Market liquidity increased compared to the previous trading session, with the VN-Index’s matched trading volume reaching over 904 million shares, equivalent to a value of more than 20.5 trillion VND. The HNX-Index also witnessed a similar positive trend, with a trading volume of over 71.7 million shares, equivalent to a value of more than 1,385 billion VND.

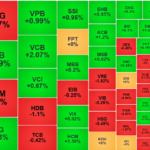

The VN-Index opened the afternoon session with a tug-of-war between buyers and sellers, as short-term profit-taking emerged, but buyers remained dominant, helping the index close in the green. In terms of impact, VCB, BID, MBB, and HPG were the most positive influences on the VN-Index, contributing over 4.3 points to the index’s gain. On the other hand, VNM, GVR, NAB, and VHM had the most negative impact but were not significant.

Similarsection class=”table”>

Similarly, the HNX-Index also showed positive momentum, influenced by the gains in MBS (+5.76%), KSV (+2.78%), CEO (+3.21%), and SHS (+1.96%).

section class=”table”>

The financial sector was the top gainer, surging 1.39%, led by STB (+2.67%), VPB (+1.3%), MBB (+1.98%), and SSI (+3.2%). This was followed by the energy and materials sectors, which rose 0.55% and 0.53%, respectively.

In contrast, the healthcare sector continued its downward trend, recording the sharpest decline in the market at -0.6%. This was mainly due to losses in DCL (-0.55%), IMP (-2.9%), DVN (-2.81%), and DHG (-0.19%).

In terms of foreign investors’ activities, they continued to be net buyers on the HOSE, with a net purchase value of over 398 billion VND. The most significant purchases were in VCI (89.68 billion VND), TCB (75.36 billion VND), SSI (64.03 billion VND), and MWG (54.85 billion VND). On the HNX, foreign investors net bought over 2 billion VND, focusing on SHS (26.21 billion VND), CEO (9.21 billion VND), MBS (8.95 billion VND), and VGS (4.56 billion VND).

section class=”table”>

Morning Session: Market Buzzed with the Return of “Bank – Securities – Steel”

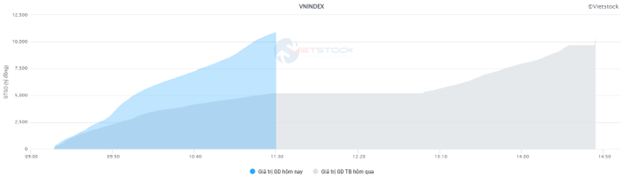

The broad-based rally painted the market green, and trading activities were vibrant in the morning session, marked by the spectacular comeback of the “bank – securities – steel” trio. At the midday break, the VN-Index climbed 10.36 points, or 0.81%, to 1,285.88 points, while the HNX-Index rose 0.58% to 235.67 points. The buying momentum was robust, with 413 stocks advancing and 233 declining.

The strong buying interest was concentrated in the large-cap stocks, improving market liquidity. The matched trading volume of the VN-Index in the morning session reached over 483 million shares, equivalent to a value of nearly 11 trillion VND, doubling that of the previous morning session. The HNX-Index recorded a matched trading volume of over 40 million shares, with a value that tripled to nearly 808 billion VND.

section class=”table with-image”>

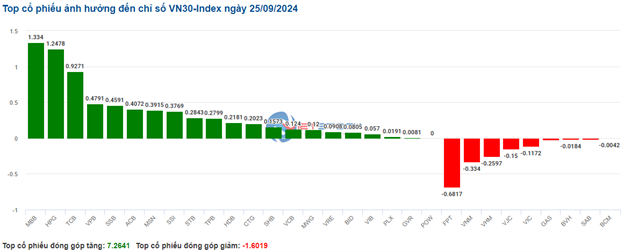

VCB was the market leader, propelling the VN-Index up by more than 2 points. BID, HPG, and TCB also made significant positive contributions, adding over 2.5 points to the index’s gain. On the flip side, VNM, FPT, and VJC posted slight declines, but their negative impact on the index was negligible.

Most sectors were painted green, with the “bank – securities – steel” trio standing out as the top performers. The securities sector led the market with a gain of 2.67%. Almost all stocks in this sector surged over 2%, notably MBS (+6.44%), HCM (+3.26%), BVS (+3.26%), SSI (+3.01%), VIX (+3.07%), VCI (+2.61%), and FTS (+2.44%).

Following closely was the steel sector, which rose nearly 2%, driven by strong demand for leading stocks such as HPG (+1.74%), HSG (+2.98%), NKG (+2.84%), TVN (+3.45%), VGS (+4.66%), and TIS (+7.46%). Although the “king” group, comprising the largest market capitalization stocks, posted a more modest gain compared to the other two groups, its contribution to the market’s surge was the most significant due to its weight in the market. The leading stocks in this group, including VCB, BID, CTG, TCB, VPB, MBB, and ACB, all advanced over 1%.

In contrast, telecommunications and information technology sectors lagged, ranking at the bottom with declines of 0.66% and 0.28%, respectively. This was mainly due to losses in VGI (-0.89%), CTR (-0.15%), VNZ (-0.43%), SGT (-1.73%), and FPT (-0.3%).

Foreign investors were net buyers on the HOSE in the morning session, with a net purchase value of over 49 billion VND. SSI was the stock that attracted the most foreign buying interest. On the HNX, foreign investors net bought over 13.5 billion VND, focusing their purchases on SHS.

