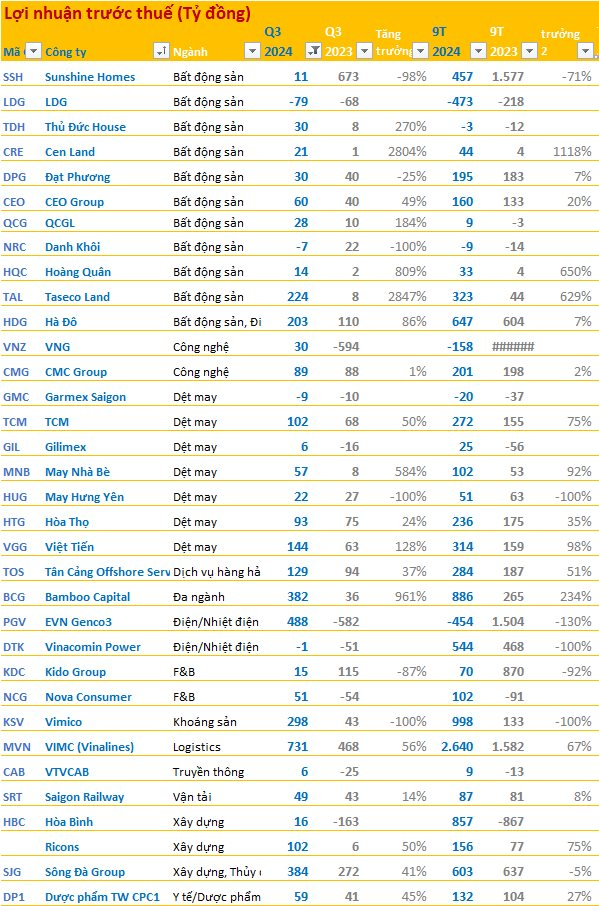

A number of enterprises have recently released their Q3/2024 financial statements, offering valuable insights into their performance and growth. Among them are prominent names in various industries, showcasing their financial achievements and contributions to the economy.

Vietnam Airlines (HVN) impresses with a 12.7% increase in revenue compared to the previous year’s Q3, amounting to VND 26,600 billion. The company also turned a profit, with a remarkable pre-tax profit of VND 975 billion, a significant improvement from the loss of over VND 2,000 billion in the same period last year. This marks the third consecutive profitable quarter for Vietnam Airlines.

Moving on, we have CEO Group (CEO) with impressive figures to showcase. Their consolidated financial statements for Q3/2024 reveal a total revenue of VND 260.4 billion and an after-tax profit of VND 48.8 billion. This remarkable performance is a testament to their growth, with the after-tax profit being 3.5 times higher than that of Q2/2024 and 1.7 times higher than the same period last year.

Another standout performer is Quoc Cuong Gia Lai (QCG), which reported impressive financial results for Q3/2024. Their revenue reached over VND 178 billion, a substantial increase of 166% compared to the same period last year. After deducting expenses, Quoc Cuong Gia Lai posted a remarkable pre-tax profit of over VND 28 billion, which is 4.5 times higher than that of 2023.

CEO Group and QCG are not alone in their success within the real estate industry. A host of other companies in this sector, including Hoang Quan, Ha Do, Taseco Land, and Cen Land, have also reported impressive profit increases.

The textile industry is also thriving, with companies like Gilimex, May Nha Be, Soi The Ky, and May Song Hong mirroring the real estate sector’s success by reporting profit increases of their own.

