These are the key findings from the Adecco Vietnam report on the Vietnam Labor Market Update for Q3 and outlook for Q4 2024.

During the third quarter of 2024, the manufacturing and processing industry experienced a significant surge in hiring, with a 35% year-over-year increase and a 52% jump from the previous quarter. This growth was primarily driven by high export demands and foreign investment inflows, particularly in the electronics, textile, and renewable energy sectors.

The Northern region emerged as a focal point for foreign investment, with Taiwanese and Chinese companies expanding their semiconductor and electronics production due to the global demand for semiconductors and Vietnam’s growing importance as a research, development, and manufacturing hub.

“We have observed a rising demand for specialized roles such as Production Department Heads, Quality Management, and Supply Chain Management, especially for candidates with Mandarin language skills,” emphasized Nguyen Thi Thu Phuong, Director of Recruitment Services in Hanoi, Adecco Vietnam.

The industrial business sector also witnessed a slight growth spurt, particularly in mechanical and electrical (M&E) positions, as companies expanded their operations to adapt to economic fluctuations.

Recruitment in the technology sector maintained its steady growth trajectory, largely driven by the digital transformation trend, with high demands for skills like Java, DevSecOps, and cybersecurity.

According to Truong Thien Kim, Deputy Director of Recruitment Services at Adecco Vietnam, despite challenges faced by major tech companies, the demand for talent in artificial intelligence (AI), digital hubs, and transformation projects has remained stable. To date, recruitment in the tech industry has increased by 35% year-over-year and a slight 5% from Q2 of 2024.

The finance and banking sector noted an increase in hiring demands during the third quarter, partly due to changes in financial conditions. Following a series of interest rate cuts by the State Bank, banks benefited from increased liquidity, easing capital pressures and boosting recruitment in investment and customer relationship management. The number of positions in this sector has surged by 35% compared to the same period last year.

Notably, there was a high demand for Mandarin-speaking experts, reflecting the strengthening business relationship between Vietnam and China. In-demand positions included investment management, customer relationship management, and debt collection.

Various sectors experienced recruitment growth in Q3/2024

Back-office positions in human resources, internal finance, and accounting remained stable, aligning with a cautious growth strategy amid ongoing economic uncertainties.

The significant increase in demand for marketing, communications, and sales positions in the FMCG sector indicated that companies in this field were ramping up investments in brand development and market expansion, propelled by the recovery in consumer spending.

In the healthcare sector, the demand for nursing and medical technology expert positions remained stable but modest, reflecting the industry’s balanced approach to expanding operations while efficiently managing resources.

Positions such as customer management, marketing, and sales experts were also in high demand across both the FMCG and healthcare sectors.

As the labor market shows signs of recovery amid ongoing uncertainties, maintaining adaptability becomes crucial. Enhancing skills in high-demand areas like technology and manufacturing, networking with industry experts, and staying updated with market trends will improve career prospects. Focusing on core soft skills and continuous learning will help individuals stand out in a competitive environment.

“After a challenging first nine months, foreign investment inflows and the global economic recovery have supported recent growth.

Looking ahead, the fourth quarter is expected to continue this trend, with a predicted recovery in the real estate sector and a further rise in the demand for skilled labor across various industries. Job seekers should prioritize not only seizing current opportunities but also preparing for future career development,” remarked Nguyen Hoang Thanh Chuong, National Director of Recruitment Services at Adecco Vietnam.

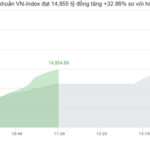

Stock Market Ascension: Elevating the Vietnamese Investor

In the recent FTSE Russell review in September 2024, Vietnam remained on the watchlist for a potential upgrade to Secondary Emerging Market status. The country’s prospects for an upgrade are still open, with organizations keeping a close eye on its progress. The next review by FTSE is expected in March 2025, followed by MSCI in 2026, which could potentially elevate Vietnam’s standing in the global financial landscape.

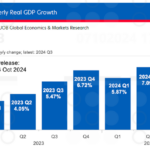

The Economy Continues its Resilient Recovery

The Vietnamese economy continued its robust recovery, propelled by improving growth dynamics on both the supply and demand sides.