Vung Ang 1 Thermal Power Plant in Ky Loi commune, Ky Anh district, Ha Tinh province. Photo: PV Power

|

According to PV Power, October marks the end of the rainy season in the Northern and North-Central regions and the beginning of the rainy season in the South-Central region. The full-month average electricity market price (FMP) is expected to be around 1,420 VND/kWh.

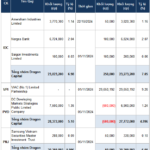

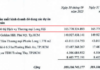

In October, the total electricity output of PV Power’s plants is estimated at approximately 1.3 billion kWh, with electricity revenue surpassing 2,194 billion VND. The Ca Mau 1&2 plants contributed the most to this revenue, accounting for 39% with over 850 billion VND. Following closely, the Vung Ang 1 plant generated over 784 billion VND, making up 36% of the total.

Source: PV Power

|

For the first ten months of 2024, the total electricity output of PV Power’s plants is estimated at nearly 12.7 billion kWh. Electricity revenue exceeded 24,380 billion VND, with the Ca Mau 1&2 plants and the Vung Ang 1 plant contributing the most, with revenues of over 9,263 billion VND and 8,681 billion VND, respectively.

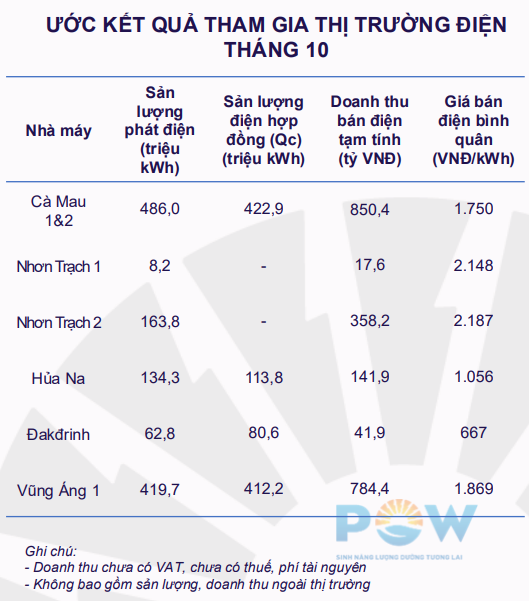

For November, PV Power sets a target of nearly 1.5 billion kWh in electricity output and an expected revenue of 2,729 billion VND, a 24% increase compared to October.

PV Power’s November Business Plan

|

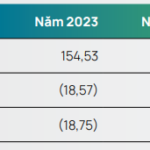

Previously, PV Power’s Q3/2024 consolidated financial statements showed a 7% year-on-year increase in net revenue to over 6,061 billion VND. After expenses, net profit surged 4.7 times compared to the same period last year to 396 billion VND, supported by a 272 billion VND increase in financial revenue, mainly from dividends and foreign exchange gains. Meanwhile, interest expenses, foreign exchange losses on revaluation, and other financial expenses decreased.

| POW’s Quarterly Net Profit for 2022-2024 |

|

|

For the first nine months of 2024, PV Power’s net revenue reached 21,686 billion VND, and net profit was nearly 1,066 billion VND, up 1% and 43%, respectively, compared to the same period last year. Thus, the company has exceeded its annual profit target by 35% after three quarters while achieving 68% of its revenue target.

In the stock market, POW shares have been on a downward trend since mid-July 2024, falling from the 15,000 VND per share region to 11,700 VND per share as of November 8, a 23% drop in the past four months.

| POW Share Price Movement since the Beginning of 2024 |

|

|

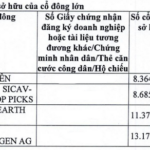

The Race to Surpass: HSC Aims High with a Proposed Capital Increase to Over VND 10 Trillion

The Ho Chi Minh City Securities Corporation (HSC) is planning to offer its existing shareholders a treat. According to the company’s recent extraordinary general meeting documents, the board of directors is seeking approval for a share sale proposal. The offer price? A tempting 10,000 VND per share, equivalent to the par value. And the timing? Well, HSC is eyeing 2025 for this enticing opportunity.

“Celebrating a Milestone: Hoa Binh Hydropower Company Reaches 280 Billion kWh of Power Generation”

On November 9, the Hoa Binh Hydropower Company achieved a significant milestone by producing 280 billion kWh of electricity. This remarkable feat celebrates 36 years of efficient management, operation, and exploitation of the country’s strategic multi-purpose hydroelectric project.

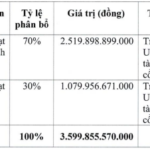

“Foreign Ownership Limit Increased to 70% for TNH, Attracting Big Players to Take a Bite”

The Joint Stock Company TNH Hospital Group (HOSE: TNH) has successfully concluded its public offering of 15.2 million shares, achieving a 100% subscription rate. Following this issuance, foreign investors now hold a substantial 47.74% stake in the company, highlighting the strong confidence and interest from the international investment community.