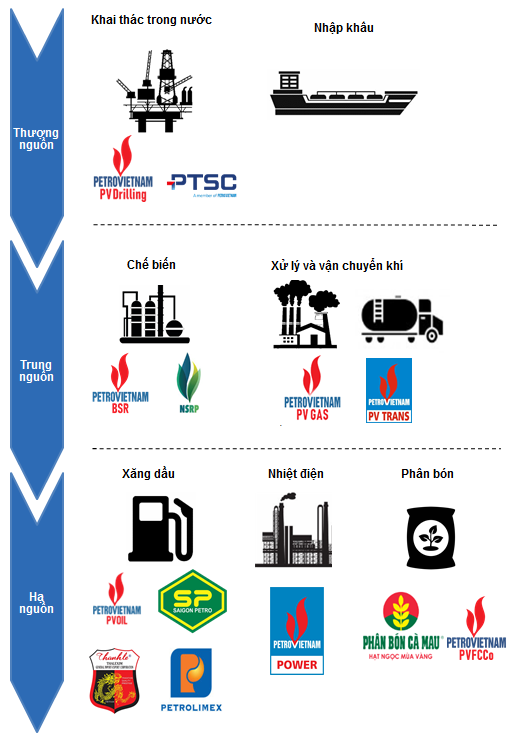

The Oil and Gas Industry’s Value Chain

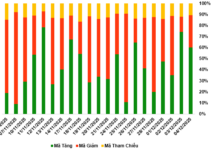

Leading Position in the Retail Fuel Industry

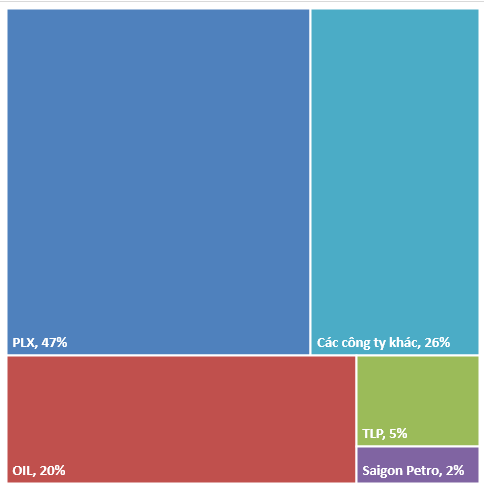

PLX is the top player in the domestic fuel retail industry, consistently maintaining a market share of around 47%. This puts it far ahead of competitors such as Vietnam Oil and Gas Group (UPCoM: OIL), Thanh Le Import-Export Trading JSC (UPCoM: TLP), and Saigon Petro Co., Ltd.

Domestic Fuel Retail Market Share in 2023

(Unit: Percentage)

Source: VietstockFinance, PLX, OIL, TLP, and Saigon Petro

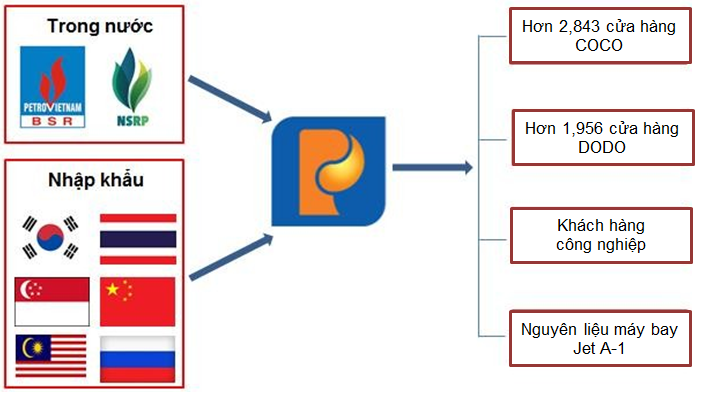

PLX distributes fuel products through three channels: the dealer/total dealer (DODO) system, the retail (COCO) channel, and industrial customers. To date, PLX maintains a significant advantage over its competitors with 48 member units directly involved in domestic fuel trading and more than 4,790 fuel stations nationwide.

PLX’s supply sources include the Dung Quat and Nghi Son refineries and imports mainly from Southeast Asian and Korean markets, leveraging Vietnam’s preferential import tax policies from free trade agreements (FTAs). However, the import-reliant nature of the business makes the financial performance of fuel retailers more susceptible to fluctuations in international oil prices.

Source: PLX Annual Report

Q3 2024 Financial Results Show a Decline

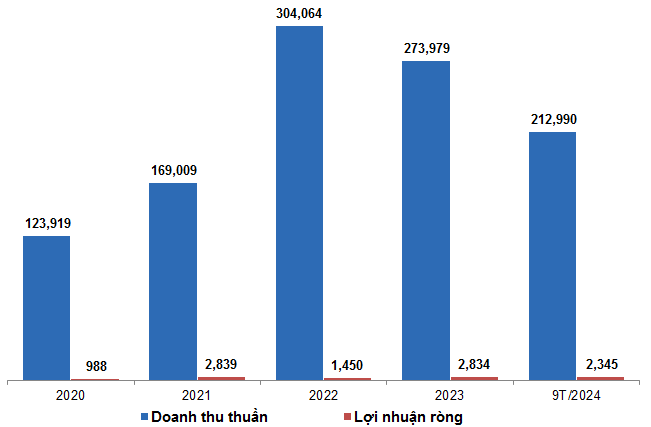

In the third quarter of 2024, Petrolimex recorded a revenue of VND64.3 trillion, an 11% decrease compared to the same period last year, while gross profit margin improved slightly from 5.22% to 5.34%. However, net profit plummeted by 91% to VND66 billion.

