Hanoi Mineral and Mechanical Joint-Stock Company (code: HGM) recently announced a resolution by its Board of Directors to distribute an interim dividend for the first time in 2024, with a ratio of 20% in cash (1 share will receive VND 2,000). The record date is November 13, and the ex-dividend date is November 12. The expected payment date is November 29, 2024.

With 12.6 million shares currently in circulation, the company is estimated to spend over VND 25 billion for this interim dividend.

As of the third quarter of 2024, the State Capital Investment Corporation (SCIC) was the largest shareholder, owning nearly 5.9 million HGM shares (equivalent to 46.6% of capital) and will receive nearly VND 12 billion in dividends.

Hanoi Mineral and Mechanical is known for its consistent cash dividend payments since its listing on the HNX in 2009. The highest dividend ever paid by HGM was VND 12,000 per share in 2012. In recent years, from 2021 to 2023, this mining enterprise has been generous in returning cash dividends to shareholders, with a ratio ranging from 40% to 45%. For 2024, the company plans to pay a minimum dividend of VND 1,500 per share.

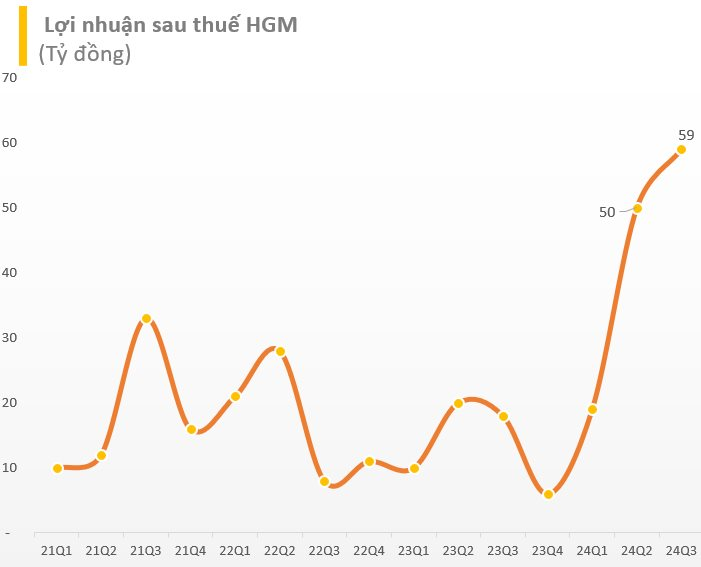

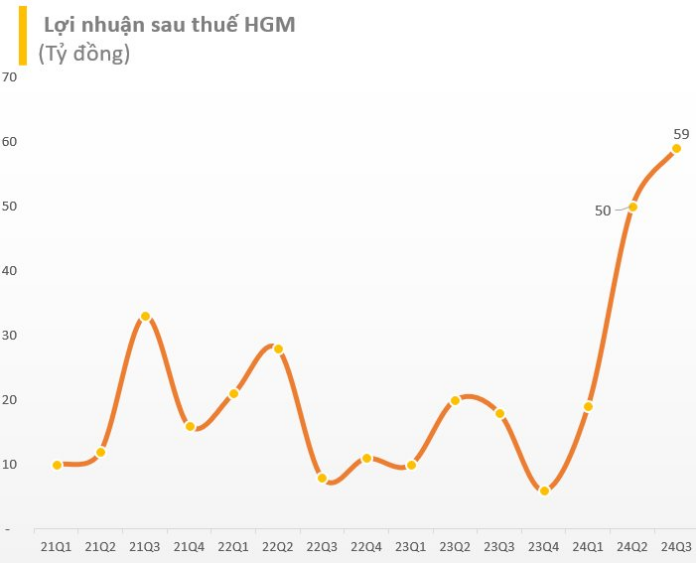

The company’s decision to distribute interim dividends follows its impressive financial results for the third quarter of 2024, with a net profit of nearly VND 59 billion, more than triple that of the same period last year. This also marks the highest quarterly profit in the company’s operating history.