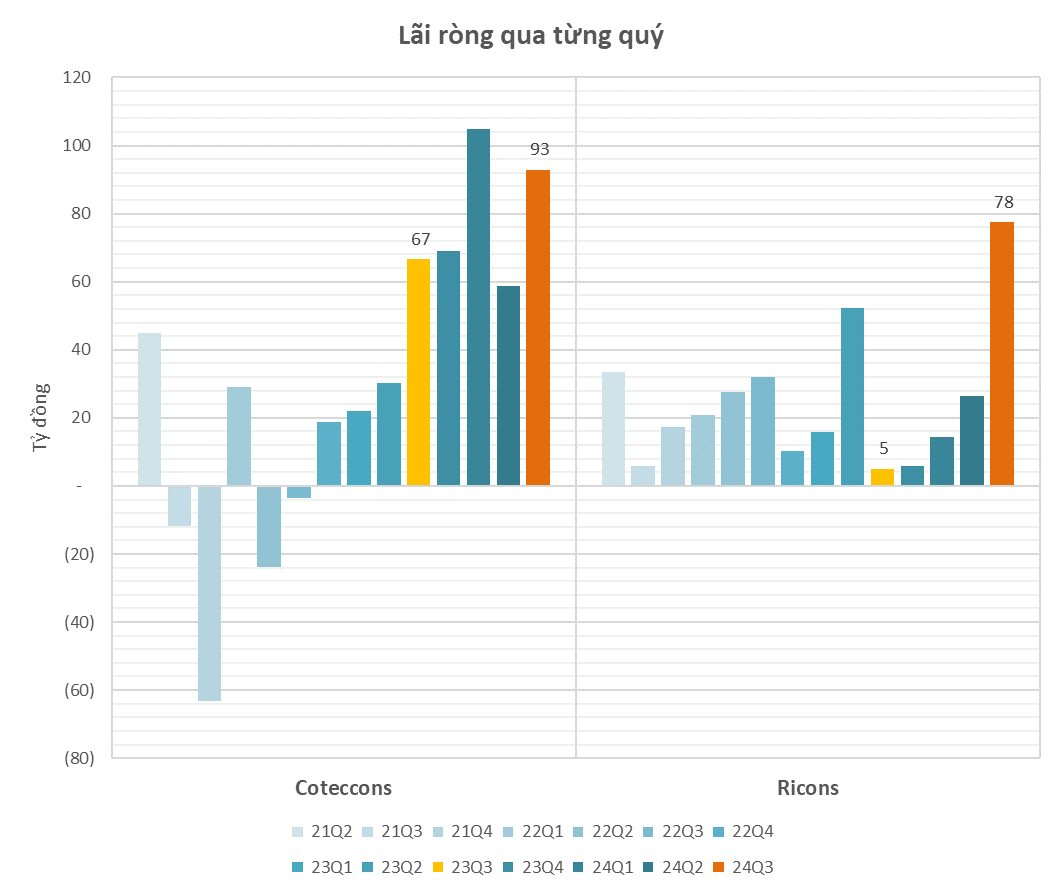

Coteccons (CTD) is another notable mention, with a net profit of VND 93 billion for Q1 of the 2024-2025 fiscal year, reflecting a 39% increase compared to the same period last year.

The Mineral Corporation (KSV) has reported impressive financial results, with a pre-tax profit that has increased sevenfold to VND 298 billion.

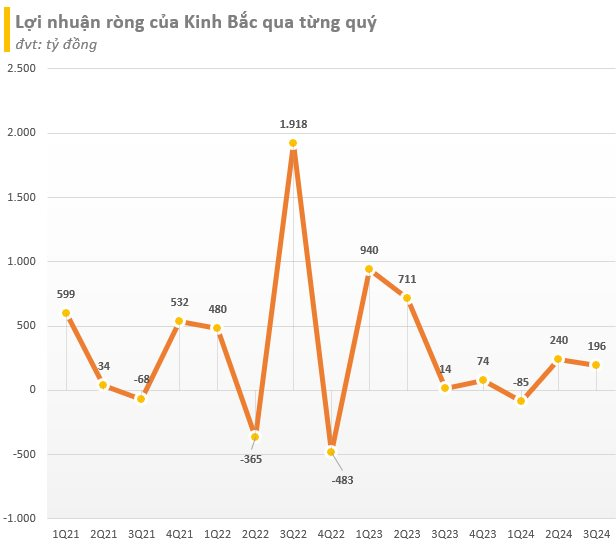

Urban Development and Construction Corporation (KBC) has also shared its Q3/2024 financial statements, revealing a remarkable threefold increase in revenue compared to the same period last year, totaling VND 950 billion. Their impressive performance is further highlighted by an after-tax profit of VND 196 billion, a staggering 14-fold increase, with EPS rising from VND 8 to VND 256.