10:30 AM: Financials and Materials Sectors Lead the VN-Index Higher

The main indices, which started the day with strong gains, turned to a tug-of-war around the reference level, indicating investors’ cautious sentiment. As of 10:30 AM, the VN-Index rose 5.2 points to trade around 1,282 points, while the HNX-Index gained 0.84 points to trade around 235 points.

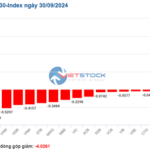

Most stocks in the VN30 basket were in positive territory, outperforming the declining stocks. Specifically, MBB, HPG, TCB, and VPB contributed 1.33 points, 1.25 points, 0.93 points, and 0.48 points to the index, respectively. On the other hand, FPT, VNM, VHM, and VJC faced selling pressure, deducting more than 1 point from the VN30-Index.

section class=”table with-image”>

The financial sector led the recovery, with most stocks in the green. Notably, securities stocks surged from the start of the ATO session, with SSI up 1.13%, HCM up 2.12%, VCI up 1.3%, and MBS up 4.75%. This positive sentiment could be attributed to the recent approval by the Ministry of Finance of Circular 68/2024/TT-BTC, which amends and supplements a number of articles of the Circulars guiding securities trading on the securities trading system, clearing, and settlement. This move helps address the issue of non-pre-funding for foreign institutional investors, paving the way for the upgrade of Vietnam’s stock market and creating opportunities for the development of companies providing services in this field.

Additionally, the banking sector also witnessed an optimistic performance, with most stocks in the green. Notable gainers included MBB (+1.58%), VPB (+0.52%), STB (+0.32%), and ACB (+0.58%).

The materials sector also attracted investment attention, with the three giants in the steel industry, HPG (+1.35%), HSG (+2.98%), and NKG (+2.61%), leading the gains. Some stocks in the chemicals industry also posted solid gains, such as DCM (+1.83%), DPM (+1.54%), and DGC (+0.61%).

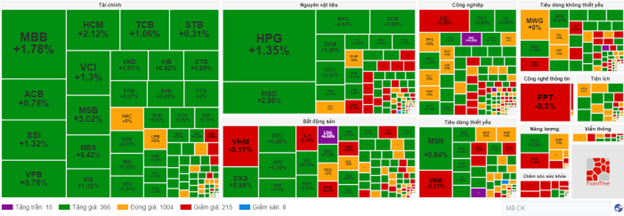

Compared to the opening, the buying momentum remained strong. There were 366 advancing stocks and 215 declining stocks.

section class=”table with-image”>

Market Open: Maintainingsection class=”table”>

At the start of the September 25 session, as of 9:30 AM, the VN-Index rose over 3 points to 1,280.69 points, while the HNX-Index also edged higher to 235.1 points.

Gold prices climbed more than 1% to hit a new record on Tuesday (September 24) as tensions in the Middle East fueled safe-haven demand, and investors anticipated further interest rate cuts in the US.

At the close of the trading session on September 24, spot gold rose 1.1% to $2,656.38 an ounce after hitting a previous high of $2,654.96. Gold futures rose 1% to $2,680.00 an ounce.

As of 9:30 AM, large-cap stocks such as VCB, HPG, and CTG were driving the market, contributing over 1 point to the gain. On the other hand, VHM, KDC, and NAB led the group with the most negative impact on the market, but the decline was less than 0.5 points.

The energy sector maintained stable growth from the start of the session, with stocks such as BSR (+1.26%), PVS (+0.72%), PVD (+0.54%), PVC (+0.76%), and PVB (+1%) posting gains. The remaining stocks in the sector were either stagnant or slightly lower.

[Lý Hỏa]

The Market Beat: A Tale of Diverging Fortunes

The market ended the session in negative territory, with the VN-Index down 2.98 points (-0.23%) to 1,287.94 and the HNX-Index falling 0.8 points (-0.34%) to 234.91. Bears dominated as 436 stocks declined while 272 advanced. The large-cap VN30-Index was a mixed bag, with 19 decliners, 8 gainers, and 3 unchanged stocks.

“Vietstock Weekly: A Cautious Outlook for the Near Future”

The sharp dip over the weekend curtailed VN-Index’s upward momentum. This pullback prevented the index from breaching the middle line of the Bollinger Bands. Moreover, the trading volume is showing signs of waning and remains below the 20-week average, indicating heightened investor caution. Currently, the MACD indicator continues to trend downward, issuing a sell signal that reflects a short-term outlook that is not yet optimistic.

The Blue-Chip Recovery: Banking on a Boom

The morning’s lackluster state quickly transformed during the afternoon session as trading momentum picked up. Leading the charge were the blue-chip stocks, with a surge from the banking sector heavyweights, complemented by strong performances from VHM and VIC, which propelled the VN-Index into a robust rally.

The Market Beat: When Diversification is Key

The market closed with the VN-Index down 3.15 points (-0.25%) to 1,258.63, while the HNX-Index bucked the trend, rising 0.32 points (+0.14%) to 225.88. The market breadth tilted towards decliners with 368 losers and 324 gainers. The large-cap stocks in the VN30-Index basket painted a similar picture, with 17 stocks in the red, 8 in the green, and 5 unchanged.