**Stock Market Session Ends on a High Note as VN-Index Surges to 1,261.28 Points**

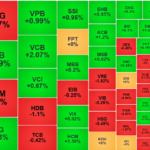

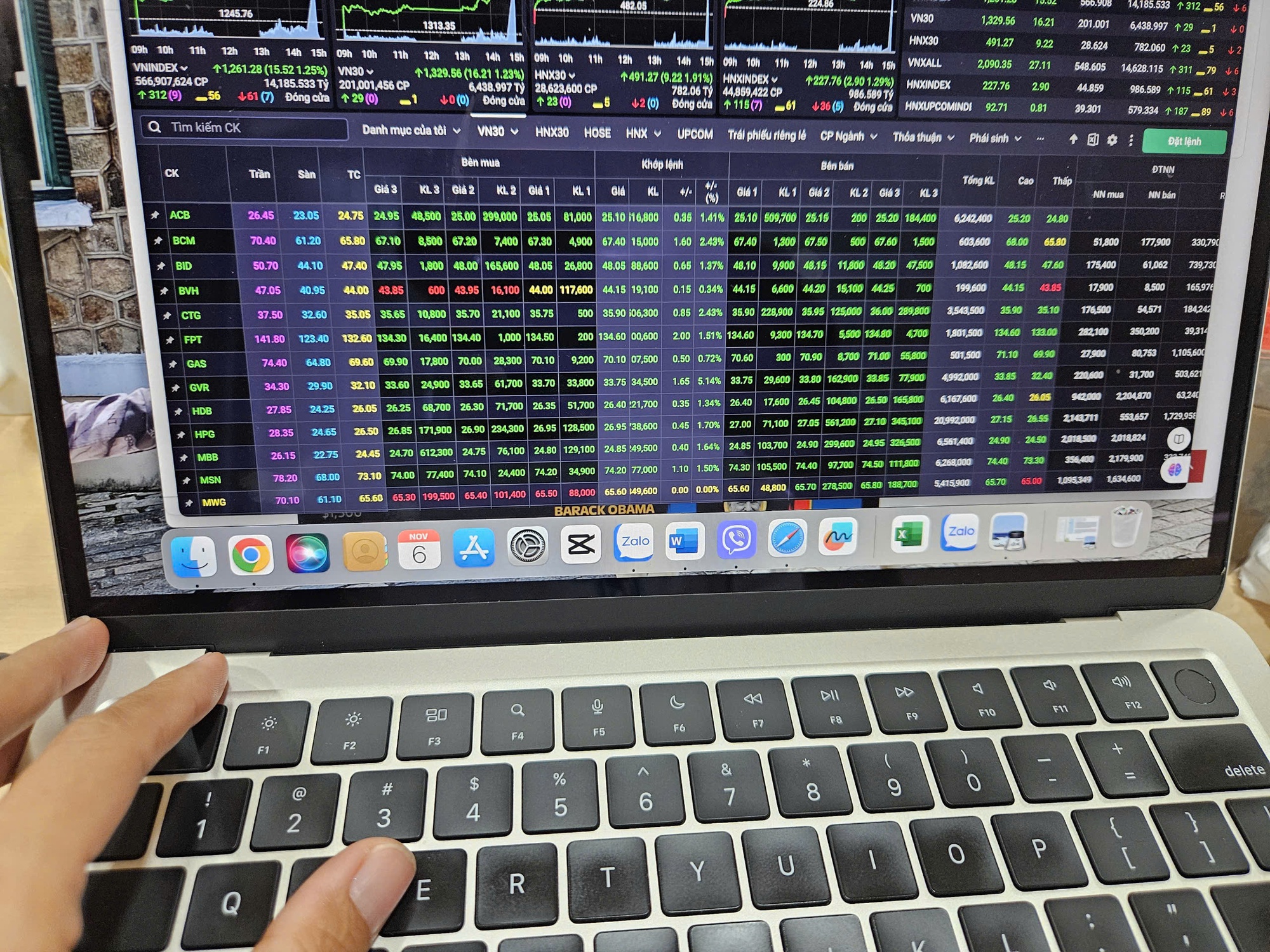

The trading session on November 6th concluded with a surprising upturn as the VN-Index reached its highest point of the day, climbing to 1,261.28 points. This marked a significant increase of 15.52 points from the previous session, while the HNX Index closed at 227.76 points, up by 2.9 points, and the Upcom also witnessed a slight gain of 0.81 points, ending at 92.71 points.

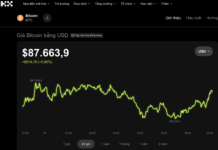

The positive momentum in the Vietnamese stock market followed the news of Donald Trump’s victory in the US Presidential election earlier in the day, according to Vietnam time.

