Vietnam Engine and Agricultural Machinery Corporation, widely known as VEAM Corp (VEA), has delighted its shareholders with a substantial dividend payout for 2023. According to the recently published resolution by the company’s Board of Directors, shareholders will receive a dividend of 50.3518%, equivalent to VND 4,035.18 per share. The record date for shareholders eligible to receive this dividend is set for November 20, 2024, with payments expected to be made by December 20, 2024.

With approximately 1.33 billion shares outstanding, VEAM is set to distribute a whopping VND 6,691 billion in this dividend round. The majority of this payout will go to the state-owned enterprise, the Ministry of Industry and Trade, which holds an 88.47% stake in the company and is set to receive nearly VND 6,000 billion in dividends.

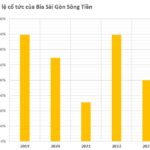

VEAM has a strong track record of rewarding its shareholders with generous cash dividends annually. Over the past five years, VEA has consistently maintained a cash dividend payout ratio of 40-50%. Given the company’s positive business outlook, BSC Securities believes that VEAM has the capacity to maintain this attractive dividend policy in 2024-2025.

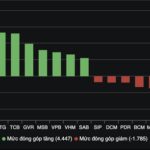

Ahead of this dividend announcement, VEA’s stock price witnessed a positive upward trend, reaching VND 45,300 per share on November 5, 2024, with improved liquidity. Year-to-date, the stock has climbed nearly 32%, resulting in a market capitalization of approximately VND 60,100 billion (~USD 2.37 billion).

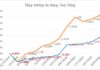

VEAM is recognized as Vietnam’s largest automobile company. However, its primary business of manufacturing and selling commercial vehicles pales in comparison to its substantial investments in renowned automotive brands. VEAM currently holds a 30% stake in Honda Vietnam, a 20% stake in Toyota Vietnam, and a 25% stake in Ford Vietnam. These strategic investments have yielded significant returns in the form of profit sharing and substantial cash dividends annually.

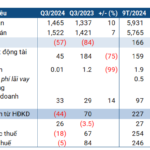

For the third quarter of 2024, VEA reported impressive financial results, with a revenue of over VND 1,048 billion, reflecting an 18% increase compared to the same period last year. Net profit for the quarter stood at VND 1,666 billion, a modest 8% improvement year-over-year. The primary growth driver for VEAM was the substantial profit contribution from its joint ventures and associates, amounting to VND 1,500 billion, a 17% increase compared to Q3 2023.

On a nine-month cumulative basis, the company’s revenue witnessed a modest 3% increase to VND 2,971 billion. Profit from joint ventures and associates reached VND 4,365 billion during this period. After accounting for expenses, VEA posted a net profit of VND 4,924 billion, largely unchanged from the previous year.

As of Q3 2024, VEAM’s total assets stood at VND 31,743 billion, an increase of VND 4,600 billion from the beginning of the year. Notably, the company holds nearly VND 20,000 billion in cash and bank deposits, with VND 19,500 billion in bank deposits alone, reflecting a significant increase of approximately VND 6,600 billion compared to the start of the year.

This substantial cash position has generated consistent interest income for VEAM. In the nine months of 2024, the company earned over VND 636 billion in interest income, equivalent to nearly VND 2.4 billion per day.

“Dropping Dividends: Pha Lai Thermal Power Reports First Loss in Three Years”

High production costs coupled with a significant decline in dividend income from subsidiaries resulted in a net loss for Pha Lai Thermal Power Joint Stock Company (HOSE: PPC) in Q3/2024, marking the first quarter of losses after twelve consecutive profitable quarters.