Illustrative Image

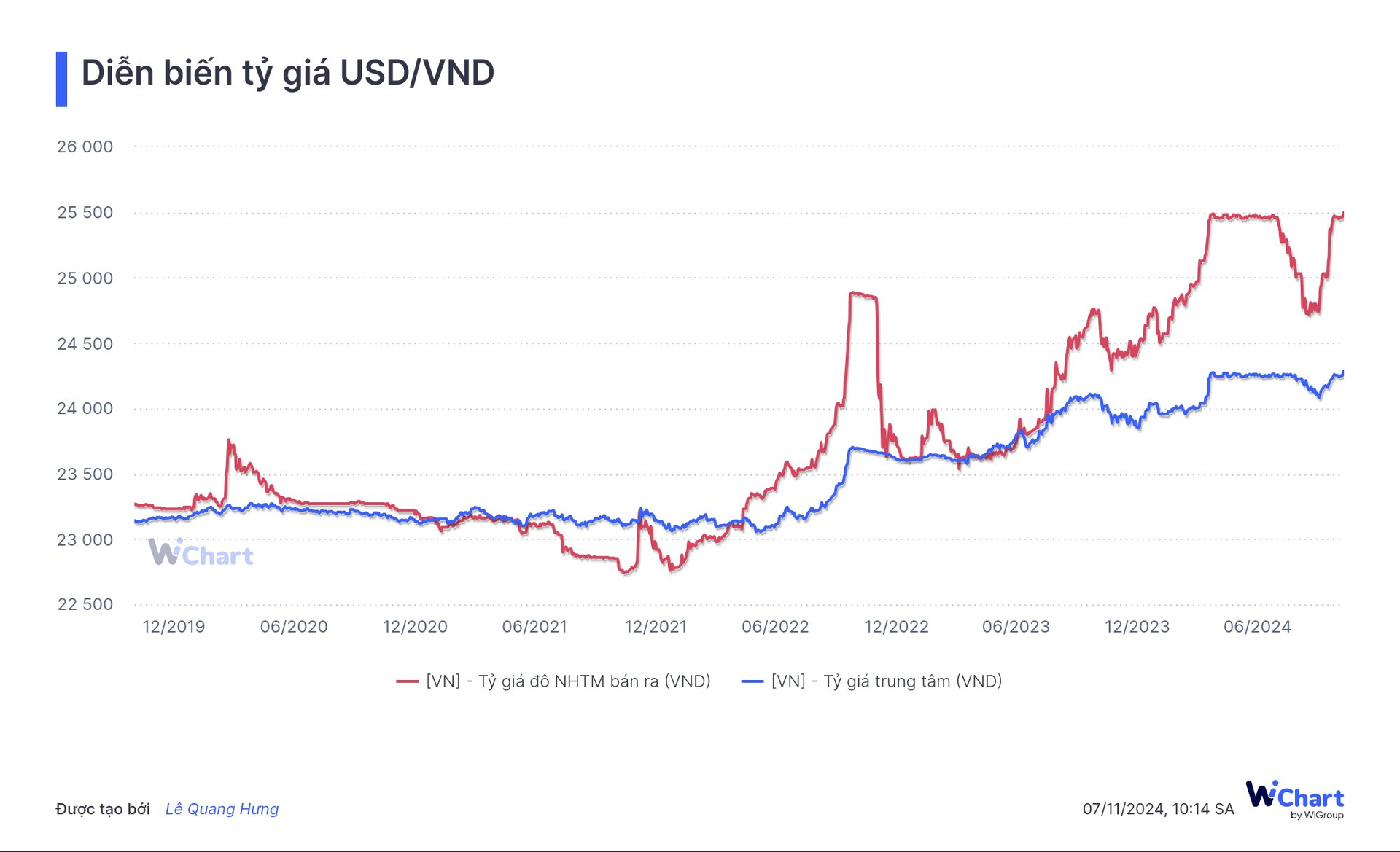

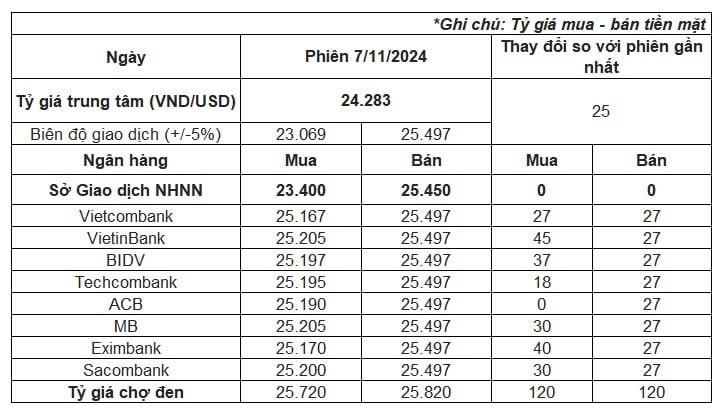

In today’s trading session (November 7th), the State Bank of Vietnam (SBV) increased the daily reference exchange rate by 25 VND to 24,283 VND/USD, the highest level since the central bank adopted the current mechanism in early 2016.

