Liquidity in the market decreased compared to the previous trading session, with the VN-Index matching volume reaching over 693 million shares, equivalent to a value of more than 15.1 trillion VND; HNX-Index reached over 52.7 million shares, equivalent to a value of more than 1,066 billion VND.

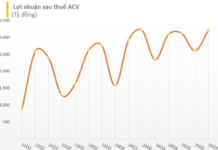

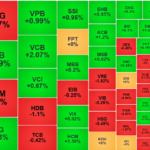

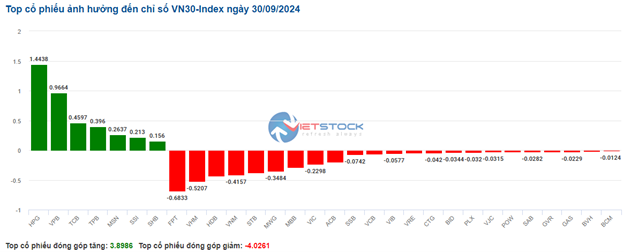

The sellers continued to dominate in the afternoon session, although buying interest emerged, it was not enough to change the situation, leading the VN-Index to close in the red. In terms of impact, VCB, VHM, BID, and VIC were the most negative influencers, taking away more than 2.3 points from the index. On the other hand, VPB, HPG, MSB, and MWG were the most positive influencers, contributing almost 1.6 points to the index.

| Top 10 stocks with the strongest impact on the VN-Index on 30/09/2024 |

Similarly, the HNX-Index also witnessed an unfavorable development, with negative influences from stocks such as NTP (-4.22%), DNP (-8.58%), IDC (-0.86%), and VCS (-1.22%)…

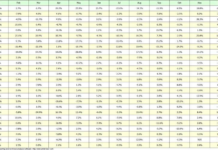

|

Source: VietstockFinance

|

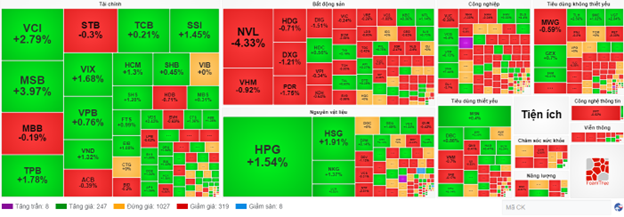

The telecommunications sector witnessed the sharpest decline in the market, falling by -1.26%, mainly due to VGI (-1.38%), YEG (-0.87%), CTR (-0.47%), and FOX (-1.12%). This was followed by the energy and real estate sectors, which decreased by 1.14% and 0.9%, respectively. On a positive note, the information technology sector witnessed the strongest recovery in the market, with green signals from FPT (+0.22%), VTB (+0.97%), and PIA (+0.37%).

In terms of foreign trading activities, foreign investors resumed net selling with a value of more than 616 billion VND on the HOSE exchange, focusing on stocks such as HPG (260.6 billion VND), STB (109.53 billion VND), GMD (48.01 billion VND), and VRE (35.45 billion VND). On the HNX exchange, foreign investors net sold more than 79 billion VND, focusing on PVS (31.93 billion VND), IDC (20.36 billion VND), SHS (15.57 billion VND), and MBS (5.57 billion VND).

| Foreign Investors’ Net Buying and Selling Activities |

Morning Session: Sellers Remain Dominant

The market continued to hesitate near the strong resistance zone. By midday break, the VN-Index lost 2.8 points, or 0.22%, to 1,288.12 points; the HNX-Index also decreased by 0.22% to 235.19 points. Sellers are gaining more traction, with 404 declining stocks versus 222 advancing stocks.

The VN-Index‘s matched volume in the morning session reached over 363 million units, equivalent to a value of more than 7.6 trillion VND. The HNX-Index recorded a matched volume of nearly 27 million units, with a value of over 511 billion VND.

In terms of impact, VHM, VCB, and BID were the main pillars exerting the most pressure, taking away more than 1.3 points from the VN-Index. Conversely, HPG, MSB, and MWG continued to attract positive buying interest in the morning session, contributing more than 1 point to the index and preventing a steeper decline.

Red dominated across most sectors, except for materials. This was the only sector that managed to stay in the green during the morning session, thanks to standout performances from steel stocks such as HPG (+1.54%), HSG (+1.67%), NKG (+0.92%), VGS (+1.3%), and TIS (+1.41%). However, most other stocks in the materials sector couldn’t escape the bearish sentiment, notably NTP (-3.44%), BMP (-3.49%), and RTB (-3.63%).

On the declining side, the telecommunications group was the worst performer, falling by more than 1%. This was mainly influenced by stocks such as VGI (-1.23%), VNZ (-3.63%), and FOC (-2.08%). Additionally, the real estate sector also exerted significant pressure on the overall market. Red prevailed across the board, with notable declines in NVL (-3.9%), VHM (-1.27%), VRE (-1.29%), PDR (-1.75%), DIG (-1.51%), TCH (-1.11%), and DXG (-1.51%).

The financial sector exhibited a mixed performance. Specifically, securities stocks maintained a strong upward momentum with SSI (+1.27%), VCI (+2.23%), BVS (+2.35%), VDS (+3.2%), and BSI (+1.02%), among others. In contrast, sellers prevailed in most banking stocks. Apart from MSB (+3.17%), EIB (+1.08%), and VBB (+1%), which recorded notable gains, the remaining banking stocks, including VCB, BID, CTG, TCB, MBB, ACB, HDB, STB, and others, witnessed slight declines by the end of the morning session.

