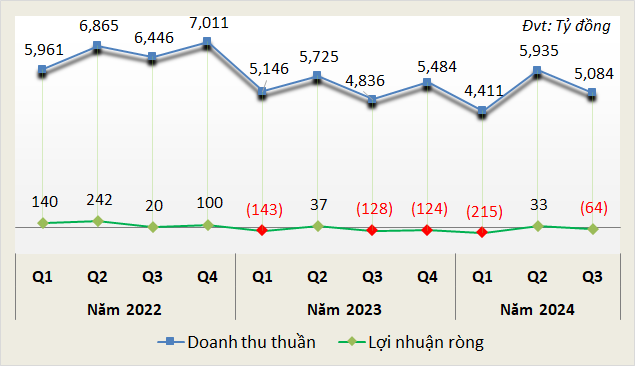

According to statistics from VietstockFinance, out of the 17 cement companies listed on the stock exchange that published financial statements from Q1 2022 to Q3 2024, after a slight profit in Q2, they reported a loss of more than 64 billion VND in Q3, with a loss of over 128 billion VND in the same period last year; while revenue increased by 5%, to 5,084 billion VND.

|

Revenue and Profit of Cement Companies from Q1 2022 to Q3 2024

Source: VietstockFinance

|

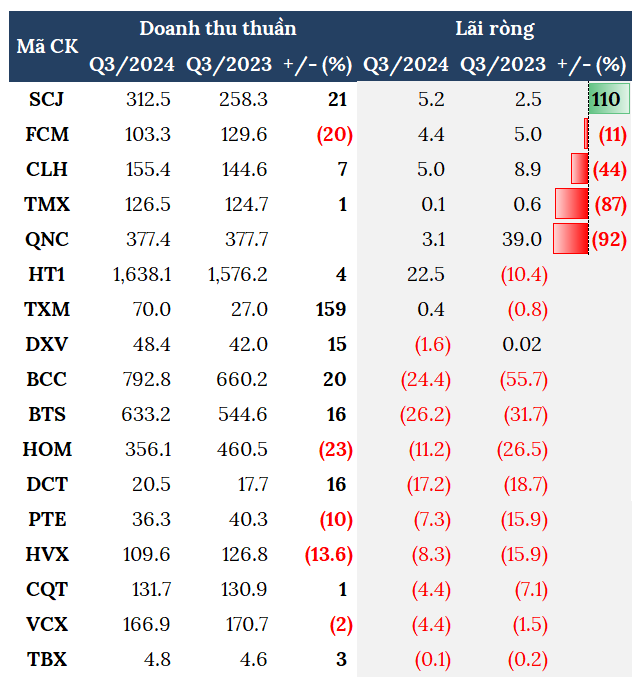

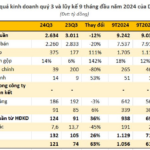

Among the 17 listed cement companies, only 1 company increased its profit, 4 decreased, 2 turned a loss into a profit, 1 turned a profit into a loss, and the remaining 9 companies continued to incur losses.

The only company that reported an increase in profit in Q3 was

|

Financial Results of Cement Companies in Q3 2024 (in billion VND)

Source: VietstockFinance

|

Xi Măng Vicem Hà Tiên (HOSE: HT1) reported a net profit of nearly 23 billion VND in Q3, compared to a loss of over 10 billion VND in the same period last year, thanks to increased cement consumption and reduced costs. Their 9-month net profit reached nearly 44 billion VND, compared to a loss of over 37 billion VND in the previous year; revenue slightly decreased by 4%, to 5,041 billion VND. Compared to the low-base plan for the year, HT1 has exceeded its profit target by 89%, and achieved 72% of its revenue target, making it the brightest spot in the industry in the first 9 months of the year.

VICEM Thạch Cao Xi Măng (HNX: TXM) reported a net profit of nearly 400 million VND in Q3, compared to a loss of 800 million VND in the same period last year. In the first 9 months, TXM’s profit exceeded 1 billion VND, a decrease of 53%. However, the company still incurred a cumulative loss of over 6 billion VND as of the end of September.

TXM stated that their operations in the first 9 months faced significant challenges due to the stagnant real estate market, intense price competition, especially in Th

In a context where most companies in the industry are incurring losses, it is commendable that CTCP Xi Măng La Hiên VVMI (HNX: CLH) maintained a net profit of 5 billion VND, and CTCP Xi Măng và Xây Dựng Quảng Ninh (UPCoM: QNC) achieved a profit of over 3 billion VND, although these figures represent a decrease of 44% and 92%, respectively, compared to the same period last year.

Most companies are still struggling

|

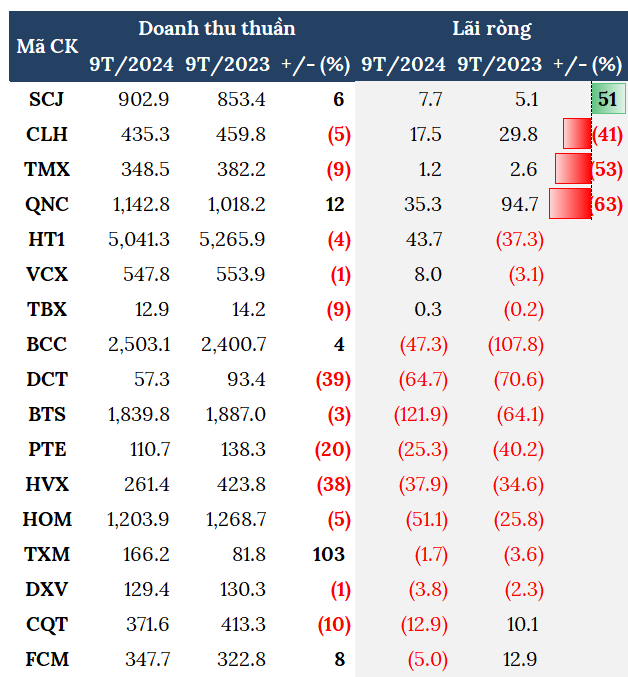

Financial Results of Cement Companies in the First 9 Months of 2024 (in billion VND)