Nevertheless, the cumulative results for the first nine months of the year exceeded the set plan, with revenue reaching nearly VND213 trillion and pre-tax profit of VND3.2 trillion, surpassing the 2024 plan by 13% and 10%, respectively.

Given the unlikely scenario of oil prices surging above $80 per barrel, positive financial results in the fourth quarter of 2024 seem improbable.

PLX’s Financial Performance from 2020 to Q3 2024

(Unit: Billion VND)

Source: VietstockFinance

2025 Outlook: Positive but Unlikely to be Transformational

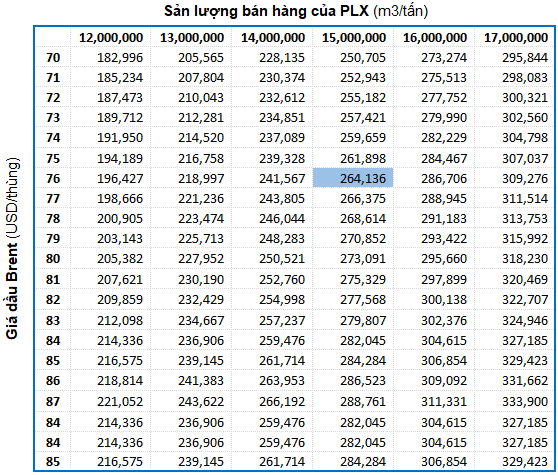

Goldman Sachs forecasts Brent crude oil prices to average $76 per barrel in 2025, based on moderate crude oil surpluses and spare capacity. Meanwhile, concerns about potential supply disruptions from Iran have eased. This suggests that a sideways trend is likely to dominate the market in 2025.

In theory, when fuel prices rise, retailers with larger inventories of lower-priced fuel stand to gain. Conversely, when prices drop sharply, businesses incur significant losses due to provisions for high-priced inventories. Based on Goldman Sachs’ prediction, PLX is not expected to experience a significant transformation in its financial performance next year.

However, there is more room for optimism than pessimism. According to the Ministry of Industry and Trade, the new Decree on fuel business proposes a pricing formula for businesses to calculate prices independently. It also stipulates that the government will announce the price-forming factors, allowing enterprises to determine prices, perform price declarations, and send them to the competent state management agency for supervision. Along with other adjustments, experts predict that these changes will help PLX enhance its profit margins from operations. The fourth draft, which is set to replace Decree No. 83/2014/ND-CP and its amendments, is expected to be approved by the end of 2024 and take effect from early 2025.

PLX’s Revenue Sensitivity Analysis

Source: VietstockFinance

PLX Stock is Fairly Valued

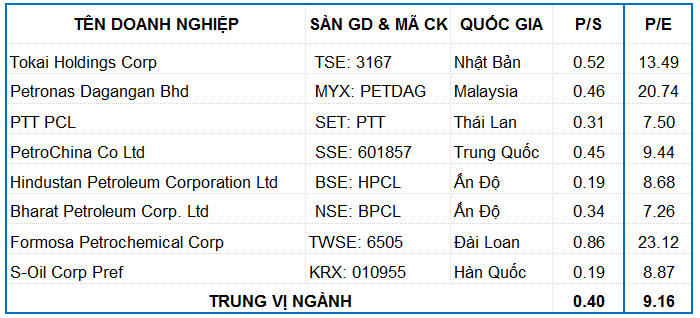

PLX is the leading company in the fuel business, distribution, and retail in Vietnam. Therefore, we use peers from the same industry in the region (India, China, Malaysia, South Korea, etc.) as a basis for fair value calculation.

Comparison Table of PLX and Its Peers

Source: Investing.com

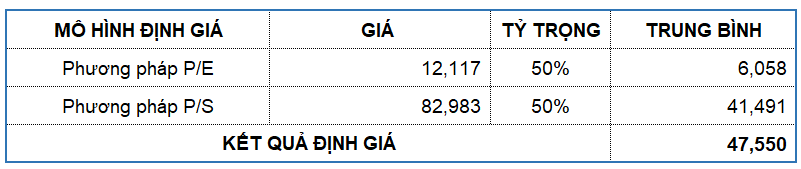

Combining the P/E and P/S methods with equal weightage, we arrive at a fair value of VND 47,550 per share. Thus, the current market price presents an attractive buying opportunity for long-term investors.

Enterprise Analysis Division, Vietstock Consulting Department