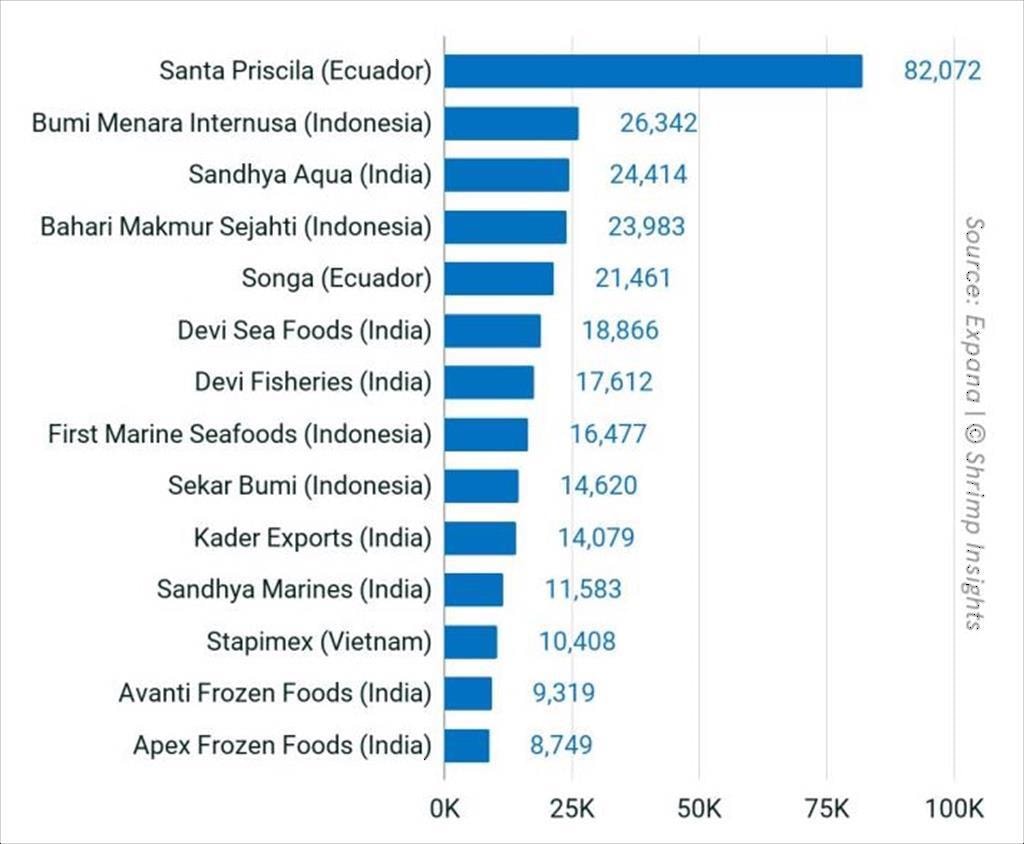

Vietnam Association of Seafood Processors and Exporters (VASEP) revealed that, according to Shrimp Insights, with over 10,000 tons of shrimp exported to the US market in 2023, Stapimex, a leading seafood company, ranked among the top 15 shrimp suppliers in the US that year. They were also the sole representative from Vietnam on this list.

Estimated supply volume from the top 15 shrimp suppliers in the US in 2023 (According to Shrimp Insights)