Saigon Railway Transport Company (SRT) has reported impressive financial results, with a revenue of over VND 563.5 billion, reflecting a notable 27% increase compared to Q3/2023. Their ability to manage expenses effectively has resulted in a pre-tax profit of over VND 49 billion, approximately 14.5% higher than the previous year. This quarter’s performance marks the highest quarterly profit in the company’s history.

VNG Corporation (VNG) has also disclosed its consolidated financial statements for Q3/2024, indicating a 32% year-on-year increase in revenue, totaling VND 2,578 billion, and a 90% surge in gross profit to VND 504 billion. Their successful quarter is further emphasized by an after-tax profit of VND 8 billion for the parent company.

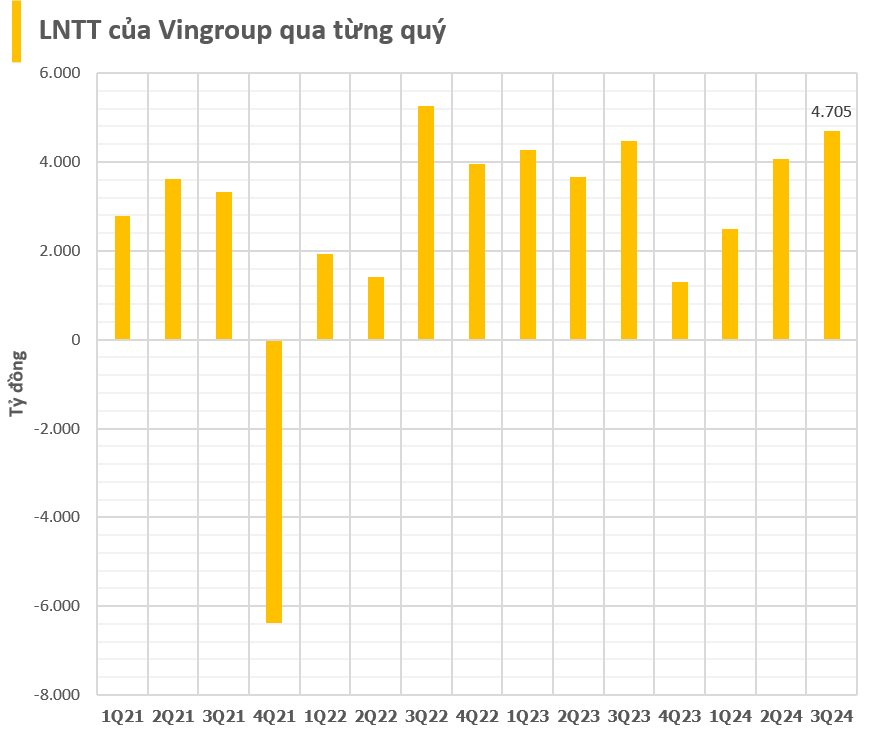

Vingroup (VIC) has reported impressive figures, with a consolidated net revenue of VND 126,916 billion for the first nine months of 2024. Specifically, in Q3/2024, the company achieved a record-breaking revenue of VND 62,851 billion. Their pre-tax profit exceeded VND 4,700 billion, a slight increase compared to the previous year.

