Illustrative Image

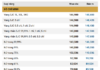

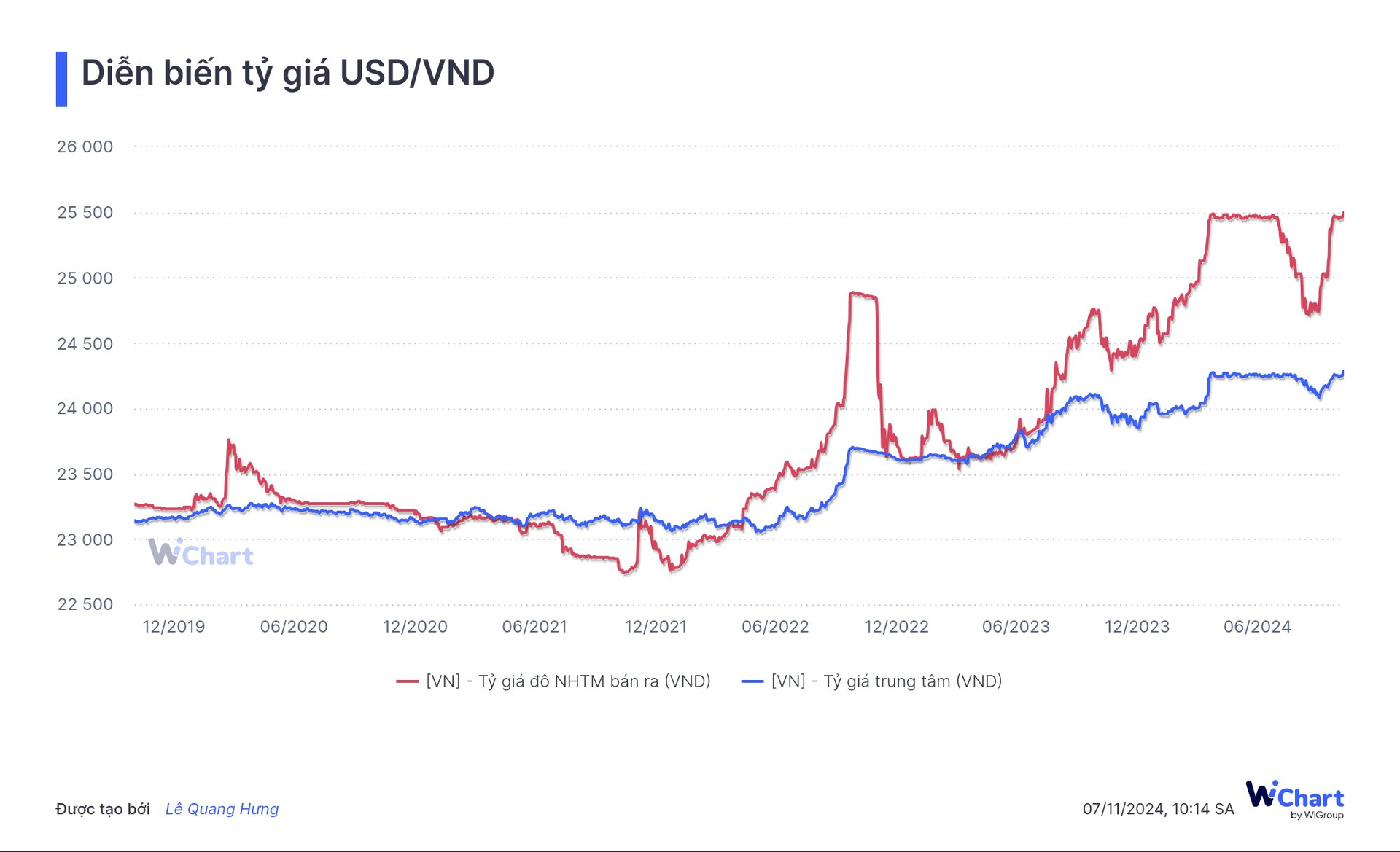

In today’s trading session (November 7th), the State Bank of Vietnam (SBV) increased the daily reference exchange rate by 25 VND to 24,283 VND/USD, the highest level since the central bank adopted the current mechanism in early 2016.

