Illustration

Enhancing Customer Experience: Overcoming Challenges for Banks and Credit Institutions

Elevating the digital banking experience for customers through a human-centric approach has become critical. To achieve this, banks must ensure a seamless, personalized experience across all channels.

However, there are challenges that banks and credit institutions need to overcome to deliver a seamless experience to their customers. One of the biggest challenges is improving legacy systems and infrastructure with upgraded software.

A drawback of implementing various channels is the inconsistency of the experience, which can cause inconvenience to users. In this case, a multi-channel integrated platform can solve this problem by allowing customers to initiate a transaction on online banking and continue or complete it on mobile seamlessly.

Another challenge is the lack of automation in the transaction system, leading to an unsatisfactory customer experience, especially for the younger generation, who dislike having to re-enter information multiple times when making transactions. Technologies such as Artificial Intelligence (AI) and machine learning can help improve customer service while significantly enhancing the integrated digital experience.

Furthermore, banks and credit institutions that fail to offer relevant or personalized services will lose customer engagement, affecting their growth and customer retention.

That’s why banks and credit institutions need to prioritize optimizing the digital customer experience while leveraging AI solutions to anticipate and address future customer issues and needs.

Redesigning the Digital Banking Journey to Deliver a Seamless User Experience

The real value comes not only from the products and services that a bank or credit institution offers but also from how they deliver that value. An exceptional customer experience can have an impact equal to, if not greater than, a quality product or an efficient process in increasing loyalty, reducing costs, and driving sustainable revenue.

According to McKinsey, 3 out of 4 top-performing banks globally have committed to some form of customer experience transformation.

Banks that undertake a user experience transformation find that the lifetime profits from a satisfied customer not only bring long-term value but can also create a positive ripple effect as customers actively promote their bank to the community.

Banks and credit institutions must start by enhancing their services on mobile applications, one of the most popular channels for customers today. Customers always expect convenience in transactions, so banks and credit institutions that lack this capability will be at a significant disadvantage.

As the pandemic changed many habits, financial institutions had to quickly adapt to digitization and remote services to stay relevant and retain customers. They need to pay attention not only to technology but also to the human element in their services, creating a sense of closeness and friendliness with customers.

Customers desire a personalized banking experience that makes them feel connected, even when transacting from home. Through technologies like AI and personalized customer care services, banks and credit unions can provide customer service that meets clients’ needs, streamlines the customer intake process, and enhances customer service through the use of chatbots and call center optimization.

Why Financial Institutions Should Partner with Fintech Providers to Enhance Customer Experience

The importance of good customer service relies on the ability of banks and credit institutions to provide a seamless digital banking experience while gaining a deeper understanding of their customers’ needs and preferences. Banks that proactively anticipate issues and maintain an up-to-date system will not only thrive but also enhance the customer experience, thereby increasing operational efficiency, driving revenue, and solidifying customer loyalty.

Moreover, a superior customer experience is the key differentiator for banks to attract and retain customers, making a significant difference in their choice of financial institution.

Mr. Nguyen Ba Chien, CEO of DTSVN (a company specializing in digital transformation solutions for the financial and banking industry), shared that in Vietnam, there are currently a few companies, including DTSVN, capable of seamlessly integrating platforms into the core system of banks, providing digital transformation and personalization services, and bringing novel experiences to users. Close collaboration between financial institutions and fintech providers is the key to delivering an exceptional customer experience in a short time and at an optimal cost.

AI: The Growth Lever for Retail Banking

Artificial Intelligence (AI) offers a plethora of advantages for retail banks. By leveraging AI, banks can enhance customer experiences, bolster security and fraud detection measures, optimize operational processes, innovate new products and services, and efficiently conduct credit analysis and risk assessments.

“Internal Messages Leaked: 18-Year-Old Fried Chicken Chain in Vietnam Accused of Serving Leftover Food”

Papas’ Chicken temporarily halts operations at its Hoang Van Thu branch in Tan Binh District, Ho Chi Minh City, as the fast-food chain’s management launches an investigation into a reported product quality issue. The popular fried chicken restaurant has assured the public that it is taking immediate action to address the concern and will provide updates as the verification process unfolds.

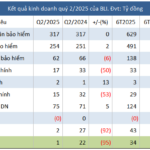

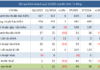

TPBank’s Strategies Fueling Its Rapid Ascent

As a customer-centric strategy has long positioned TPBank amongst the front-runners shaping the landscape of retail banking in Vietnam, the superior and trendy nature of its products backed by cutting-edge digital banking technology that “anticipates and moves fast,” has also made TPBank the primary transaction bank for many customers.

Bring the personal experience of home with Techcombank Mobile

With relentless efforts from Techcombank, Techcombank Mobile is steadily evolving to become a unique digital banking space, where users can freely express their individuality.