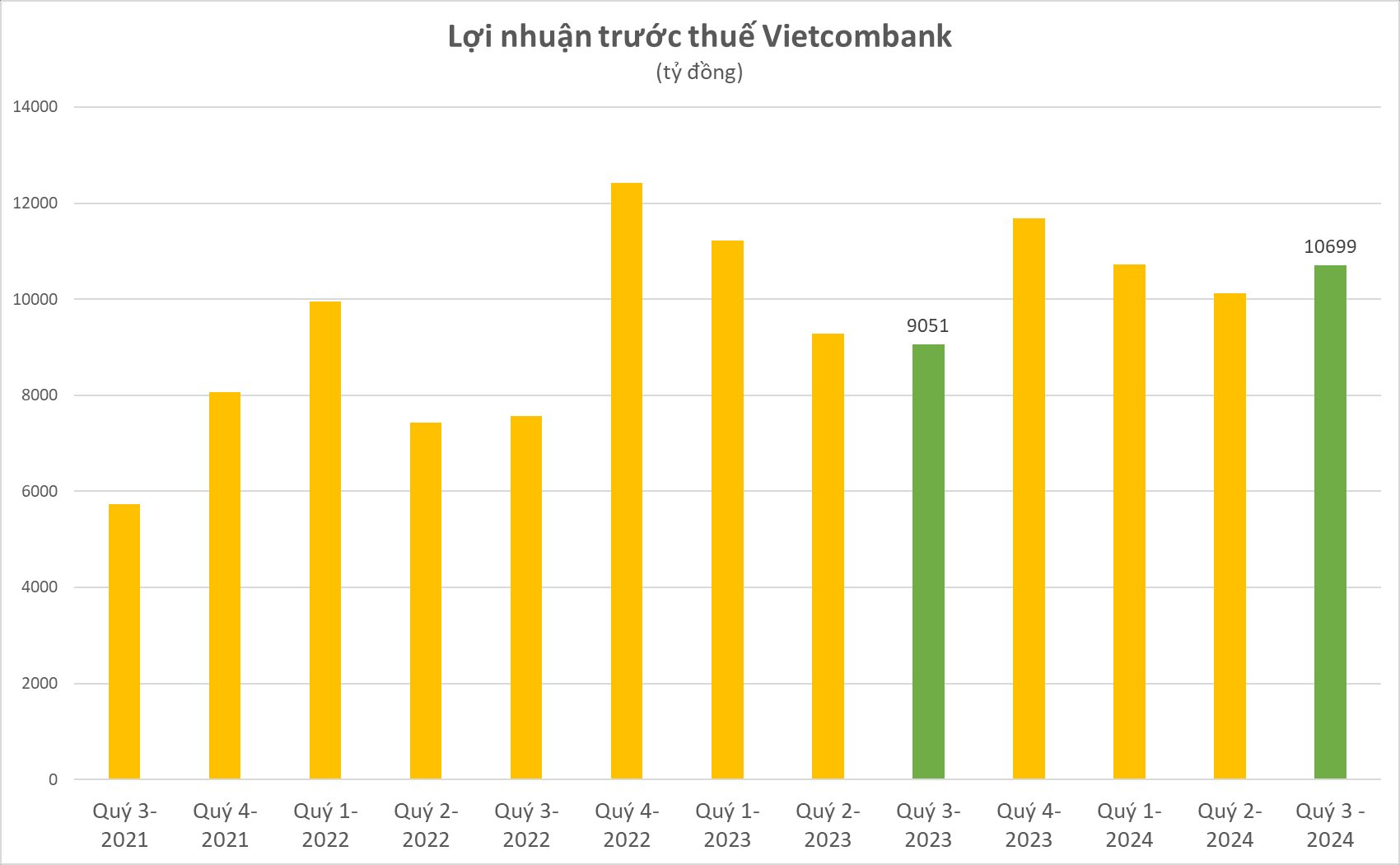

Vietcombank (VCB) has maintained its strong performance, with a pre-tax profit of VND 10,699 billion in Q3/2024, reflecting an 18% increase compared to the same period last year. This positions them as the leader in the banking system in terms of pre-tax profit. For the first nine months of the year, Vietcombank’s pre-tax profit reached VND 31,533 billion, a 7% increase. As of the end of September, the bank’s total assets stood at VND 1.93 million billion, a 5% increase from the beginning of the year.

