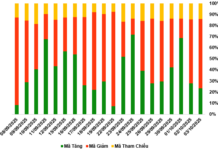

Green credit can be understood as lending activities for investment, production, and business that do not cause harm and contribute to environmental protection. While the balance of green credit in commercial banks has tended to increase year by year, in terms of outstanding balance, it is still very modest compared to the total credit of the whole economy.

According to the State Bank of Vietnam (SBV)’s data, updated until the end of the first half of this year, the balance of green credit reached nearly VND 680,000 billion, equivalent to about 4.5% of the total outstanding balance of the economy. The majority of this was concentrated in the fields of renewable energy and clean energy.

Banks actively provide green loans

Green credit is being prioritized by banks as one of the main goals in their long-term business strategies.

For instance, at BIDV, as of March 31, 2024, the outstanding balance of green credit reached VND 73,394 billion (accounting for 4% of the bank’s total credit balance) for 2,069 business plans of 1,698 customers. BIDV’s lending portfolio for green and sustainable development fields is expected to reach USD 3 billion by 2025, accounting for about 5% of BIDV’s total outstanding balance.

Vietcombank also recorded a nearly six-fold increase in the scale of green credit outstanding balance over the past five years, from VND 7,890 billion at the end of 2018 to more than VND 46,100 billion at the end of 2023, accounting for approximately 4% of the bank’s total credit balance.

Similarly, VietinBank has also developed and promulgated the bank’s sustainable finance framework, launched a green finance package worth VND 5,000 billion to promote sustainable business development, and established a system for managing environmental and social risks in green credit activities…

Dr. Nguyen Thi Thu Ha, Deputy Head of Agribank’s ESG Steering Committee, affirmed: “Agribank has up to 70% of its outstanding loans in the agriculture and rural sector, so the development of green credit is very important. Every year, there is at least VND 50,000 billion in preferential capital for clean agriculture.”

This credit package is for businesses, cooperatives, farm owners, etc., participating in the stages of producing clean agricultural products, with lending rates reduced by 0.5%/year to 1.5%/year compared to Agribank’s preferential interest rates for the agriculture and rural sector.”

Commercial banks’ green credit lending remains sluggish. Illustrative image

Recently, ACB officially announced its “Sustainable Finance Framework.” This is considered a set of tools for ACB to apply in its practical business activities and is in line with the bank’s strategy to develop green finance in fields such as renewable energy, green transportation, and green buildings…

SHB Bank has also focused on lending for investing in green energy, renewable energy, infrastructure development, and building a circular economy for key regions.

Impetus needed for green credit acceleration

Mr. Ngo Tan Long, ACB’s Deputy General Director, affirmed that ACB is ready to accompany businesses transitioning towards sustainable development. In the long run, the bank will promote green capital in line with ACB’s ESG (Environmental, Social, and Governance) strategy.

“For example, at the beginning of 2024, ACB proactively provided a credit package with a scale of VND 2,000 billion from the bank’s capital for enterprises in the green portfolio. As of the end of August, we had disbursed 86% of the capital of this green credit package,” said Mr. Long.

Ms. Nguyen Thi Thu Ha assessed that Agribank has proactively committed to and gradually implemented ESG, actively carried out social activities, community contributions, risk management, and comprehensive finance. However, the agriculture and rural sector is greatly affected by climate change and may use a lot of water, fertilizer, pesticides, chemicals, and land with a history of deforestation…

Meanwhile, the legal framework for implementing ESG is not yet specific, so Agribank also faces certain difficulties and obstacles in its ESG implementation.

Commenting on the modest scale of green credit compared to expectations, Assoc. Prof. Dr. Nguyen Huu Huan, a finance and banking expert, said that green credit in Vietnam is currently focused on lending to businesses operating in the field of clean energy and renewable energy and has not flowed strongly into clean agriculture. This is because the agricultural sector is always vulnerable to climate change.

Even with clean energy and renewable energy, providing green credit is not easy. It is challenging to assess the level of damage for green energy projects that are being implemented for the first time, both for the bank and the investor.

For example, there are green projects that, according to initial calculations, businesses believe will take only 5-6 years to recoup their investment. Still, in reality, there are projects that have been operating for 15-20 years before becoming profitable. This also makes green projects riskier than traditional investment models…

From the banks’ perspective, although they have recently oriented themselves towards sustainable development and prioritized green credit, they must also comply with factors related to capital safety to prevent the risk of bad debt explosion. Moreover, there is currently a phenomenon of “greenwashing,” where some enterprises exaggerate their environmental efforts to create a favorable impression on consumers to increase sales or obtain loans with lower interest rates from green credit packages. This situation also contributes to banks’ hesitation to “open doors” to loan projects that claim to be “green.”

“As for enterprises that want to transition from a ‘brown’ to a ‘green’ economy, it will certainly entail huge investment costs. Therefore, only large enterprises will have the demand and resources for this transition, while small and medium-sized enterprises (SMEs) are not yet considering this, in my opinion. When SMEs, which account for a large proportion of the economy, do not have a demand for green credit, how can the scale of green credit grow?” said Dr. Nguyen Huu Huan.

“A more significant reason why green credit has not developed as expected is the lack of a legal basis for green credit activities in the legal system, specifically the lack of guidelines detailing the criteria for green sectors. This situation leads to a lack of basis for banks to build mechanisms for implementing green activities and providing credit,” he added.

To promote the growth of green credit, Ms. Nguyen Thi Thu Ha, Deputy Head of Agribank’s ESG Steering Committee, proposed: “First, the authorities should promptly build and issue environmental criteria and specific criteria for projects eligible for green credit so that credit institutions have a legal basis to determine projects and project components that meet the conditions for green credit.

Second, there is a need to promote the development of the carbon market through regulations on the management of carbon credits, emissions trading, and carbon credits. Establishing the rules for operating the carbon credit exchange and implementing capacity-building activities and raising awareness about the development of the carbon market… will help accelerate the official operation of the carbon credit exchange in Vietnam.

Third, it is necessary to build and form a system of data on businesses’ compliance with and violations of environmental requirements, providing a basis for credit institutions in assessing and determining the level of environmental risk when evaluating borrowers. This will help restrict credit for activities that harm the environment.”

“Leading the Pack”: How PVN, Petrolimex, Vitas, and TH Milk are Championing Vietnam’s ESG Economy

Vietnam is rapidly advancing in the field of green economics, with an impressive annual growth rate of 12-14%. In addition, the country boasts the first National Institute of Internal Auditors to be recognized by the International Institute of Internal Auditors (IIA) as independent, just two years after its establishment.

“Compensation is Key, But It’s Not Just About the Salary”

“Money matters, but it’s not everything”: This was the key message from Ingrid Christensen, Director of the International Labor Organization (ILO) in Vietnam, as she addressed a recent workshop. Christensen emphasized that while salary and benefits are crucial factors for workers, offering higher wages alone is not a sustainable solution for retaining talent.

The Dark Side of ESG

“Dynamic Equilibrium” coupled with “Dynamic Capabilities” enables organizations to establish a sustainable competitive advantage by calibrating their resources and capabilities in response to the ever-changing business landscape. This approach allows businesses to be agile and responsive, ensuring they remain resilient and ahead of the curve in a volatile market environment.

Viettel IDC: Leading the Way in Sustainable Digital Infrastructure in Vietnam

Viettel IDC, Vietnam’s leading large-scale and green Data Center and Cloud Computing services provider, has been recognized for its excellence by winning the prestigious ‘Sustainable Infrastructure Awards’ category at the ESG Business Awards 2024.