Siam Cement Group (SCG) Temporarily Halts Operations at Long Son Petrochemicals Complex

Siam Cement Group (SCG), Thailand’s largest cement producer and industrial conglomerate, listed on the SET, has temporarily halted operations at its Long Son Petrochemicals (LSP) complex in Vietnam to curb operating costs, with plans to restart when conditions are more favorable.

According to the Bangkok Post, the suspension is expected to last at least six months, starting in mid-October, just two weeks after LSP commenced commercial operations on September 30, with a production capacity of 74,000 tons.

“We have to adjust our business operations to cope with the challenges in the petrochemical industry,” said Thammasak Sethaudom, Chairman and CEO of SCG.

The petrochemical complex uses naphtha, a product of fossil fuels, as its main feedstock to produce high-density polyethylene (HDPE), but naphtha is expensive.

“The margin between naphtha and HDPE is $300 per ton due to the slowdown in the global petrochemical market,” said Sakchai Patiparnpreechavud, CEO and President of SCG Chemicals. “If the margin increases to $400 per ton, we will consider whether to continue operating at LSP.”

The suspension does not mean that SCG Chemicals will stop investing in this petrochemical complex, he said.

SCG Chemicals plans to upgrade LSP, allowing it to use ethane, a colorless, odorless hydrocarbon gas, as feedstock because it is cheaper than naphtha.

Sakchai said the company expected to invest $700 million in the new project, especially to build an ethane storage facility.

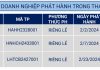

The Long Son Petrochemical Complex is invested by Long Son Petrochemicals Co., Ltd. (LSP) – a wholly-owned subsidiary of SCG Chemical (SCGC). The Long Son Petrochemical Complex project was granted an investment certificate in July 2008, with an initial total investment capital of $3.77 billion, which later increased to $4.5 billion and $5.4 billion in the final phase.

SCG Group Tightens Its Belt

On a group scale, Siam Cement Group (SCG), Thailand’s leading cement and building materials company, announced it is preparing a cost-cutting and liquidity-boosting plan to counter a drop in nine-month performance this year, according to The Nation (Thailand).

While the company’s revenue during this period was THB 380.66 billion (USD 11.21 billion), similar to the previous year, its earnings before interest, taxes, depreciation, and amortization (EBITDA) were THB 38.76 billion, a 10% decrease compared to the same period last year.

Meanwhile, the company’s profit was THB 6.85 billion, a 75% decrease compared to the same period last year, mainly due to spending on the Long Son Petrochemical Complex in Vietnam, as well as a drop in income from capital and profits of associated companies.

In the third quarter alone, SCG generated THB 128.19 billion in revenue (USD 3.78 billion) and THB 9.87 billion in EBITDA. The company made THB 721 million in profit, an 81% decrease compared to the same period last year due to foreign exchange losses.

Chairman and CEO Thammasak Sethaudom predicted that revenue would only increase by 3% this year due to global economic fluctuations, negative sentiment about the petrochemical industry, Middle East conflicts, an influx of Chinese products, and baht volatility.

Therefore, the company is planning to counter these risks by cutting costs by THB 5 billion (USD 0.15 billion) by 2025 and boosting working capital by THB 10 billion in the first quarter.

The company also plans to sell assets to boost liquidity and improve production efficiency to maintain EBITDA by increasing alternative fuel consumption at cement plants to 50% and adopting robotics in tile manufacturing.

Unprofitable businesses, such as parcel delivery service SCG Express and Oitolabs Technologies Private Limited (Oitolabs), a digital technology and software company based in India acquired by SCG Cement-Building Materials, will be suspended. The potential suspension of other businesses will be decided by mid-2025.

SCG confirmed that the company still has strong cash flow of THB 48 billion (USD 1.42 billion), of which THB 34 billion (USD 1 billion) has been allocated for investment this year.

Additionally, the company will benefit from China’s economic stimulus measures and the Thai government’s budget.

However, the company will closely monitor risks arising from the impact of the US presidential election on Chinese product inflows into Thailand, the Middle East conflict’s impact on fuel costs, and baht volatility.

“We just need to be patient to cope with the risks of this year and next year because we still have money. But we should cut costs to gain long-term profits,” said Thammasak.

He added that the company is continuing to invest in ASEAN and noted that sales in the region had increased by 10% in the first nine months compared to the same period last year.

1 baht ~ 746 VND, 1 USD ~ 33.9 baht

The First Time in 87 Years: Volkswagen’s Surprising Move – A Lightweight Action with Heavyweight Consequences for the European Titan.

The company’s production activities will undergo a radical transformation if the aforementioned action is approved.

The Race to Reduce Costs: An Auto Giant’s Plea to Suppliers to Avoid a $250 Million Loss per EV.

The company is urging suppliers to come up with cost-cutting solutions, even those that had previously been dismissed. With a proactive approach, they are seeking innovative ways to reduce expenses, encouraging suppliers to think outside the box and present ideas that may have been overlooked in the past.

What’s Left for Vietnam’s Plastics Tycoon Tran Duy Hy After Selling 70% of Duy Tan Plastics to SCG?

After having sold his entire core business to SCG in 2021, entrepreneur Tran Duy Hy started a new business venture in the recycled plastics sector through two flagship companies, Duy Tan Recycled Plastic located in Long An and Plascene based in California, USA. According to Le Anh, the representative of Duy Tan Recycled Plastic, the company is still struggling with losses.