and polluting the environment for profit.

The fourth responsibility is philanthropic, involving sharing and contributing to society. It is essential that businesses engage in philanthropy using legitimate profits and rightful earnings, rather than using charity as a means of self-promotion.

Lastly, Dr. Viet Anh added that businesses have a responsibility to ensure succession and provide training for the next generation of leaders.

With these considerations in mind, several questions arise regarding the appropriate framework for Vietnamese businesses striving for sustainable development goals.

According to Dr. Viet Anh, the first priority is to comply with the law and earn rightful profits. Additionally, in today’s era of digital transformation and economic openness, integration is crucial. In a globalized trading environment, achieving sustainability goals without external cooperation is impossible. Therefore, management thinking must become more open to leveraging external resources, including financial, technological, and relational capital. By embracing openness, businesses can gain leverage and tap into a wider range of resources to address the various frameworks and perspectives.

Returning to the topic of sustainability reporting, Dr. Viet Anh emphasized the need to address two critical aspects: the impacts of the business on the environment and the necessary corrective actions. Additionally, external influences on the business must be managed and measured effectively. This entails mitigating risks arising from external factors and minimizing harmful effects on society. “We need to prioritize and focus our efforts, rather than spreading ourselves too thin,” the expert advised.

One standard that Dr. Viet Anh mentioned is the ISO standard for social responsibility, a globally recognized framework. In contrast, ESG currently stands as a concept or framework, open to interpretation and lacking a universally accepted definition.

The key to establishing a sustainable competitive advantage lies in embracing a philosophy of “dynamic balance” coupled with “dynamic capabilities.” By doing so, organizations can adapt their resources and capabilities to the changing business environment, positioning themselves for long-term success.

The New Land Price List Adjustment’s Impact on Ho Chi Minh City

The recent land price adjustments in Ho Chi Minh City are a significant move, reflecting the city’s development and the need to adapt to the changing reality. Despite short-term challenges, the new land price list brings about a host of positive impacts. It lays the foundation for a sustainable real estate market, promoting transparency, fairness, and the city’s comprehensive development while addressing the current situation.

“Sustainable Agriculture in Thanh Hoa: Embracing Green Practices for a Prosperous Future”

Organic farming practices are gaining traction among households and cooperatives in Thanh Hoa province. By embracing eco-friendly and sustainable agricultural methods, they are producing goods that are not only safe for consumers but also environmentally conscious. This approach is pivotal to fostering long-term growth in the agricultural economy, minimizing environmental footprints, and promoting the well-being of the community.

“Empowering the Sustainable Evolution of the Textile and Footwear Industries”

The Memorandum of Understanding between the Ministry of Industry and Trade and IDH on supporting the sustainable development of Vietnam’s textile and footwear industries will enhance the competitiveness of domestic textile and footwear enterprises. It will also contribute to Vietnam’s international commitments on sustainable development and climate change in the coming years.

Sustainable Investing: A Global Trend, Not a Passing Fad

“Sustainable investing has become a hot topic as it ushers in a new era of environmental consciousness and a ‘new playing field’ for businesses and investors alike. This was emphasized by journalist Kim Hanh, who shed light on the importance of this paradigm shift and how it is changing the landscape of the business world.”