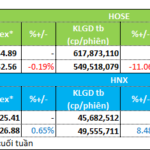

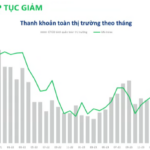

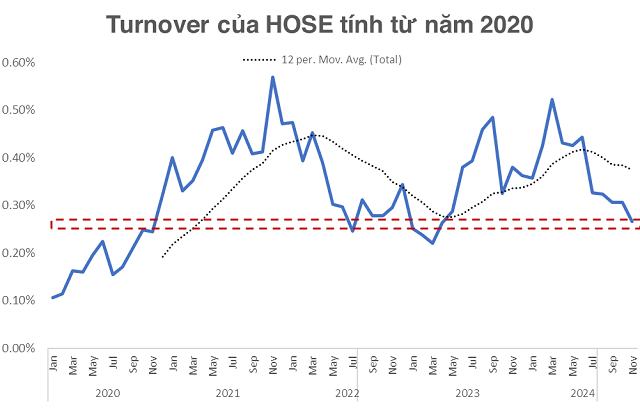

The dullness in liquidity in the first trading sessions of November 2024 has been almost identical to the trough in early 2023. The average trading value on the HOSE floor (including matching) was just VND 13,700 billion/session, the lowest since May 2023. The psychology of the majority of investors in the market has become “jaded” with the market’s movements.

However, the market’s gloom in the current period is hardly comparable to the beginning of 2023, as that was the time when investors had just experienced a huge shock after the VN-Index fell by 32.78% in 2022, the second-biggest damage in history.

Meanwhile, the capitalization of HOSE at the present time has increased by more than 20% compared to the beginning of 2023, to over VND 5,000 trillion.

A measure reflecting the market’s vibrancy, taking into account capitalization, is the Turnover ratio (Trading value/Market capitalization), which will provide more accurate insights for investors. Accordingly, the Turnover ratio of HOSE in November 2024 averaged close to the April 2023 average.

In fact, the dullest period for the market in the last 2 years was in March 2023, with an average Turnover ratio of 0.22%. If the market repeats the gloom of March 2023, the total average trading value of HOSE could fall to around VND 11,000 billion.

This would also be a “rather sad” scenario for investors, as in early 2023, it took us more than 5 months for the money to flow back into the market and confirm the uptrend.

Doubts still arise

“The speculative market is born in gloom, grows through doubt, thrives on optimism, and dies of satisfaction.” One of Sir John Templeton’s famous quotes still holds true for the movements of the Vietnamese stock market.

Even in a dull period like early 2023, the market still had separate opportunities in the group of Public Investment stocks after the simultaneous groundbreaking of 12 component projects of the North-South Expressway Project Phase 2.

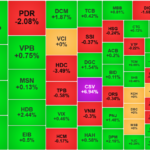

At present, HOSE also sees some stocks arousing investors’ doubts. Some codes have increased well since the beginning of November 2024, such as VTP (+21%), TLG (+15%), SZC (+9%), HVN (+6.7%), and MSH (+5.8%). Among them, VTP has set a new all-time high, while TLG is on its way to conquering a new peak.

It is known that VTP has just invested in the Viettel Logistics Park Project in Lang Son province. The company plans to put this project into operation in 2025, but the investment capital for this project has not been announced.

With TLG, thanks to the momentum from exports, revenue and profit after tax for the first 9 months of 2024 increased by 14% and 53%, respectively.

Looking at a broader perspective, after the trading session on November 8, the short-term uptrend of some stocks has improved, with 43% of codes surpassing the MA20 on the HOSE.

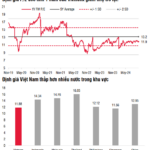

Mr. Nguyen The Minh, Director of the Research and Customer Development Division of Yuanta Vietnam Securities, said: “The election risk has passed, but the psychology of domestic investors is now looking at and wary of each other. Meanwhile, large-cap stocks are still under selling pressure from foreign investors, although the scale of net selling has decreased compared to the beginning of the year. This is still acceptable when capital is not only withdrawn from Vietnam but also from other markets.

Perhaps large-cap stocks need to lower their altitude. But it is not excluded that the market will still have Mid Cap and Small Cap waves even if the VN-Index has not successfully conquered the 1,300-point milestone.”

In general, the expert from Yuanta Securities expects the market to improve in the last months of 2024.

The Surprising Surge of Penny Stocks: A Market Phenomenon

Liquidity saw a significant improvement during the afternoon session; however, funds did not largely flow into the blue-chip stocks. It was the mid-cap and small-cap stocks that witnessed a surge as the liquidity in the mid-cap group increased by 37% compared to the previous day, while the small-cap group witnessed a remarkable 44% increase, leaving the VN30 with just a 14% gain.

SSI Research: Short-term Volatility Presents Buying Opportunities for Long-term Investors

“According to SSI Securities Corporation’s November 2024 strategy report, the SSI Research Center for Analysis and Investment Consulting believes that the market may fluctuate in the short term. However, this also presents an opportunity to buy potential stocks at reasonable prices to build a long-term investment portfolio.”