The aviation industry faces a colossal challenge when it comes to sustainability, considering its rapid growth and significant carbon footprint. As highlighted in Simpliflying’s report, “The State of Sustainable Aviation,” if left unchecked, the industry’s current 2-3% contribution to global carbon emissions is projected to soar to a staggering 25% by 2050.

To put this into perspective, if the aviation industry were a country, it would rank among the top 10 carbon-emitting nations on Earth. According to worldwildlife.org, air travel is currently the most carbon-intensive activity an individual can undertake. A single round-trip flight between New York and London generates more emissions than the average person in Paraguay produces in an entire year. Thus, it is imperative for the global aviation industry to embark on a sustainable path forward immediately.

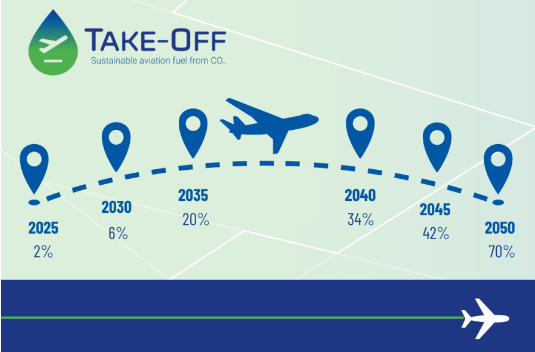

At present, Sustainable Aviation Fuel (SAF) stands as the only viable option for decarbonizing aviation, as alternative technologies, such as hydrogen or electric aircraft, are still years away from commercialization.

THE RAPID RISE OF THE SAF MARKET

Despite its nascent stage, the development and adoption of SAF face several challenges: it is considerably more expensive than traditional jet fuel, its supply is limited, and the path to sourcing the necessary renewable feedstocks and energy for production remains unclear. However, the SAF market has been growing at an impressive pace.

According to ResourceWise, the market has grown from $520 million in 2023 to an estimated $790 million in 2024—a remarkable year-over-year increase of over $250 million. This growth underscores the significant demand for sustainable solutions. Research and Markets, a leading research firm, predicts that the SAF market will reach a whopping $3.92 billion by 2028, nearly quintupling its current sales volume in just four years.

DRIVING FORCES BEHIND THE SAF “REVOLUTION”

In the push to green the aviation industry, we’ve witnessed a growing number of airlines worldwide embracing SAF. Airports have also offered various incentives and benefits to encourage aviation companies to transition to renewable alternatives.

Organizations such as the International Air Transport Association (IATA) and the American Society for Testing and Materials (ASTM) have made strides to improve supply chain processes and disseminate knowledge about SAF. These efforts will help reduce implementation costs while increasing the global availability of SAF.

The growth of SAF is further propelled by stringent commitments from governments, environmental groups, and the aviation industry itself. The International Civil Aviation Organization’s (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) sets rigorous targets for reducing aviation emissions, providing a guiding framework for airlines to adopt SAF more widely.

Governments are also introducing mandatory policies for minimum SAF usage, such as the RefuelEU initiative in Europe, and similar mandates in Japan, Singapore, and Indonesia. The United States government is actively supporting policies for SAF research and development.

ESTABLISHED COMPANIES AND STARTUPS ARE HEAVILY INVESTING IN SAF’S FUTURE

Businesses are employing diverse strategies to engage in the SAF supply chain. According to Simpliflying’s 2023 Sustainable Aviation Fuel Powerlist report, there are now 100 companies actively working on and developing various solutions within the SAF supply chain.

Some companies focus on technology development and transfer (such as Honeywell UOP, Topsoe, and Velocys), while larger entities offer end-to-end solutions, ensuring feedstock supply, SAF production, and delivery to aircraft (feedstock-to-wingtip approach), including prominent names like Neste and SkyNRG.

In Vietnam, pioneering airlines and suppliers have already taken steps toward SAF adoption. Vietnam Airlines, the national carrier, operated its first SAF-powered flight, with the flight number VN660, from Singapore to Hanoi on May 27, 2024.

ThaiVietjet Airlines also joined the fray, operating an SAF-fueled flight from Phuket, Thailand, to Danang on July 10, 2024.

On the supplier side, Petrolimex Aviation, a leading aviation fuel company, is the first enterprise in Vietnam with plans to import and supply SAF domestically. In the near future, we can expect SAF to be available in the Vietnamese market, supplied and produced by local companies.

As more countries and businesses commit to net-zero emissions targets by 2050 and embrace renewable energy sources, SAF’s role in the fight against climate change becomes increasingly vital.

Viettel IDC: Leading the Way in Sustainable Digital Infrastructure in Vietnam

Viettel IDC, Vietnam’s leading large-scale and green Data Center and Cloud Computing services provider, has been recognized for its excellence by winning the prestigious ‘Sustainable Infrastructure Awards’ category at the ESG Business Awards 2024.

The Green Revolution: Leading the Way in Eco-Consciousness

With extended producer responsibility, businesses are now accountable for the collection and recycling of waste generated from their products. This shift has led to a surge in recycling demands, empowering recyclers with additional resources and presenting a unique opportunity to revolutionize waste management.