With a band of +/- 5%, the exchange rate ceiling and floor are therefore now set at 23,069 VND/USD and 25,497 VND/USD, respectively.

Meanwhile, the buying and selling rates offered by the central bank remained unchanged at 23,400 VND/USD and 25,450 VND/USD, respectively.

Despite the significant increase in the daily reference rate, commercial banks continued to keep their USD/VND quotes at the ceiling level. As a result, all major banks are currently selling USD at 25,497 VND/USD, the highest level in history, even surpassing the rates observed in April and May 2024. This also marks the 13th consecutive session where commercial banks have quoted their rates at or near the ceiling level.

So far this year, the USD/VND exchange rate in the commercial banking sector has increased by approximately 1,100 VND, or 4.4%. Specifically, in October and November alone, the VND has depreciated by more than 3% against the USD.

In the interbank market, the exchange rate closed at 25,385 VND/USD on November 6th, an increase of 39 VND compared to the previous session, bringing the total increase since the beginning of the year to over 4.6%.

In the free market, after a sharp decline in the previous session, the USD rebounded strongly this morning. Currently, foreign exchange trading points are buying and selling USD at around 25,720 VND/USD and 25,820 VND/USD, respectively, a significant increase of 120 VND compared to yesterday’s rates. Overall, the USD has appreciated by about 1,000 VND, or 4%, in the free market since the beginning of the year.

The surge in the USD/VND exchange rate comes as the US Dollar Index (DXY), which measures the strength of the greenback against a basket of major currencies, soared above 105 points, reaching its highest level since early July 2024.

According to Reuters, the US dollar is hovering near a four-month high as markets react to Donald Trump’s overwhelming victory in the US presidential election and the Republican Party’s retention of the Senate. Control of the House of Representatives remains uncertain, with the Republican Party currently holding a majority.

A comprehensive Republican victory would enable the party to implement more significant legislative changes, potentially causing greater turmoil in the currency market.

Trump’s policies on illegal immigration, new tariffs, and deregulation could boost growth and inflation, reducing the likelihood of Fed interest rate cuts.

Nikos Tzabouras, a senior market analyst at Traduel, commented, “This could push inflation higher and force the Fed to loosen policy more slowly, which is dollar-positive.”

According to the CME Group’s FedWatch tool, the market now expects a 70% chance of a Fed rate cut next month, down from 77% in the previous session, following the election results.

As the USD/VND exchange rate faces significant pressure from both international markets and rising domestic foreign currency demand, the SBV is employing a dual approach to curb the rate’s ascent.

The first measure involves the resumption of treasury bill issuance after a nearly two-month hiatus. Starting October 18th, the SBV began auctioning treasury bills again, aiming to absorb excess VND liquidity in the banking system and push up interbank lending rates.

For banks in need of support, the SBV remains willing to provide loans through the open market operation (OMO) channel, but at a relatively high interest rate of 4% per annum.

By utilizing both treasury bills and OMO simultaneously, the SBV aims to achieve the dual objective of ensuring liquidity for the banking system while reducing pressure on the exchange rate by narrowing the interest rate differential between the VND and the USD in the interbank market.

As the exchange rate continued to climb, the SBV resorted to a more forceful measure: foreign currency intervention. From the afternoon of October 24th, the SBV raised the intervention exchange rate to 25,450 VND/USD at the Vietnam Foreign Trade Stock Company (Vietcombank). Additionally, according to sources in the interbank market, the central bank notified banks of the resumption of spot foreign currency intervention sales at the rate of 25,450 VND/USD – the same intervention rate applied by the SBV in April 2024.

Thus, the SBV is employing both treasury bills and foreign currency sales to curb the rising exchange rate, similar to the approach taken in the second quarter and early third quarter of this year. The central bank’s actions are expected to help rein in the surging exchange rate, but they may also impact VND liquidity in the interbank market.

The Financial Currency Market: A Stable Investment Haven

According to a report by the Ministry of Planning and Investment, despite facing challenges and difficulties, the economy in October and the ten-month period showed a strong recovery. Economic and social activities rebounded quickly after natural disasters and floods. In October, several international organizations upgraded their growth forecasts for Vietnam in 2024, predicting it could be the highest among ASEAN+3.

The Greenback’s Strength Against the Vietnamese Dong: A Historic High, Pushing Banks to the Limit

The U.S. dollar index (DXY) hovers around a four-month high as markets react to Donald Trump’s decisive victory in the U.S. presidential election. This development underscores the pivotal role that political events play in shaping global economics and currency dynamics.

Gold Prices Stuck as US Treasury Yields Keep Rising

This week, gold prices could be volatile due to a slew of upcoming U.S. economic data, which is likely to reshape expectations for the Federal Reserve’s interest rate path. With markets closely watching for any insights into the Fed’s future moves, the precious metal’s performance hinges on these critical releases.

Gold Prices Slip in Early Monday Trade, Experts Point to “Anomalies”

“It’s an anomaly that gold prices have continued to break records recently, despite rises in the USD and US Treasury bond yields.