BIDV (BID) has demonstrated its financial prowess with a pre-tax profit of VND 6,498 billion in Q3/2024, marking a 10% increase compared to the same period last year. For the first nine months, their pre-tax profit reached VND 22,047 billion, a 12% increase year-on-year.

VietinBank (CTG) has also shown impressive growth, with a pre-tax profit of VND 6,553 billion in Q3/2024, a substantial 35% increase year-on-year. Their nine-month pre-tax profit stood at VND 19,513 billion, a 12% increase compared to the previous year. As of the end of September, VietinBank’s total assets were valued at VND 2.23 million billion, reflecting a 9.7% increase compared to the same period last year.

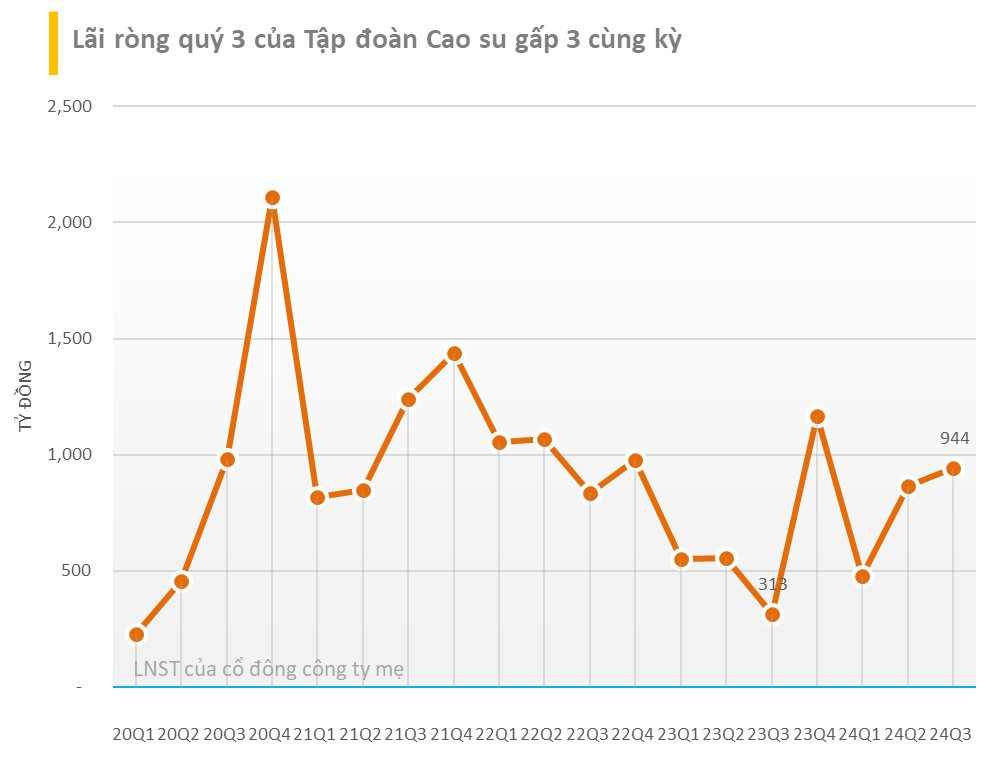

The Vietnam Rubber Group (GVR) has reported a remarkable 110% increase in pre-tax profit for Q3/2024, surpassing VND 1,300 billion.

Tasco (HUT) has also joined the list of successful enterprises, reporting a pre-tax profit of over VND 50 billion, more than triple that of the previous year. This impressive feat can be largely attributed to their significant increase in revenue.

Petrolimex (PLX), a giant in the fuel trading industry, has reported a revenue of VND 64,324 billion and a pre-tax profit of VND 241 billion for Q3/2024. However, these figures represent an 11% and 80% decrease, respectively, compared to the same period last year.

PV Power (POW) has demonstrated financial resilience with a 6.7% year-on-year increase in revenue, totaling VND 6,061 billion for Q3/2024. Their financial prowess is further emphasized by a pre-tax profit of VND 548 billion, an impressive 6.6-fold increase compared to the same period last year, thanks to strong financial investment activities and the absence of financial expenses.

