Illustration

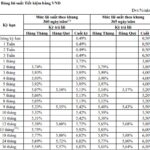

BIDV’s November 2024 Savings Interest Rates for Individual Customers

As of the beginning of November, BIDV offers interest rates ranging from 1.7% to 4.7% per annum for individual customers depositing at the counter.

Specifically, customers who deposit for a term of 1-2 months will receive an interest rate of 1.7% per annum; terms of 3 and 5 months will be offered the same interest rate of 2% per annum; and terms of 6 and 9 months will earn an interest rate of 3% per annum.

For deposits with a term of 12 months or more, a uniform interest rate of 4.7% per annum is applied.

Interest Rate Table for Individual Customers Depositing at BIDV Counter in November 2024

|

Term

|

Interest Rate

|

|

No fixed term

|

0.10%

|

|

1 Month

|

1.70%

|

|

2 Months

|

1.70%

|

|

3 Months

|

2.0%

|

|

5 Months

|

2.0%

|

|

6 Months

|

3.0%

|

|

9 Months

|

3.0%

|

|

12 Months

|

4.70%

|

|

13 Months

|

4.70%

|

|

15 Months

|

4.70%

|

|

18 Months

|

4.70%

|

|

24 Months

|

4.70%

|

|

36 Months

|

4.70%

|

Source: BIDV

In addition to over-the-counter deposits, BIDV also accepts online deposits through the Mobile Banking/Internet Banking application. For this method, BIDV offers interest rates that are 0.1% to 0.3% higher than those for counter deposits.

Accordingly, deposits with a term of 1-3 weeks will earn an interest rate of 0.3% per annum; terms of 1-2 months will receive 2% per annum; terms of 3-5 months will be offered 2.3% per annum; terms of 6-11 months will earn 3.3% per annum; and terms of 12-18 months will be subject to an interest rate of 4.7% per annum. The highest interest rate currently offered by BIDV is 4.8% per annum for online individual deposits with a term of 24-36 months.

Interest Rate Table for Individual Customers Depositing Online at BIDV in November 2024

|

Term

|

Interest Rate

|

|

1 week

|

0.3%

|

|

2 weeks

|

0.3%

|

|

3 weeks

|

0.3%

|

|

1 Month

|

2.0%

|

|

2 Months

|

2.0%

|

|

3 Months

|

2.3%

|

|

4 months

|

2.3%

|

|

5 Months

|

2.3%

|

|

6 Months

|

3.3%

|

|

9 Months

|

3.3%

|

|

11 Months

|

3.3%

|

|

12 Months

|

4.70%

|

|

13 Months

|

4.70%

|

|

15 Months

|

4.70%

|

|

18 Months

|

4.70%

|

|

24 Months

|

4.90%

|

|

36 Months

|

4.90%

|

Source: BIDV

BIDV’s November 2024 Interest Rates for Business Customers

For business customers, BIDV offers interest rates ranging from 1.6% to 4.2% per annum. Specifically, business customers who deposit for a term of 1-2 months will receive an interest rate of 1.6% per annum; terms of 3-5 months will earn 1.9% per annum; and terms of 6-11 months will be offered an interest rate of 3% per annum.

The highest interest rate offered to business customers at BIDV in November is 4.2% per annum, applicable to terms ranging from 12 to 60 months.

Interest Rate Table for Business Customers at BIDV in November 2024

|

Term

|

VND

|

|

No fixed term

|

0.20%

|

|

1 month

|

1.60%

|

|

2 months

|

1.60%

|

|

3 months

|

1.90%

|

|

4 months

|

1.90%

|

|

5 months

|

1.90%

|

|

6 months

|

3.0%

|

|

7 months

|

3.0%

|

|

8 months

|

3.0%

|

|

9 months

|

3.0%

|

|

10 months

|

3.0%

|

|

11 months

|

< |

Latest Savings and Loan Interest Rates at TPBank: How High Can They Go?

With an impressive 5.7% annual interest rate, TPBank offers an attractive deal for those looking to save over a 36-month period. This rate applies to standard deposits and shines as an appealing option for those seeking steady, long-term financial growth. Additionally, TPBank has announced a base lending rate of 8.4% for personal loans with a 12-month tenure, providing customers with a competitive and accessible opportunity to borrow funds for their short-term financial needs.

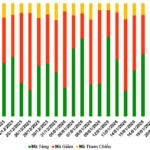

The Special Controlled Bank Continues to Increase Savings Interest Rates for the Second Time in September

Dong A Bank has once again raised its savings interest rates. This is the second time in September that the bank has increased its savings rates, marking a positive shift for customers.