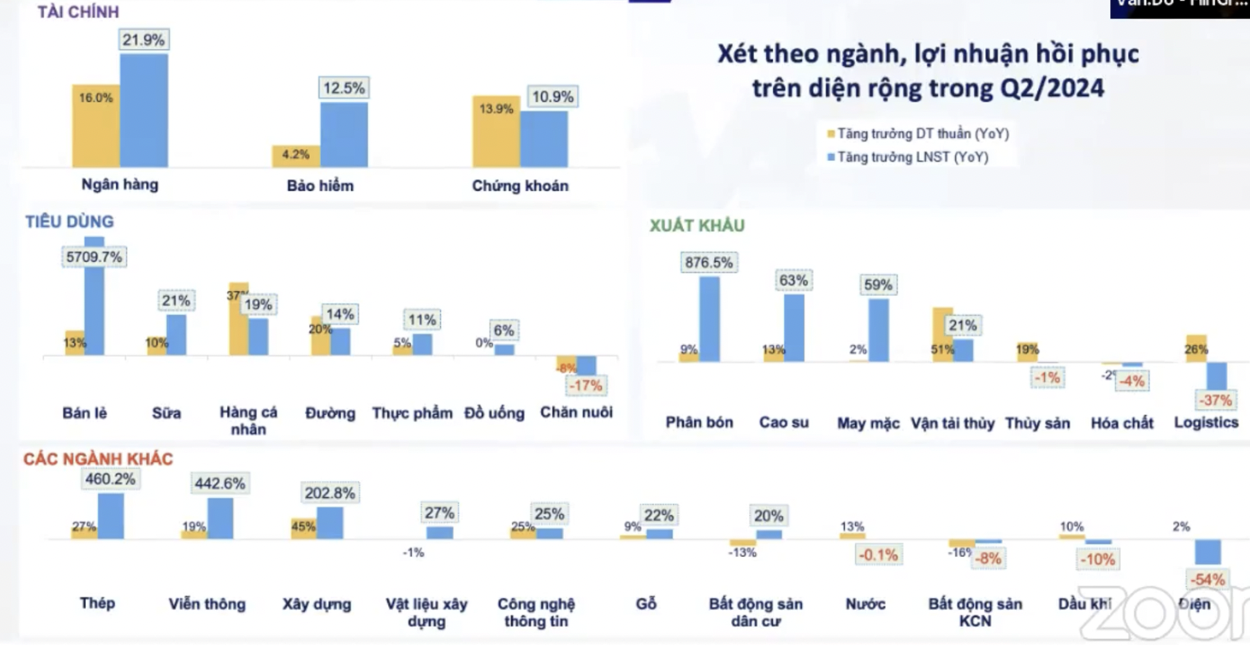

Although trading volume did not show significant improvement, with the value of transactions on the HOSE remaining above 14 trillion VND, many stocks witnessed robust trading activity. A slew of stocks in the real estate and industrial real estate sectors closed with strong gains, including KBC, SZC, LDG, LHG, and GVR. Securities stocks also surged, with notable gains in MBS, AGR, BVS, and VDS. Additionally, stocks in the banking, steel, and oil and gas sectors experienced positive movements.

Among the large-cap stocks, GVR, CTG, BID, TCB, FPT, HPG, and MBB had the most positive impact on the VN-Index.

The stock market was a sea of green during the trading session.

Foreign investors continued to sell off their holdings, but the net selling value decreased compared to previous sessions, with net selling on the HOSE exceeding 380 billion VND, mainly focused on VHM, MSN, SSI, and VCB.

Why did the Vietnamese stock market surge following the US Presidential election? In a quick interview with Nguoi Lao Dong newspaper, Mr. Nguyen The Minh, Director of Research and Product Development for Individual Customers at Yuanta Vietnam Securities Company, analyzed that historically, during US Presidential elections, the VN-Index tends to exhibit low liquidity and minimal fluctuations before the election, and may even experience negative trends. However, after the election results are announced, the Vietnamese stock market has consistently shown positive momentum. In the short term, there may be strong fluctuations and adjustments over a few sessions, but the overall trend is expected to be positive in the next few months, or even up to a year.

Notably, with Donald Trump’s victory, his policies are expected to have a significant impact on Vietnam’s economy and stock market. Mr. Minh highlighted three key issues. First, Trump has expressed support for the Federal Reserve’s (FED) intervention to lower interest rates, which could provide stronger and clearer support for the US economy in the coming period. Second, interest rates may witness a more significant drop in 2025, benefiting Vietnam, particularly export and logistics businesses, as export turnover rebounds. Third, his energy and oil policies, as well as his trade policies with major countries, including China, will have implications for Vietnam’s economy and stock market.

The Market Beat: A Tale of Diverging Fortunes

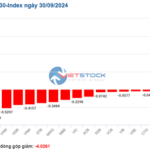

The market ended the session in negative territory, with the VN-Index down 2.98 points (-0.23%) to 1,287.94 and the HNX-Index falling 0.8 points (-0.34%) to 234.91. Bears dominated as 436 stocks declined while 272 advanced. The large-cap VN30-Index was a mixed bag, with 19 decliners, 8 gainers, and 3 unchanged stocks.

“Vietstock Weekly: A Cautious Outlook for the Near Future”

The sharp dip over the weekend curtailed VN-Index’s upward momentum. This pullback prevented the index from breaching the middle line of the Bollinger Bands. Moreover, the trading volume is showing signs of waning and remains below the 20-week average, indicating heightened investor caution. Currently, the MACD indicator continues to trend downward, issuing a sell signal that reflects a short-term outlook that is not yet optimistic.

The Stock Market Week of October 28 – November 1, 2024: A Fragile Recovery

The VN-Index experienced a volatile week with alternating sessions of gains and losses. The cautious sentiment among investors is evident as trading volume remains below the 20-day average. Moreover, the continuous net selling by foreign investors will likely impact the growth trajectory of the VN-Index in the coming period.

The Blue-Chip Recovery: Banking on a Boom

The morning’s lackluster state quickly transformed during the afternoon session as trading momentum picked up. Leading the charge were the blue-chip stocks, with a surge from the banking sector heavyweights, complemented by strong performances from VHM and VIC, which propelled the VN-Index into a robust rally.