Vietjet (VJC) has maintained its positive trajectory, reporting a consolidated revenue of VND 52,200 billion for the first nine months of 2024, reflecting a notable 19% increase year-on-year. Their consolidated after-tax profit reached VND 1,405 billion, an astonishing 564% increase compared to 2023.

FPT Retail (FRT) has also shared its financial achievements for the first nine months of 2024, with a consolidated revenue of VND 28,657 billion, a 24% increase year-on-year, putting them on track to meet their annual plan. Their pre-tax profit stood at VND 358 billion.

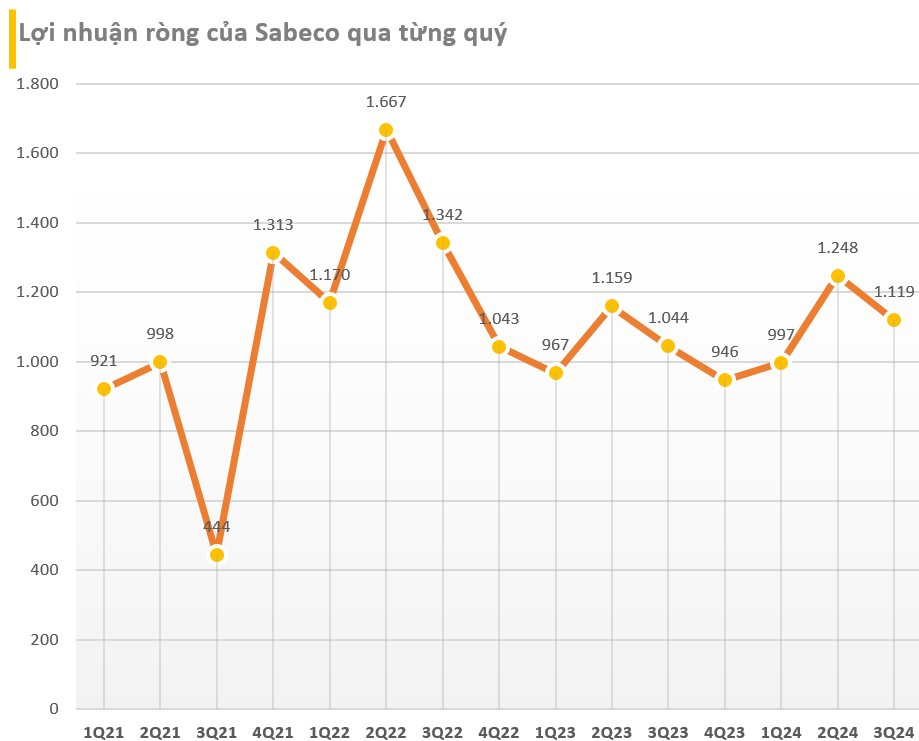

Sabeco (SAB) has maintained its strong performance, with a net revenue of VND 7,640 billion and a net profit of VND 1,119 billion for Q3/2024, reflecting a 3.4% and 7.2% increase, respectively, compared to the same period last year.

The above-mentioned enterprises are not alone in their success, as a host of other companies have also reported their Q3/2024 financial statements as of October 31, 2024. These businesses span various industries and sectors, and their achievements contribute to the overall economic growth and prosperity of the nation.

“Soaring Provisioning Costs, Yet BVBank’s 9-Month Pretax Profit Triples Year-on-Year”

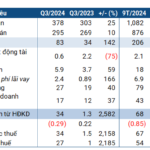

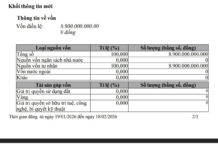

The consolidated financial statements show that despite increasing provisions for risk, BVBank (BVB on UPCoM) reported a remarkable pre-tax profit of nearly VND 182 billion for the first nine months, almost triple that of the same period last year. This impressive performance is attributed to a significant increase in core income from lending activities, showcasing the bank’s resilience and strong positioning in the market.