Vietnam’s Textile and Garment Industry Targets $44 Billion in Exports for 2024

The industry has seen a boost in orders, with exports stabilizing after a challenging 2023. According to recent data from the General Statistics Office, in the first ten months of 2024, textiles and garments ranked fourth among Vietnam’s top export commodities, reaching VND 30,572 billion, a 10.5% increase compared to the same period last year.

Textile and Garment Exports Increase by 10.5% Year-on-Year

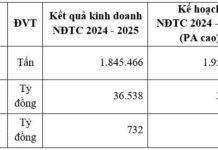

As a leading player in the industry, the Vietnam National Textile and Garment Group (Vinatex) reported a more than 7% increase in export turnover for the first nine months of 2024 compared to the same period in 2023. Their business results for the first three quarters achieved 73.6% of the plan, a 2% increase year-on-year, while profits reached 80% of the plan, a surge of over 70% from the previous year.

Vinatex’s leadership also noted that most of Vietnam’s key export markets for textiles and garments are showing positive signs of recovery. Specifically, inflation in the US, Vietnam’s largest market, eased to 2.5% in August 2024, the lowest since March 2021, while retail sales for the month rose 2.11% year-on-year. Europe’s economy is also showing signs of stabilization, with inflation at 2.4% in August, the lowest since June 2021, and a slight increase in retail sales. In Japan, the country’s second-largest market, GDP grew by 2.9% year-on-year in the second quarter of 2024, a 7% increase from the previous quarter. Although inflation remains high, there is a slight upward trend in household spending.

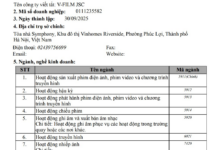

Thanh Cong Textile Garment Investment Trading Joint Stock Company (TCM) has secured approximately 92% of its quarterly revenue plan for the fourth quarter and about 90% of its annual revenue plan for 2024. In addition to their traditional products, TCM is focusing on environmentally friendly and recycled high-value products to enhance their product value chain. They are also exploring new markets while expanding their domestic market presence.

With forecasts of improved export conditions in the remaining months of the year and based on their order intake, TCM is optimistic about achieving their annual plan. Mr. Le Tien Truong, Chairman of Vinatex, attributes the recovery in export orders to the shift of orders from China, Bangladesh, and Myanmar to Vietnam. Inventory levels in key markets such as the US, Europe, and Japan have been trending downward compared to the previous year, and improving consumer demand has led to a rebound in orders from partners.

“It is expected that orders for the garment industry in the fourth quarter of 2024 and the first quarter of 2025 will remain abundant, although prices have not improved significantly,” said Mr. Truong. “In the long term, when the interest rate reduction policies in major markets positively impact their economies, creating stable jobs and purchasing power, prices will improve,” he added.

CPTPP Provides a Significant Boost

According to Mr. Vu Duc Giang, Chairman of the Vietnam Textile and Apparel Association (Vitas), free trade agreements have significantly contributed to the industry’s growth. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has opened up new markets for Vietnamese textiles and garments, such as Canada, Australia, and New Zealand. It has also helped businesses adapt to the purchasing practices of importers within the bloc, leading to notable growth in exports to intra-bloc countries, particularly in the Americas.

A report from the Ministry of Industry and Trade highlights the textile and garment industry as one of the sectors benefiting the most from the CPTPP agreement.

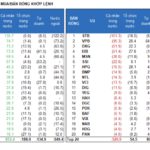

Vietnam Customs data shows that the export turnover of textile and garment products to 10 CPTPP partner markets in July 2024 reached US$660.11 million, a 22.58% increase from the previous month and a 10.86% increase year-on-year. In the first seven months of 2024, exports to CPTPP member countries increased by 6.94% year-on-year to nearly US$3.66 billion, accounting for 18.05% of Vietnam’s total textile and garment exports to all markets.

The strongest growth was seen in exports to Mexico. Although it only accounted for 3.25% of the industry’s total export turnover to CPTPP member countries in the first seven months of 2024, exports to Mexico surged by 31.84% compared to the same period last year.

Despite these positive results, Mr. Giang pointed out that Vietnamese businesses face intense competition when exporting to CPTPP markets. For example, compared to Bangladesh, Vietnam has higher labor costs and social insurance and medical expenses. Bangladesh also enjoys preferential tariffs as a least developed country, while Vietnam has to fulfill comprehensive commitments in new-generation free trade agreements.

However, Vietnamese businesses have the upper hand when it comes to geographical location, large port systems, and the ability to produce diverse high-value products, such as suits, winter coats, and swimwear, with a rich variety of designs and quick delivery times.

Export Target of $44 Billion is Within Reach

Vitas believes that the industry’s export target of $44 billion for 2024 is achievable, especially with the year-end peak season for holiday orders for Christmas and New Year. The Institute for Strategy and Trade Policy Research (Ministry of Industry and Trade) shares this view, adding that the political crisis in Bangladesh, a major garment exporter, presents an opportunity for Vietnamese garment businesses to expand their market share globally.

Despite the positive outlook, the Chairman of Vinatex advises businesses to remain cautious, especially those producing raw materials, as they have faced challenges for the past 30 months. Businesses should tightly manage their production and business activities, closely follow their plans, effectively identify and prevent risks, and be prepared for any unforeseen circumstances to achieve their annual plans and seize opportunities in 2025.

The Abundant Orders: Vietnam’s Textile and Garment Industry on Track to Achieve $44 Billion Export Target

The Vietnam Textile and Apparel Association (Vitas) asserts that the textile industry’s 2024 export target of $44 billion is well within reach. The end of the year typically sees a surge in production orders for the Christmas and New Year festive season, which bodes well for meeting this ambitious goal.