Masan Group Announces SK Group’s Successful Divestment of 76 Million Shares

Công ty Cổ phần Tập đoàn Masan (Masan Group) has announced that SK Investment Vina I Pte. Ltd. (SK Group) has successfully divested 76 million shares of Masan Group through a private agreement. Following this transaction, SK Group’s ownership stake in Masan Group has decreased to 3.67% of the charter capital, and they are no longer a major shareholder.

This transaction is notable as it involves a significant number of shares in a company that has not yet reached the foreign ownership limit (FOL) in Vietnam. The remaining shares held by SK Group will be subject to the usual transfer restrictions.

On September 4, Ms. Chae Rhan Chun, representing SK Investment Vina I and holding nearly 132 million shares of MSN, stepped down from the Board of Directors of Masan Group. On the same day, SK Group and Masan Group agreed to extend the time frame for SK Group’s put option with Masan Group by up to five years.

Additionally, SK Group will transfer its 7.1% stake in WinCommerce (WCM) to Masan Group for a price of $200 million, valuing WCM at over $2.8 billion. This transaction underscores the confidence that international investors have in Masan Group’s long-term growth prospects.

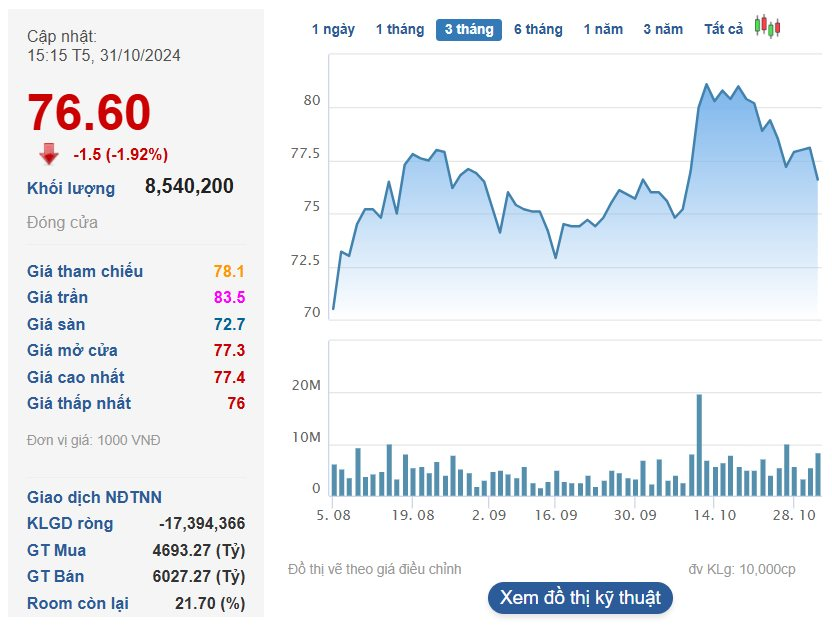

In a related development, Masan Group’s shares (MSN) closed October at VND 76,600 per share, a 5% decrease from its peak earlier in the year but still 15% higher than at the beginning of 2024. The company’s market capitalization stands at approximately VND 110 trillion.

According to Masan’s announcement, the transaction was led by large institutional investors based in Asia, Europe, and the United States. This contributes to a stable shareholder structure for Masan Group as the company continues to drive growth and execute strategic initiatives.

Jefferies Singapore Ltd acted as financial advisor and underwriter to SK Group for the international offering. VietCap served as broker for SK Group.

In other news, Nguyen Yen Linh, daughter of Mr. Nguyen Dang Quang, Chairman of Masan Group’s Board of Directors, has registered to purchase 10 million MSN shares to increase her ownership stake. The transaction is expected to take place through private agreements and/or order matching from October 29 to November 18, 2024.

Prior to this transaction, Ms. Yen Linh did not hold any MSN shares. If successful, her ownership stake in Masan Group will increase to 0.66% of the charter capital.

In 2018, SK Group became a major shareholder of Masan Group and held a put option for shares in MSN in 2024. As part of this strategic investment, SK Group also invested in WCM with a 16.3% stake and in The CrownX, Masan’s integrated consumer retail platform, which merged WCM and Masan Consumer Holdings, with a 4.9% stake.

In the third quarter of 2024, Masan Group reported a net profit of VND 701 billion, a fifteen-fold increase from the same period last year, driven by the growth of its consumer retail business and a decrease in net interest expenses.

For the first nine months of 2024, Masan achieved a net profit after tax of VND 1,308 billion after allocation of minority interests (NPAT Post-MI), completing 130.8% of the net profit plan approved by shareholders at the beginning of the year.

The Rise of the Securities Companies: Can Masan Reach its Audacious Target of 2,000 Billion VND Net Profit?

In the first nine months of 2024, Masan achieved a remarkable profit of 1.308 trillion Vietnamese dong after allocation of minority interests, surpassing its initial plans by a significant margin. With this impressive performance, the company is well on its way to achieving its ambitious full-year net profit target of 2 trillion Vietnamese dong, as per the positive scenario laid out.

The Billion-Dollar Deal: A Massive $5,600 Billion Agreement on Masan Stock, Foreigners Sell Off

Ending the October 31 session, a staggering 17.3 million MSN shares were traded, amounting to a colossal value of over 1.3 trillion VND. This monumental trade volume topped the stock exchange charts, leaving all other transactions in its shadow.

Masan: Confident to Achieve 2024 Profit Plan of $86 Million

In Q3 2024, Masan reported a staggering 701 billion VND in profit, an astonishing nearly 14-fold increase compared to the same period last year, and surpassing its quarterly profit plan by 130% in the base-case scenario. The company is now focused on the final quarter, aiming to get closer to its ambitious 2,000 billion VND profit goal for the year.