With a band of +/- 5%, the exchange rate ceiling and floor are therefore now set at 23,069 VND/USD and 25,497 VND/USD, respectively.

Meanwhile, the buying and selling rates offered by the central bank remained unchanged at 23,400 VND/USD and 25,450 VND/USD, respectively.

Despite the significant increase in the daily reference rate, commercial banks continued to keep their USD/VND quotes at the ceiling for the 13th consecutive session, with all major lenders offering a selling rate of 25,497 VND/USD – the highest level in history, even surpassing the rates seen in April and May 2024.

So far this year, the USD/VND exchange rate at commercial banks has climbed by around 1,100 VND, or 4.4%. Specifically, in October and November alone, the Vietnamese currency has depreciated by over 3% against the greenback.

In the interbank market, the exchange rate ended the November 6th session at 25,385 VND/USD, up 39 VND from the previous session, bringing the year-to-date increase to over 4.6%.

In the free market, after a sharp drop yesterday, the USD rebounded this morning. Currently, currency exchange points are buying and selling USD at 25,720 VND/USD and 25,820 VND/USD, respectively, a significant increase of 120 VND compared to yesterday’s rates. Since the beginning of the year, the free market USD rate has risen by about 1,000 VND, or 4%.

The surge in the domestic USD/VND exchange rate comes as the US Dollar Index (DXY), which measures the greenback’s strength against a basket of major currencies, soared past the 105-point mark – its highest level since early July 2024.

According to Reuters, the US dollar is hovering near a four-month high as markets react to Donald Trump’s decisive victory in the US presidential election and the Republican Party’s retention of the Senate. Control of the House of Representatives remains uncertain, with the Republican Party currently holding a majority.

A Republican sweep would enable the party to enact more significant legislative changes and potentially cause greater turmoil in the currency markets.

Trump’s policies on illegal immigration, new tariffs, and deregulation could boost growth and inflation, reducing the likelihood of Fed interest rate cuts.

“This could push inflation higher and force the Fed to tighten policy more slowly, which is dollar-positive,” said Nikos Tzabouras, a senior market analyst at trading platform Traduel.

According to the CME Group’s FedWatch tool, the market now sees a 70% chance of a Fed rate cut next month, down from 77% in the previous session, following the election results.

As the USD/VND exchange rate faces mounting pressure from both international markets and rising domestic foreign currency demand, the SBV is employing a dual approach to curb the rate’s ascent.

The first measure involves the resumption of treasury bill issuance after a nearly two-month hiatus. Starting October 18th, the SBV began offering treasury bills again, aiming to absorb excess Vietnamese dong liquidity from the banking system and push up interbank lending rates.

For banks in need of support, the SBV remains ready to provide loans through the open market operation (OMO) channel, but at a relatively high interest rate of 4% per annum.

By utilizing both treasury bills and OMO simultaneously, the SBV aims to achieve the dual objective of ensuring liquidity for the banking system while reducing pressure on the exchange rate by narrowing the interest rate differential between the Vietnamese dong and the US dollar in the interbank market.

As the exchange rate continued to climb, the SBV resorted to a more forceful measure: foreign currency intervention.

Starting in the afternoon of October 24th, the SBV raised the USD selling rate for foreign currency intervention at the Vietnam Bank for Agriculture and Rural Development (Agribank) to 25,450 VND/USD. Additionally, according to market sources, the central bank notified commercial banks about the resumption of spot foreign currency intervention sales at the same rate of 25,450 VND/USD – matching the intervention rate announced in April 2024.

By deploying both treasury bills and foreign currency sales simultaneously, the SBV is employing a strategy similar to that used in the second quarter and early third quarter of this year. This approach is expected to help curb the sharp rise in the exchange rate, although it may also impact Vietnamese dong liquidity in the interbank market.