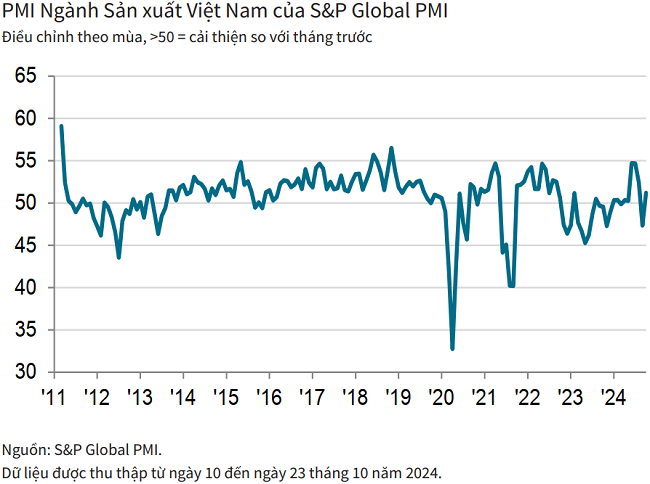

On November 1st, S&P Global released the Purchasing Managers’ Index (PMI) report for Vietnam’s manufacturing sector, highlighting three key points: the ongoing recovery from the impact of Typhoon Yagi, the rebound in output and new orders, and persistent disruptions to supply chains and production.

RECOVERY FROM TYPHOON, OUTPUT AND NEW ORDERS REBOUND

October data indicates a recovery in Vietnam’s manufacturing sector following the impact of the September typhoon, with both output and new orders rising. However, the typhoon’s aftermath lingered into October, constraining output growth and causing supplier delivery delays and a buildup of outstanding work.

The PMI for Vietnam’s manufacturing sector climbed to 51.2 in October, up from 47.3 in September and back above the 50-point threshold after disruptions caused by Typhoon Yagi in the previous month. Business conditions have now strengthened in six of the past seven months, although the improvement in October was only marginal.

According to the S&P Global report, the improvement in the sector’s health was centered on the rebound in output and new orders as the recovery from the typhoon took hold. However, the growth rate of these indicators was slower than in the months preceding September as some companies continued to experience disruptions in the aftermath of the typhoon and associated flooding.

Along with the rise in total new orders, new export orders also increased marginally in October, despite reports of softening international demand.

With some companies still operating below maximum capacity due to typhoon-related issues, backlogs of work rose for the fifth consecutive month, although the rate of increase was lower than the two-and-a-half-year high recorded in September.

Manufacturers continued to utilize finished goods inventory to fulfill orders amid partial production disruptions. Post-production inventory declined at the fastest rate in three months.

STABLE MARKET CONDITIONS FUEL PRODUCTION OPTIMISM

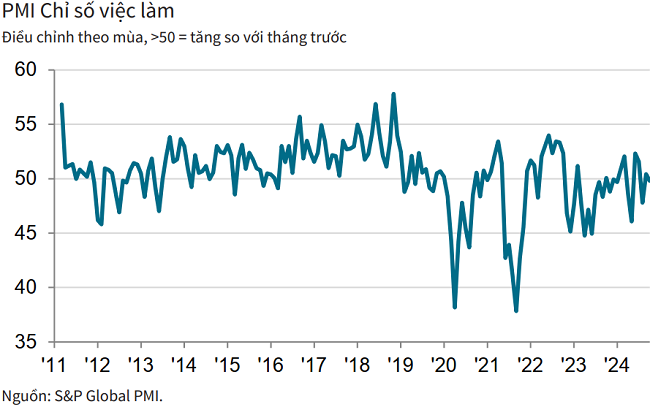

Meanwhile, employment fell, reversing the previous month’s increase, as some companies reported resignations reducing staff numbers.

Supplier delivery times lengthened for the second straight month in October as typhoon-related transportation disruptions persisted. However, the extent of delay was milder than in September.

Purchasing activity rebounded amid rising new orders and expectations of higher output in the coming months. Nonetheless, the rate of increase was modest, with some companies indicating sufficient inventory levels.

Pre-production inventories continued to decline as inputs were used to support output growth. However, the rate of decrease was far weaker than the near-record drop observed in the previous survey.

Manufacturers reported rising input costs due to currency weakness and higher oil, metal, and transportation prices. To offset these increases, companies raised their output prices. However, the rate of output price inflation was marginal as some survey respondents mentioned that competitive pressures had led them to reduce prices.

Growing sales, stable market conditions, and expansion plans collectively contributed to positive expectations for manufacturing output in the year ahead. However, optimism softened to a nine-month low and was below the historical average for the index. Some companies cited uncertainties surrounding the US presidential election as a dampener on business confidence.

Commenting on the survey results, Andrew Harker, Economics Director at S&P Global Market Intelligence, stated that the October data signaled a recovery from the disruptions caused by Typhoon Yagi, with companies experiencing rising new orders and the ability to expand production.

However, he acknowledged that some companies were still feeling the impact of the typhoon, which constrained growth rates. As a result, stronger growth is anticipated as more manufacturers resume operations at full capacity toward the end of the year.

The Vice Premier: Commerce and Industry Must Be the Vanguard

In a meeting with the Ministry of Industry and Trade on the afternoon of September 17, Deputy Prime Minister Bui Thanh Son instructed the ministry to continue refining its institutional framework to address challenges and facilitate development. This includes unblocking stalled projects, such as those in the power and gas sectors, to unlock resources for economic and social recovery.

The Seafood Industry is Rocked by Storm Yagi

The recent Typhoon No. 3 (Yagi) has wreaked havoc on aquaculture, resulting in a severe shortage of raw materials for seafood processing businesses. The storm’s impact has been far-reaching, with many shipments delayed and left in prolonged storage, potentially affecting product quality and increasing the risk of financial losses for these businesses.

“Aiming High: Striving for Higher Growth in 2024 and 2025 to Make Up for the Previous Three Years”

At the regular Government meeting for August 2024, held on September 7th, Prime Minister Pham Minh Chinh urged a strive to achieve and exceed all 15 key targets for socio-economic development for 2024. Emphasizing economic growth, the Prime Minister pushed for higher growth rates in 2024 and 2025 to make up for the previous three years of the term.