The domestic stock market continued its downward trend on November 4, with the VN-Index losing more than 10 points and hovering just above the 1,240-point mark. The implementation of Circular 68/2024/TT-BTC, which allows foreign institutional investors to trade stocks without full payment, failed to stop the market’s decline.

Brokers face losses, investors feel discouraged

What’s worth noting is that while the Vietnamese market was in the red, major global markets in Asia, Europe, and America were flourishing in green. This contrast has left domestic investors disheartened, leading them to cut their losses and sell their stocks at low prices. As a result, the VN-Index closed at its lowest level since mid-September 2024, with liquidity remaining low as trading value on the HOSE floor barely exceeded VND 15,800 billion.

Investors and experts are hopeful for a revival of the stock market in the remaining months of the year. Photo: LAM GIANG

According to MBS Vietnam, the average liquidity of the entire market has dropped to its lowest level in seven weeks, reaching approximately VND 16,380 billion. Excluding negotiated transactions, the trading value stood at only about VND 12,381 billion. The VN-Index has lost its upward momentum since the beginning of August when it was at the 1,280-point level and has continued to search for a bottom in recent weeks.

Numerous investors have expressed their disappointment with the market’s performance, stating that it has not only fallen short of their expectations but also led to significant losses. Mr. Hoai Minh, a resident of Binh Thanh District, Ho Chi Minh City, who holds stocks in real estate and construction companies, shared that despite positive third-quarter results from his invested businesses, stock prices have consistently declined.

“Real estate stocks have been fluctuating within a narrow range for the past eight months, while infrastructure construction stocks have been on a downward trend, causing my account to sink deeper into the red,” said Minh. “Initially, I tried to average down, but for about a month now, I’ve uninstalled the trading app and stopped trading.”

Investors holding stocks in other sectors, such as securities, steel, and oil and gas, find themselves in similar situations, facing losses despite their efforts to average down. Ms. Doan Thi Thu Huyen, a consultant at Yuanta Securities Vietnam, shared that the decline in market liquidity and the resulting decrease in trading activities have directly impacted brokers’ incomes. “Typically, when the market is sluggish and investors feel discouraged, fewer people open trading accounts, indicating that the market is in a bottom-forming phase,” she added.

Mr. Tran Anh Giau, a broker at Mirae Asset Securities, echoed similar sentiments, stating that his income has taken a significant hit due to investors’ inactivity. “The Vietnamese macro economy is performing well, but the stagnation of the VN-Index has created a sense of wariness and reluctance among investors to trade, leading to a substantial drop in brokers’ transaction fee income,” he explained. “Additionally, many investors are stuck with losing positions, which further adds pressure on the brokerage team.”

A Breath of Fresh Air from Foreign Investors

Regarding Circular 68/2024/TT-BTC, which came into effect on November 2, allowing foreign institutional investors to trade stocks without full payment and introducing a roadmap for English language disclosure, some major securities companies have started implementing the new trading regulations.

Mr. Barry Weisblatt David, Head of Analytics at VNDIRECT Securities Corporation, stated that they are adhering to the instructions of the Vietnam Securities Depository (VSD) and the directives of Circular 68 to onboard clients and provide the required services. VNDIRECT is collaborating with consulting firms from the Big Four accounting firms to establish risk assessment procedures for each client…

“This circular is significant as it demonstrates the government’s commitment to attracting foreign investment into the stock market, positioning Vietnam as an attractive investment destination,” said Mr. Barry Weisblatt David.

Circular 68 is expected to encourage some fund managers to increase their allocation to Vietnam as it enables more cost-effective investments. However, the impact may be limited as it does not affect allocations from funds such as PYN, Dragon Capital, or VinaCapital, which are already fully invested in Vietnam. The circular will primarily apply to regional funds or global frontier and emerging market funds interested in Vietnam.

From the perspective of a foreign investment fund, Ms. Nguyen Hoai Thu, CEO of VinaCapital’s Securities Investment Division, mentioned that many securities companies have prepared the necessary procedures for foreign investors to trade. However, it is crucial to ensure that these procedures are implemented smoothly in practice without any glitches or disruptions to investors’ trading activities.

Securities companies also need to prepare sufficient capital to provide funding for foreign investors’ transactions. “Risk control for securities companies is essential to prevent situations where foreign investors purchase securities but fail to make payments,” added Ms. Hoai Thu.

Regarding the contribution of Circular 68 to the roadmap for upgrading Vietnam’s stock market, a VinaCapital expert stated that after establishing the legal framework and implementation procedures to allow foreign institutional investors to purchase securities without requiring 100% cash corresponding to the order value, FTSE Russell will need to gather feedback from foreign investors currently investing in the Vietnamese stock market. If no obstacles are encountered, FTSE Russell can then make an official decision regarding the market upgrade.

According to the VNDIRECT expert, there is a possibility that the FTSE Russell will announce an upgrade to emerging market status in March 2025. This announcement is expected to positively impact market sentiment and individual investor buying sentiment. Foreign ETFs tracking the Vietnamese market may also increase their assets under management as foreign investors anticipate the emerging market upgrade, leading to stock price increases in the first quarter of 2025. While estimates vary, it is anticipated that between $500 million and less than $1 billion in foreign capital will flow into Vietnam, particularly into businesses that hold a significant weight in the FTSE FM index.

Gold and Stock Talkshow

On the morning of November 5, NLD Newspaper organized a talk show on the theme “Gold Hits Record Highs, Stock Market Struggles: Where Are the Opportunities?” featuring renowned economic and financial experts who analyzed the factors influencing the stock market and gold prices in the present and their outlook for the future.

Has the Market Bottomed Out?

Ms. Tran Khanh Hien, Head of Analysis at MBS, opined that despite the USD Index hovering around the 104-point mark, the State Bank has resumed net pumping to support the system’s liquidity amid rising credit demand towards the end of the year. Interbank interest rates have decreased, the exchange rate has shown signs of cooling down, and the VND has appreciated against the USD. Along with Circular 68, these factors are expected to positively influence the market in the coming period.

“The Vietnamese stock market typically experiences a growth cycle from November to the end of February of the following year. In the last two years, 2022 and 2023, the VN-Index hit its bottom in November and initiated a strong recovery afterward. The possibility of the Federal Reserve cutting interest rates by another 0.25 percentage points in their November meeting, along with robust public investment disbursement and credit growth domestically, could also benefit the stock market,” analyzed Ms. Khanh Hien.

The Foreign Selling Spree: Unraveling the 7/11 Session’s Massive Sell-off of Over VND 400 Billion

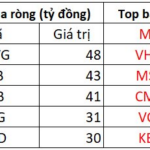

The aforementioned stocks, MWG, STB, and TCB, witnessed robust buying activity from foreign investors on the HOSE exchange. The foreign buying interest in these stocks was evident, with respective net buying values of 48 billion, 43 billion, and 41 billion VND.

Unveiling a New Policy: Welcoming the Wave of Foreign Investment to Vietnam’s Stock Market

Vice President of the SSC shared that Circular No. 68/2024/TT-BTC is a result of an expedited and transparent regulatory process, showcasing the strong collaboration between regulatory bodies, operators, and market participants. This collaborative effort is aimed at upgrading and building a securities market that is safe, comprehensive, robust, integrated, and sustainably developed.