Ho Van Long, Deputy General Director and Chief Financial Officer of International Commercial Joint Stock Bank (VIB), has registered to purchase 3 million VIB shares to diversify his investment portfolio. The transactions are expected to take place from December 7, 2023, to November 6, 2024.

VIB shares have been actively traded recently

If the transactions are successful, Mr. Long will own approximately 14.53 million VIB shares (excluding 1.96 million shares as dividends for existing shareholders at a ratio of 17% and nearly 150,000 shares under the employee stock option program), representing a 0.573% stake in VIB.

A few days ago, the Commonwealth Bank of Australia (CBA) announced that it had sold approximately 10% of its stake in VIB (approximately 300 million VIB shares) through the Ho Chi Minh City Stock Exchange (HoSE). With this transaction, VIB’s strategic shareholder earned approximately AUD 320 million, equivalent to over VND 5,300 billion.

Currently, VIB shares are trading at VND 18,600 per share, up 0.54% from the previous session.

At the Vietnam Export Import Commercial Joint Stock Bank (Eximbank), Ms. Tran Thi Thanh Nha, spouse of Mr. Ngo Tony, Chairman of the Supervisory Board of Eximbank, recently registered to sell 123,298 EIB shares from October 30 to November 8, 2023, to recoup her investment.

Ms. Nha plans to sell all her shares through the matching method. EIB shares are currently trading at VND 19,400 per share, up 3.47% from the previous session.

Another bank that has announced transactions of insiders and persons related to insiders is the Southeast Asia Commercial Joint Stock Bank (SeABank).

Accordingly, Mr. Le Huu Bau, spouse of Ms. Nguyen Thi Nga, Vice Chairman of the Board of Directors of SeABank, successfully sold over 43.7 million SSB shares through a matching agreement on October 24, 2023.

Prior to the transaction, Mr. Bau owned nearly 94.4 million SSB shares, equivalent to 3.329% of the bank’s charter capital.

SSB shares are currently trading at VND 16,550 per share, down 0.9% from the previous session. Based on this price, Mr. Bau is estimated to have earned over VND 720 billion from the sale of SSB shares.

Currently, Ms. Nguyen Thi Nga holds 111.5 million SSB shares, equivalent to a 3.936% stake in SeABank.

In the trading session this afternoon, November 5, the VN-Index continued to fluctuate narrowly around 1,244.3 points, down 0.41 points compared to the previous session; HNX Index decreased by 0.12 points to 224.33 points, while Upcom increased by 0.15 points to 91.75 points.

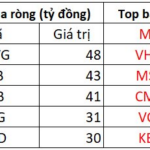

The market witnessed a sharp decline in liquidity, with the trading value on the HOSE reaching just over VND 4,600 billion. Foreign investors continued their net selling trend with a value of over VND 300 billion, focusing on FPT, MSN, KBC, and VHM stocks.

A rare bright spot was the positive performance of many bank stocks, with gainers contributing to the VN-Index’s rise, including EIB, TCB, LPB, and VIB.

Why Did Vietnamese Stocks Soar Post US Presidential Election?

The VN-Index soared and closed at a record high right after the US Presidential election results were announced, surprising many investors.

The Market Beat: A Tale of Diverging Fortunes

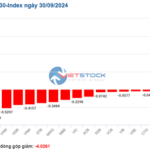

The market ended the session in negative territory, with the VN-Index down 2.98 points (-0.23%) to 1,287.94 and the HNX-Index falling 0.8 points (-0.34%) to 234.91. Bears dominated as 436 stocks declined while 272 advanced. The large-cap VN30-Index was a mixed bag, with 19 decliners, 8 gainers, and 3 unchanged stocks.