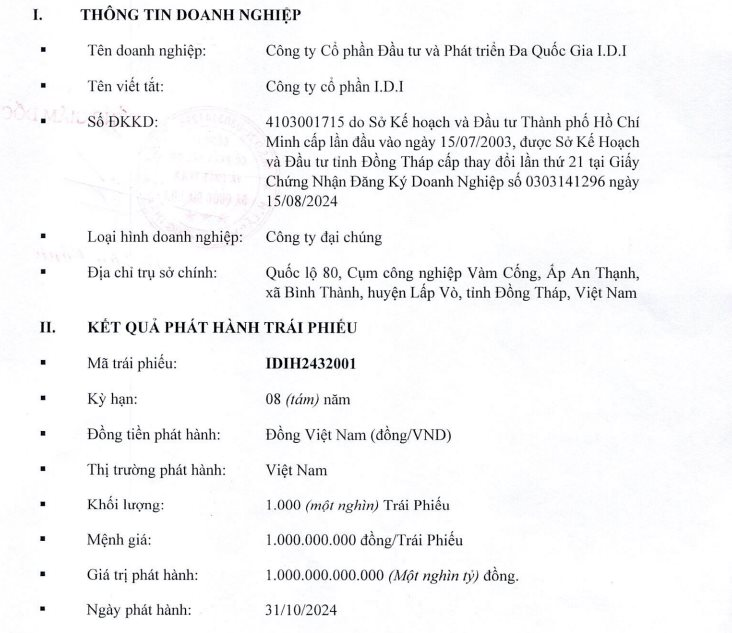

Multi-National Investment and Development Joint Stock Company (HoSE: IDI) has successfully issued the IDIH2432001 bond series with a value of VND 1,000 billion and an 8-year term, according to a disclosure on the Hanoi Stock Exchange (HNX).

Specifically, the IDIH2432001 bond series was issued domestically with a volume of 1,000 bonds, a par value of VND 1 billion per bond, and a corresponding issuance value of VND 1,000 billion.

The bond series was issued and completed on October 31, 2024, making the maturity date October 31, 2032.

This bond series is secured by a payment guarantee from GuarantCo Ltd, a limited liability company incorporated under the laws of Mauritius, with its registered address at 3rd Floor, Alexander House, 35 Cybercity, Ebene 72201, Mauritius. Details of the payment guarantee are stipulated in the Bond Terms and Conditions and the Guarantee Agreement.”

The bond series offers a fixed interest rate of 5.58% per annum, which is a record low in the current corporate bond market for fundraising (excluding banks).

The Vietnam Securities Depository is the custodian organization, and Vietnam Joint Stock Commercial Bank Securities Company (VCBS) is the related unit.

Source: HNX

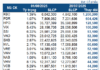

In terms of business performance, in the third quarter of 2024, IDI recorded an after-tax profit of VND 17.8 billion, a decrease of 23.88% compared to the same period in 2023.

According to the company’s explanation attached to the report, the decrease was due to a 75.24% increase in selling expenses, equivalent to an increase of VND 21.98 billion. This was attributed to higher international shipping freight rates compared to the previous year.

Additionally, financial income decreased by 61.78%, equivalent to a decrease of VND 35.31 billion, due to lower deposit interest rates and the recognition of dividend income from an associated company in the third quarter of 2023.

For the first nine months of the year, IDI recorded an after-tax profit of VND 54.1 billion, a decrease of 20.03% compared to the same period in 2023.

As of September 30, 2024, IDI’s total assets were VND 8,368 billion. Of this, owner’s equity was VND 3,463 billion, payables were VND 4,894 billion, and short-term and long-term loans and finance leases were VND 4,344 billion.

In the stock market, by the end of the morning session on November 7, IDI shares were trading at VND 8,400 per share, down 0.36% from the previous session, with a matched volume of 337,000 units.

Notably, this is the lowest price range for IDI shares in the past year.

The Profit Windfall: KBC’s Q3 2024 Net Profit Soars to 14 Times the Previous Year’s, Raking in Over $40,000 in Daily Bank Interest

For the nine-month period, Kinh Bac Urban reported a 58% and 82% year-on-year decline in revenue and net profit, respectively, to VND 1,994 billion and VND 351 billion.

“The Perils of Being a Perpetual Money Lender”

“I find it hard to believe that we are handing over money for others to spend,” exclaimed National Assembly Deputy Le Quan, referring to cases related to corporate bonds. Emphasizing the need for proper regulations, he pointed out that the Vietnamese bond market has not been developing as per market rules. To mitigate risks for investors, he proposed holding auditing firms accountable.

The Rise of the Securities Companies: Can Masan Reach its Audacious Target of 2,000 Billion VND Net Profit?

In the first nine months of 2024, Masan achieved a remarkable profit of 1.308 trillion Vietnamese dong after allocation of minority interests, surpassing its initial plans by a significant margin. With this impressive performance, the company is well on its way to achieving its ambitious full-year net profit target of 2 trillion Vietnamese dong, as per the positive scenario laid out.