Foreign investors net sold nearly 342 billion VND on the HOSE exchange in the morning session, with prominent selling activities in HPG (net selling of nearly 179 billion VND). On the HNX exchange, foreign investors net sold nearly 32.5 billion VND, focusing their sales on SHS.

10:30 AM: Selling Pressure Persists

Cautious trading sentiment caused the main indices to fluctuate around the reference levels. As of 10:30 AM, the VN-Index slightly decreased by 1.71 points, hovering around 1,289 points. The HNX-Index dropped by 0.15 points, trading around 235 points.

The breadth of the VN30 basket was tilted towards the downside, with 23 declining stocks and 7 advancing stocks. Among them, FPT, VHM, HDB, and VNM had a relatively negative impact on the index, deducting 0.68 points, 0.52 points, 0.44 points, and 0.42 points, respectively. On the supportive side, most banking stocks, including VPB, TCB, TPB, and SHB, contributed nearly 2 points to the VN30-Index.

Source: VietstockFinance

|

The real estate sector continued to face headwinds, with most stocks trading in negative territory and recording the sharpest decline in the market, at -0.63%. Specifically, VHM fell by 1.04%, HDG decreased by 0.89%, DXG dropped by 0.91%, and notably, NVL plunged by 4.33% after announcing its reviewed consolidated financial statements for the first half of 2024, reflecting a loss of over 7,300 billion VND.

The main reason for Novaland’s significant loss was the independent opinion of the auditor, who requested a provision for land rent and land use fees to be paid based on the 2017 land price scheme for the 30,106 ha Nam Rạch Chiếc project in Thủ Đức City, Ho Chi Minh City (Lakeview City project – developed by Century 21 International Investment JSC), according to the tax authority’s notification dated January 8, 2021.

Following a similar trend, the telecommunications sector continued to experience mild selling pressure across most stocks. Specifically, VGI declined by 0.77%, CTG decreased by 0.08%, ELC fell by 0.41%, and YEG dropped by 0.43%…

On the other hand, the materials sector demonstrated a decent recovery, although the movement within the sector was somewhat mixed. On the upside, buying interest concentrated on the three largest steel stocks: HPG (+1.54%), HSG (+1.91%), and NKG (+1.37%). Conversely, plastics stocks like BMP (-3.33%), NTP (-2.81%), and AAA (-0.31%) struggled amid persistent selling pressure.

Compared to the opening, sellers continued to hold the upper hand. There were 319 declining stocks versus 247 advancing stocks.

Source: VietstockFinance

|

Market Open: Cautious Start

On September 30, as of 9:30 AM, the VN-Index hovered around the reference level, trading near 1,289 points. The HNX-Index also witnessed a mild decline, trading around 235 points.

On the morning of September 29, in Đà Bắc district, Hòa Bình province, Prime Minister Phạm Minh Chính attended the groundbreaking ceremony for the Hòa Bình – Mộc Châu expressway (from Km19 to Km53 in Hòa Bình province) with a total investment of nearly 10,000 billion VND.

The Hòa Bình – Mộc Châu expressway project in Hòa Bình province has a total length of approximately 34 km and a total investment of 9,997 billion VND. The project is expected to be completed by 2028, and the land clearance phase for the 4-lane road will require approximately 354.37 ha.

As of 9:30 AM, red temporarily prevailed in the VN30 basket, with 21 declining stocks, 2 advancing stocks, and 6 stocks trading flat. Among them, ACB, BCM, BID, and BVH were the top losers. Conversely, HPG, SHB, TPB, and MSN were the top gainers.

The materials sector stood out as one of the most active sectors in the market during the morning session, with most stocks trading in positive territory, such as HPG (+1.54%), HSG (+1.91%), TVN (+3.41%), NKG (+1.83%), BFC (+0.48%), KSB (+1.03%), and others…

“Vietstock Weekly: A Cautious Outlook for the Near Future”

The sharp dip over the weekend curtailed VN-Index’s upward momentum. This pullback prevented the index from breaching the middle line of the Bollinger Bands. Moreover, the trading volume is showing signs of waning and remains below the 20-week average, indicating heightened investor caution. Currently, the MACD indicator continues to trend downward, issuing a sell signal that reflects a short-term outlook that is not yet optimistic.

The Blue-Chip Recovery: Banking on a Boom

The morning’s lackluster state quickly transformed during the afternoon session as trading momentum picked up. Leading the charge were the blue-chip stocks, with a surge from the banking sector heavyweights, complemented by strong performances from VHM and VIC, which propelled the VN-Index into a robust rally.

The Market Beat: When Diversification is Key

The market closed with the VN-Index down 3.15 points (-0.25%) to 1,258.63, while the HNX-Index bucked the trend, rising 0.32 points (+0.14%) to 225.88. The market breadth tilted towards decliners with 368 losers and 324 gainers. The large-cap stocks in the VN30-Index basket painted a similar picture, with 17 stocks in the red, 8 in the green, and 5 unchanged.

The Momentum of Declines Persists

The VN-Index ended the week on a bearish note, forming a Black Marubozu candlestick pattern while slicing through the middle Bollinger Band. This reinforces the increasingly pessimistic outlook. Moreover, trading volume remaining below the 20-day average underscores the growing investor caution. The MACD indicator continues its downward trajectory, reinforcing the sell signal. This suggests that the risk of short-term corrections persists.