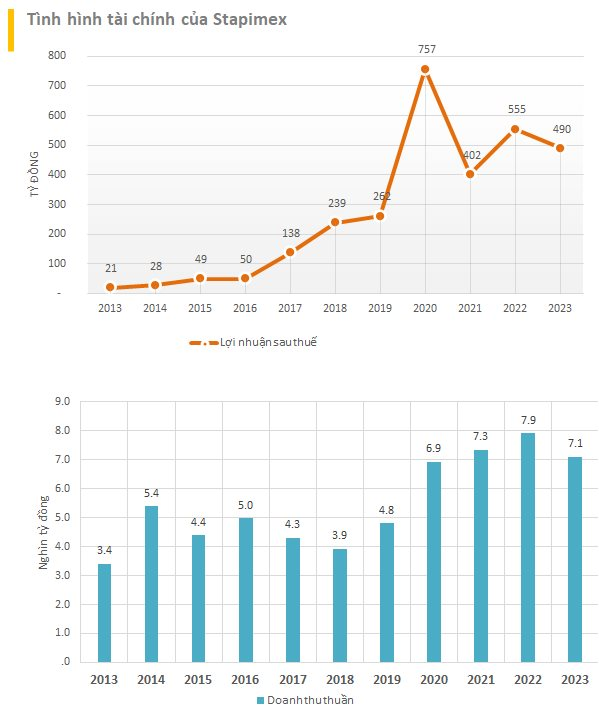

In 2023, Stapimex surpassed other major players in the shrimp industry to become the most profitable shrimp enterprise. However, compared to their performance in 2022, Stapimex’s business results took a step back in 2023.

Specifically, Stapimex’s audited financial statements for 2023 showed a 10% decrease in revenue year-over-year, amounting to 7.101 billion VND. Despite significant cost reductions, especially a 50% decrease in selling expenses compared to the previous year, their after-tax profit still declined by 12%, totaling 490 billion VND.

As of the end of 2023, Stapimex’s charter capital was a modest 77.5 billion VND, and their owner’s equity stood at 2.613 billion VND, derived from accumulated profits after tax (over 995 billion), capital surplus (over 109 billion), and Development Investment Fund (1.453 billion VND).

Their total assets amounted to 2.616 billion VND, including a significant surge in cash and cash equivalents, which increased by 65.5 times compared to the previous period, reaching 785 billion VND. Stapimex has always been known for not engaging in long-term borrowing. However, in 2023, the company significantly increased short-term borrowing to supplement their working capital.

Despite the setbacks due to market challenges, 2023 marked the year when Stapimex once again rose to the top in terms of profitability in the industry. Previously, in 2020, Stapimex had surpassed Minh Phu Group, led by Mr. Le Van Quang, to become the most profitable shrimp enterprise, with a net profit of 757 billion VND, surpassing Minh Phu by 1.2 times (617 billion VND) and Fimex VN by 3.3 times (225 billion VND).

Stapimex also boasts an impressive EPS, surpassing its peers in the industry listed on the stock exchange. With an owner’s equity of 2.613 billion VND and 7 million outstanding shares, their book value (BV) per share climbed to nearly 370,000 VND.

In terms of seafood, Stapimex boasts superior financial metrics compared to Minh Phu, as they don’t pursue large-scale farming but focus on procurement and processing. While Minh Phu owns thousands of hectares of farming areas, feed mills, and hatcheries, operating a closed-loop model, Stapimex has a modest 70-hectare farming area.

Mr. Ta Van Vung, CEO of Stapimex, shared with Forbes Vietnam that the company solely focuses on procurement and processing, attributing this decision to limited resources for farming, feed, and breeding, as well as the lack of extensive land to implement such operations. Aside from the aforementioned 70-hectare farming area, approximately 40% of the input materials for Stapimex’s two enterprises come from partnerships with six cooperatives spanning 500 hectares. The remaining 60% is sourced externally.

Stapimex has a tradition of paying high cash dividends. In July, they distributed an interim cash dividend for the first period of 2024 at a rate of 50%, equivalent to 5,000 VND per share. For six consecutive years, from 2015 to 2019, Stapimex paid cash dividends at a rate of 50%. During the 2020-2023 period, this figure doubled to 100%.

Why FDI Flows into Vietnam Slowed in 2024 and Which Sectors Benefited from a Trump Presidency?

Foreign direct investment (FDI) inflows into Vietnam slowed in 2024 but are expected to continue on an upward trajectory, even with the implementation of new US tax laws.

The Electric Revolution: Vietnam’s Chance to Lead or Fall Behind in the New Era.

The CEO of Dat Bike shed light on two pivotal trends: the shift from gasoline to electric vehicles and the move to diversify manufacturing away from China. These trends, when intersecting, present a unique opportunity to forge a new industry.

The Fashion Brand Lep’ Shuts Down: A CEO’s Heartfelt Letter on the Reasons for Closing After 8 Years

The fashion brand, Lep’, has just announced via their Facebook fan page that they will be closing all their stores. This surprising news has left many fans of the brand shocked and saddened. As Lep’ has built a strong reputation for its unique and trendy designs, this abrupt announcement has certainly caught the attention of the fashion industry and its loyal customers.