MARKET REVIEW FOR THE WEEK OF 10/28-11/01/2024

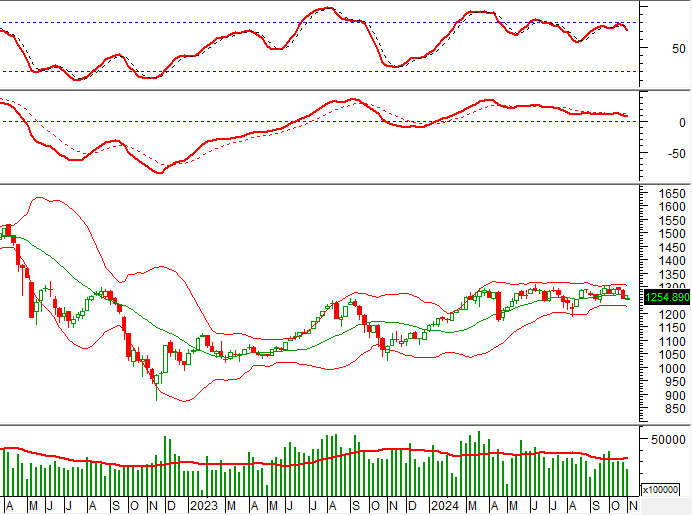

The strong decline in the last session of the week (10/28-11/01/2024) has curbed the upward momentum of the VN-Index. As a result, the index failed to surpass the Middle line of the Bollinger Bands. Additionally, trading volume is showing signs of contraction and remains below the 20-week average, indicating heightened investor caution.

Currently, the MACD indicator continues to trend downward after issuing a sell signal, reflecting a still-cautious short-term outlook.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Pullback to the Neckline in Progress

On 11/01/2024, the VN-Index declined and is experiencing a pullback after breaking down below the Neckline of a Double Top pattern, suggesting persistent pessimism.

Furthermore, the MACD indicator remains below zero and continues to trend downward, issuing a sell signal. This suggests that the corrective phase may extend into the upcoming sessions, with the index’s near-term support level at the September 2024 lows (approximately 1,240-1,255 points).

HNX-Index – Down Day Following Three Consecutive Up Days

On 11/01/2024, the HNX-Index declined after three straight up days, with trading volume remaining below the 20-day average, indicating a cautious investor sentiment.

However, the MACD is narrowing its gap with the Signal line, and the index rebounded slightly after retesting the August 2024 lows (approximately 219-224 points). If the MACD issues a buy signal, the HNX-Index‘s recovery potential may be sustained in the coming period.

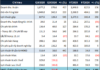

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index of the VN-Index has crossed above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will diminish.

Foreign Capital Flow Variation: Foreign investors continued to sell on 11/01/2024. If this trend continues in subsequent sessions, the outlook will become increasingly pessimistic.

Vietstock Consulting Technical Analysis Department

The Blue-Chip Recovery: Banking on a Boom

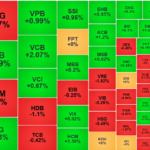

The morning’s lackluster state quickly transformed during the afternoon session as trading momentum picked up. Leading the charge were the blue-chip stocks, with a surge from the banking sector heavyweights, complemented by strong performances from VHM and VIC, which propelled the VN-Index into a robust rally.

The Market Beat: When Diversification is Key

The market closed with the VN-Index down 3.15 points (-0.25%) to 1,258.63, while the HNX-Index bucked the trend, rising 0.32 points (+0.14%) to 225.88. The market breadth tilted towards decliners with 368 losers and 324 gainers. The large-cap stocks in the VN30-Index basket painted a similar picture, with 17 stocks in the red, 8 in the green, and 5 unchanged.

The Momentum of Declines Persists

The VN-Index ended the week on a bearish note, forming a Black Marubozu candlestick pattern while slicing through the middle Bollinger Band. This reinforces the increasingly pessimistic outlook. Moreover, trading volume remaining below the 20-day average underscores the growing investor caution. The MACD indicator continues its downward trajectory, reinforcing the sell signal. This suggests that the risk of short-term corrections persists.