Source: VietstockFinance

|

Xi Măng VICEM Bút Sơn (HNX: BTS) was the company with the highest loss in Q3, reporting a loss of more than 26 billion VND, marking the eighth consecutive quarter of losses (since Q4 2022). In the first 9 months, BTS incurred a net loss of nearly 122 billion VND, compared to a loss of over 64 billion VND in the previous year; while its revenue was nearly 1,840 billion VND, a decrease of 3%.

Xi Măng VICEM Hoàng Mai (HNX: HOM) also reported a loss of over 11 billion VND, compared to a loss of nearly 27 billion VND in the same period last year. In the first 9 months, HOM’s revenue was nearly 1,204 billion VND, a decrease of 5%, and its net loss exceeded 51 billion VND.

HOM stated that the cement industry continues to face challenges due to high supply, intense price competition in both the domestic market and exports, inventory pressure, and excess production capacity. Additionally, the trend of shifting from bagged cement to bulk cement has negatively impacted their business effectiveness, as their brand value is associated with bagged cement.

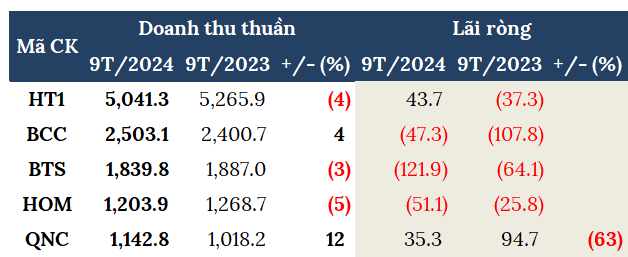

In the first 9 months, 5 companies achieved revenue above 1,000 billion VND, including HT1, BCC, BTS, HOM, and QNC. Among them, QNC experienced a 63% decrease in profit, resulting in a profit of over 35 billion VND; HT1 turned a loss into a profit; while the other 3 companies continued to incur losses.

|

Top Companies with Revenue above 1,000 Billion VND in the First 9 Months (in Billion VND)

Source: VietstockFinance

|

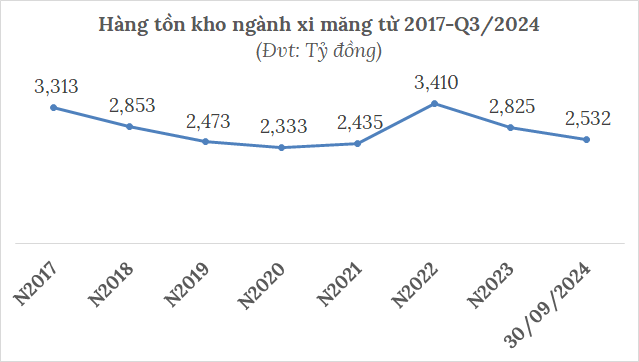

As of the end of September, the total inventory value of the listed cement companies exceeded 2,500 billion VND, a decrease of over 10% compared to the beginning of the year. HT1, the industry leader, accounted for more than 30% of this inventory value, with nearly 790 billion VND in inventory, an 11% decrease from the beginning of the year. The value of HT1’s finished goods was nearly 432 billion VND, an increase of 11% compared to the beginning of the year.

Source: VietstockFinance

|

Is the cement industry still uncertain?

The cement industry continues to face numerous challenges in production and consumption due to various factors such as high fuel and energy prices, including coal prices. Additionally, weak domestic consumption resulting from slow implementation of public investment projects and a stagnant real estate market has impacted the industry.

In 2024, the domestic market is expected to consume approximately 60-62 million tons of cement. Meanwhile, there are currently 61 operating cement plants in the country, with a total designed capacity of 117 million tons/year, and an actual production capacity that could exceed 130 million tons/year. This disparity between consumption and capacity highlights inefficiencies and potential waste, as well as the impact on the livelihood of workers in the industry.

In the first 9 months of 2024, domestic cement consumption remained at a low level, similar to the previous year, and cement exports decreased by more than 4%, reaching 22.5 million tons.

Amid these challenges, some companies have resorted to reducing their selling prices to offset maintenance costs.

Profitable Third Quarter for Vietnamese Giants: Vietnam Airlines Soars with Impressive Profits, While Real Estate and Textile Companies, Including Quốc Cường Gia Lai, Report Exponential Gains

Coteccons (CTD) has announced a net profit of VND 93 billion for the first quarter of the 2024-2025 fiscal year, marking a significant 39% increase from the same period last year.

The Mighty Makeover: “Camau Protein’s Quarterly Profit Plunge: Hoarding a Staggering $9,000 Billion in Cash”

The explanation provided in the consolidated financial statements attributes the almost 63% increase in profit to the reduction in cost of goods sold, which outpaced the decrease in revenue. Additionally, this year’s revenue deductions were significantly lower than those of the previous year, contributing to the substantial growth in profit.