On November 12, over 99.9 million MZG shares of Miza JSC will officially be traded on the UPCoM market. The reference price for the first trading day is VND 11,900 per share, equivalent to a valuation of nearly VND 1,200 billion.

Established in 2010, Miza is headquartered in the Small and Medium Industrial Cluster of Nguyen Khe, Nguyen Khe Commune, Dong Anh District, Hanoi. The company specializes in recycling waste paper to produce packaging paper products, supplying them to packaging factories nationwide. It also recycles waste (various types of paper scraps) to create reusable products for production and consumption.

During the 2015-2016 period, Miza expanded its waste paper recycling line to manufacture high-quality packaging paper, increasing its capacity from 25,000 tons/year to 32,500 tons/year. By 2017, the company had invested in an additional line, bringing the total factory capacity to 40,000 tons/year.

Currently, Miza is investing in the Miza Nghi Son Packaging Paper Factory Project, phase 2. It involves constructing a second production line at Miza Nghi Son Limited Company with a capacity of 120,000 tons/year, boosting the total capacity of the paper production line to 240,000 tons/year.

Following multiple capital increases, Miza’s charter capital now stands at nearly VND 1,000 billion. The company plans to issue nearly six million shares to pay a 6% dividend for 2023. The expected timeline for this issuance is in 2024, following approval from the State Securities Commission of Vietnam. Post-issuance, the company’s charter capital will increase to nearly VND 1,060 billion.

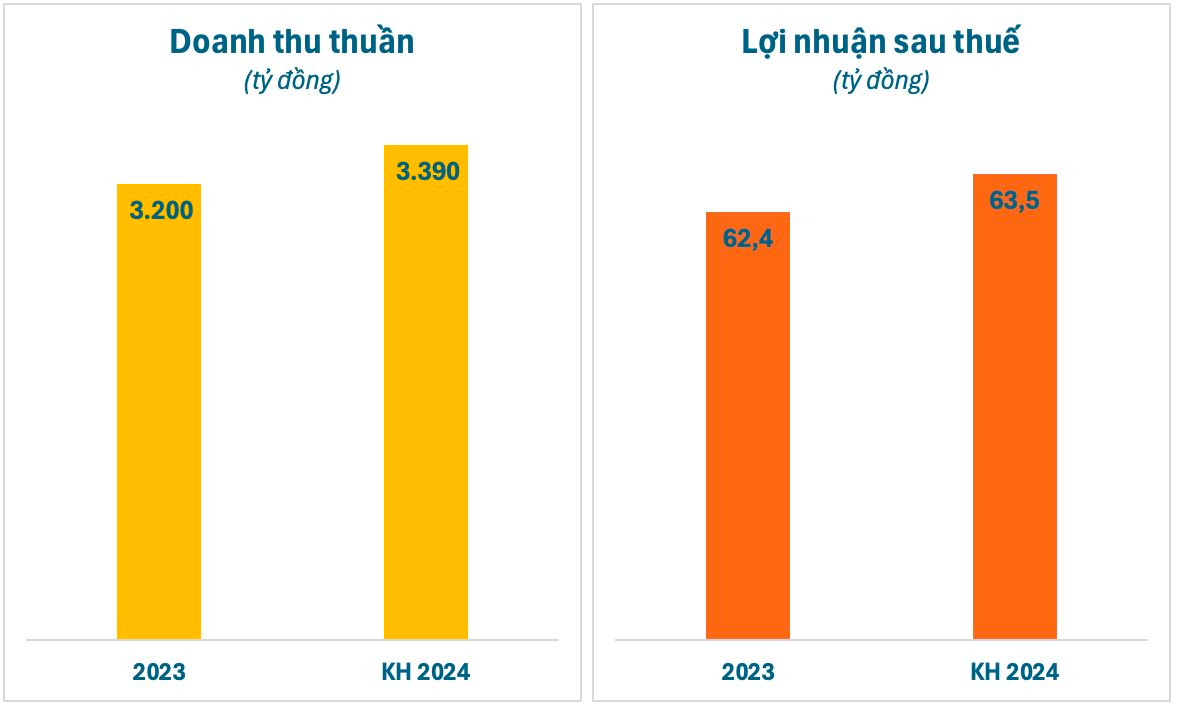

In recent years, Miza has consistently generated thousands of billions of dong in revenue from the sale of various papers and packaging. In 2023, the company recorded more than VND 3,200 billion in net revenue and over VND 62.4 billion in after-tax profit, surpassing its annual profit target by 8%.

For 2024, Miza has set a target of over VND 3,390 billion in net revenue and an after-tax profit of over VND 63.5 billion, representing a 6% and 2% increase, respectively, compared to the previous year.

In the third quarter of 2024, Miza recorded more than VND 1,090 billion in net revenue, a 56% increase compared to the same period in 2023. Its after-tax profit reached VND 20.5 billion, a significant improvement compared to the loss of VND 3.4 billion in the previous year.

For the first nine months of 2024, Miza achieved net revenue of VND 3,121 billion and after-tax profit of VND 45.2 billion, a 40% and 29% increase, respectively, compared to the same period last year. With these results, the company has accomplished 92% of its revenue plan and 71% of its annual profit target.

As of September 30, Miza’s total assets exceeded VND 4,300 billion, a 12% increase from the beginning of the year. This comprises mostly fixed assets (VND 1,637 billion) and short-term receivables (VND 1,157 billion). Financial borrowings account for nearly 57% of the total capital source, with short-term debt making up a significant portion of the nearly VND 2,450 billion in outstanding debt.