According to the company’s explanation, the increase in profit was attributed to efficient sales performance, resulting in over VND 112 billion in net revenue, more than double that of the previous year and setting a record high.

For the first nine months of the year, HGM’s net revenue reached nearly VND 249 billion, up 68% year-on-year, surpassing the annual plan by 38%. After-tax profit exceeded VND 127 billion, up 165% compared to the same period last year and exceeding the annual profit target by 220%.

As of September 30, 2024, the company’s bank deposits exceeded VND 252 billion, double the amount from the beginning of the year. The after-tax profit not yet distributed also increased to nearly VND 129 billion.

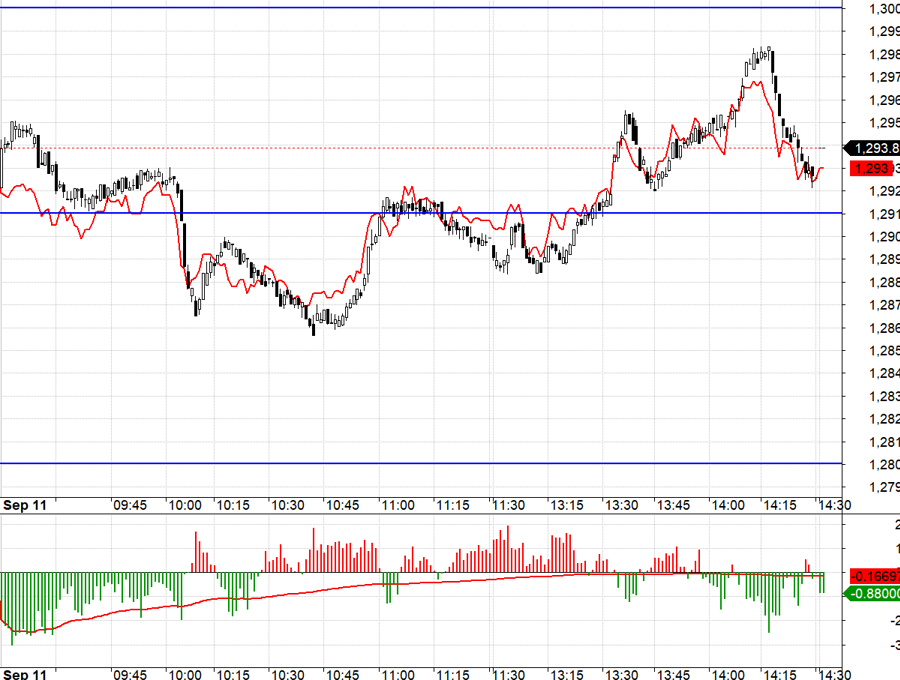

On the stock exchange, HGM’s share price is currently trading at the reference price of VND 103,400 per share after hitting the daily limit-up on November 4. Since the beginning of August, HGM shares have surged by 90% in just three months. Notably, this is the highest price ever recorded by the stock since its listing.

The Electric Revolution: VinFast Speeds Ahead with a Massive Order of 2,200 Electric Cars for a New Taxi Venture.

For the first nine months of the year, the company’s net profit stood at over 19 billion VND, a remarkable 211% surge compared to the same period last year, surpassing the full-year profit target.

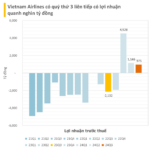

Vietnam Airlines Posts Near-Thousand Billion Profit for Third Consecutive Quarter, Yet Remains in a 35,000 Billion Cumulative Loss, With Stock Rising for Four Straight Sessions

For the nine-month period ending September 2024, Vietnam Airlines reported a revenue of VND 79,161 billion, a remarkable 17% increase compared to the same period last year. The airline also achieved a impressive net profit of nearly VND 6,000 billion during this time frame.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)