With an issuance rate of up to 50% (shareholders owning 2 shares are entitled to purchase 1 new share) and nearly 720 million shares currently in circulation, HSC plans to offer an additional 360 million new shares to its shareholders. This will bring the total number of shares to nearly 1.08 billion, corresponding to a charter capital of VND 10,800 billion.

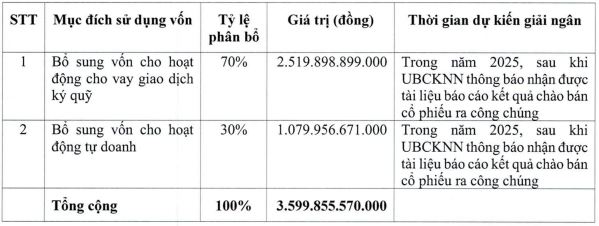

According to the plan, HSC will utilize the approximately VND 3,600 billion raised from this issuance to increase the operating capital of the Company, thereby expanding its margin trading and underwriting capacity.

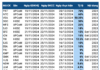

Specifically, the Company intends to allocate nearly VND 2,520 billion (70%) to supplement capital for margin lending and nearly VND 1,080 billion (30%) for underwriting activities. The disbursement is expected to take place in 2025.

The General Meeting of Shareholders authorized the Board of Directors to modify the capital usage plan, with the value of changes not exceeding 50% of the proceeds from the issuance, as stipulated by laws. The Board of Directors is also required to report to the General Meeting of Shareholders at the nearest meeting.

|

HSC’s Capital Usage Plan

Source: HSC

|

It is understandable why HSC aims to boost its margin and underwriting activities, as these two segments contributed to a slight increase of 4% in net profit in the third quarter compared to the same period last year, amounting to over VND 222 billion.

Overall, HSC‘s financial performance for the first nine months of this year has been positive, with operating revenue increasing by more than 50% year-on-year to nearly VND 3,100 billion, resulting in a 64% rise in net profit to VND 813 billion.

HSC attributed this positive outcome to improved market liquidity and market share, which had a favorable impact on the Company’s brokerage and margin lending revenue. Additionally, the Company’s underwriting performance was boosted by favorable market conditions in 2024.

As of September 30, 2024, HSC‘s total assets amounted to VND 32,715 billion, with equity reaching VND 10,057 billion. The earnings per share (EPS) for the first nine months of 2024 stood at VND 1,391 per share.

| HSC’s Net Profit in Recent Quarters |

“DIG Increases Ownership in Cap Saint Jacques Building Operator to 99.9%”

In a disclosure dated November 7, Construction Development Investment Corporation (HOSE: DIG) announced that it had increased its ownership stake in its subsidiary, DIC Tourism Joint Stock Company (DIC Hospitality), from 78.3% to 99.9%.

“Foreign Ownership Limit Increased to 70% for TNH, Attracting Big Players to Take a Bite”

The Joint Stock Company TNH Hospital Group (HOSE: TNH) has successfully concluded its public offering of 15.2 million shares, achieving a 100% subscription rate. Following this issuance, foreign investors now hold a substantial 47.74% stake in the company, highlighting the strong confidence and interest from the international investment community.

“A Stunning Turnaround: Novaland’s Q3 Profits Soar to Over 3,000 Billion VND”

Despite an exceptional surge in profits during the third quarter of 2024, Novaland Group (Novaland), listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker symbol ‘NVL’, faces the grim prospect of historical annual losses. With a staggering cumulative loss of over VND 4,000 billion in the first nine months of the year, the real estate giant is struggling to stay afloat.

“Q3 2024: NVL Records Impressive Profits, Requests HOSE to Lift Warning”

Previously, HOSE placed NVL stock in alert status from September 23 onwards due to the listed entity’s delay in submitting its semi-annual 2024 financial statements, which exceeded the regulated deadline by over 15 days. Concurrently, HOSE also included this stock in the list of those subjected to margin cuts.