In the announcement, the Company stated that it would rectify the issue immediately in November 2024 and subsequently disclose all relevant information as required. In fact, SVD promptly addressed the matter, and their website is now back to normal.

Noteworthy among the information disclosed after November 4 were the trading notifications of two family members of Vu Tuan Phuong (CEO of SVD) and his daughter, Vu Phuong Linh.

Accordingly, Mr. Phuong and his daughter respectively sold nearly 5.52 million shares and 1 million shares held to serve their personal financial needs, to be executed in November-December 2024.

Family of a textile company’s CEO intends to sell all their shares

|

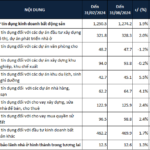

Information disclosed after November 4, 2024

Source: SVD

|

Recently, SVD also drew attention when the Hai Phong Customs Department issued a penalty decision on October 11 for under-declaring tax rates, resulting in an underpayment of taxes. However, the scale of the penalty was insignificant, amounting to just over VND 500,000.

Earlier, on September 23, SVD appointed Board member Le Thi Van Anh as Chairwoman, replacing Mai Anh Tuan, who had resigned. The Company also appointed Mr. Nguyen Van Don as a member of the Board of Directors. These decisions were made at the 2024 Extraordinary General Meeting of Shareholders held on the same day.

The General Meeting also approved the important addition of real estate-related business lines to serve the Company’s development orientation.

The SVD management assessed that after a period of stagnation due to the economy’s impact, the real estate market this year has been more positive than last year, influenced by new laws (housing, land, and real estate business).

The company also believes that alongside the improving demand, real estate prices are on an upward trend.

Given the positive developments in the real estate market, SVD aims to invest in, develop projects, and engage in real estate trading to establish and exploit potential land funds for its future development orientation.

The company intends to use its own capital and mobilize additional funds from individuals and organizations through equity issuance, bond offerings, or bank loans. The total expected investment is unlimited.

This textile company’s foray into real estate comes amid consecutive years of losses in 2022 and 2023, amounting to over VND 2 billion and nearly VND 37 billion, respectively, which led to SVD‘s stock being placed under warning and control from April 10, 2024.

However, the situation seems to have improved in the first nine months of 2024, as SVD‘s business results recovered, with a net profit of nearly VND 2.3 billion, compared to a loss of over VND 12 billion in the same period last year.

The company shared that in the third quarter, domestic product consumption achieved good results. The positive recovery of the domestic market and the increasing demand from customers contributed to more effective production and business operations than in the same period in 2023. Revenue reached nearly VND 102 billion, up 38%, and gross profit was nearly VND 6.2 billion, up 186%.

In addition, the company implemented appropriate sales policies for each product category, optimized the production process, improved labor efficiency, and implemented financial risk mitigation measures to ensure stable profits amid fluctuating interest rates.

| SVD‘s business results are gradually improving in 2024 |

Vu Dang Investment and Trading Joint Stock Company is a member of Vietnam’s textile and garment industry, established in 2013, specializing in producing and supplying OE (open-end) yarn domestically and internationally, with a total output of 800 tons/month.

The company exports its products to various countries, including Turkey, Thailand, South Korea, Malaysia, and especially the Chinese market.

In addition to the yarn market, the company also manufactures 100% cotton towels, such as sports towels, dining towels, kitchen towels, glass towels, face towels, and mats, all woven from the company’s yarn.

Uni Complex Townhomes: Alleviating the Scarcity of Townhome Supply in Binh Duong

The wave of investment in Binh Duong is transformative, driving the growth of premium services and the demand for quality living spaces. Uni Complex is strategically located within the modern infrastructure of Binh Duong New City, offering an attractive proposition to customers with competitive pricing and the potential for future value appreciation.

Why Did Van Xuan Group and Military Bank Agree on a VND 1 Collateral Value?

Introducing Van Xuan Binh Duong, a subsidiary of the esteemed Van Xuan Group, which boasts an impressive shareholding worth 1VND. This valuable asset is not just a number; it serves as a rock-solid guarantee, securely mortgaged at MB Bank’s An Phu branch. With such a formidable backing, Van Xuan Binh Duong stands tall, exuding strength and reliability.

The Elements that Make Thuy Nguyen District (Hai Phong City) an Attractive Investment Destination

Thủy Nguyên District in Hai Phong presents an enticing opportunity for investors with its multitude of favorable factors. The district boasts an array of advantages that make it an ideal location for large-scale urban development projects. With a unique blend of positive attributes, this area is poised to become a thriving hub of activity, attracting attention from far and wide.