Questioning the Governor of the State Bank, Mr. Tran Anh Tuan, a representative of Ho Chi Minh City, asked the Governor to provide solutions to stabilize the foreign exchange market and exchange rates, as well as measures to reduce interest rates to improve people’s access to credit.

Governor Nguyen Thi Hong answers questions, morning of November 11

|

In response, Governor Nguyen Thi Hong of the State Bank of Vietnam acknowledged the complex developments in the international monetary market. After a period of tightening, the US Federal Reserve loosened its monetary policy, and many central banks around the world also lowered interest rates and adjusted their monetary policies. The US dollar has been fluctuating complexly, with periods of sharp decline, and since the third quarter, it has increased and is currently fluctuating at high levels.

These developments, according to Ms. Hong, have impacted the domestic foreign exchange market. “Stabilizing the exchange rate and foreign currency is challenging because it depends on the actual supply and demand in the market, meaning the amount of foreign currency spent in the economy and the revenue generated,” said Ms. Hong.

In addition, the foreign exchange market still faces dollarization, so it is affected by significant psychological expectations. That is, organizations and businesses that have foreign currency do not sell it, and even when they do not need foreign currency, they buy it, so this is a challenge for management. However, Ms. Hong stated that the State Bank remains steadfast in its goal of flexible management of exchange rates and foreign currencies, in line with market developments. Currently, the exchange rate is allowed to fluctuate by +/- 5%. “When the market fluctuates too much, the State Bank will consider selling foreign currency to stabilize and meet the people’s needs,” the Governor informed.

Delegate Tran Hong Nguyen – Binh Thuan Province Delegation

|

Ms. Tran Hong Nguyen, Vice Chairman of the Legal Committee, raised concerns about bad debt. “How does the Governor evaluate bad debt, and what are the solutions to reduce it in the banking system? If it cannot be reduced, how will it affect monetary management?” she asked.

In response, Governor Nguyen Thi Hong acknowledged that bad debt tends to increase. According to the State Bank’s data, by the end of September, the ratio of bad debt on the balance sheet was 4.55%, almost equal to the level at the end of 2023. This figure is higher than the 2% recorded in 2022. “This is the reality because, since 2020, COVID-19 has caused difficulties for people and businesses. They have reduced income, and unable to repay bank loans, resulting in bad debt,” said Ms. Hong.

To control bad debt, the State Bank requires banks to carefully assess customers’ repayment capacity before lending and to control new bad debt. For existing bad debt, banks are urged to step up measures to urge customers to repay and auction off collateral for bad debt. However, Ms. Hong admitted that this is “also difficult in the current context.”

As a consequence of increasing bad debt, according to the Governor, banks have to reduce lending rates while still paying interest on deposits from the people, while customers cannot repay their loans. Nevertheless, Ms. Hong stated that the State Bank has taken several measures to lower lending rates, requesting banks to cut operating costs to further reduce lending rates for businesses and people. In the past, banks have waived or reduced VND 50,000-60,000 billion in interest rates to support customers.

“Supporting credit but still controlling inflation”

Delegate Nguyen Thi Viet Nga – Hai Duong Province Delegation

|

Delegate Nguyen Thi Viet Nga (Hai Duong Province) pointed out the difficulties faced by businesses in production and operations, with a 21% increase in the number of businesses withdrawing from the market. “In the future, what practical solutions will the State Bank propose to the Government regarding credit and capital to support businesses in production and operations, meeting development goals?” she asked.

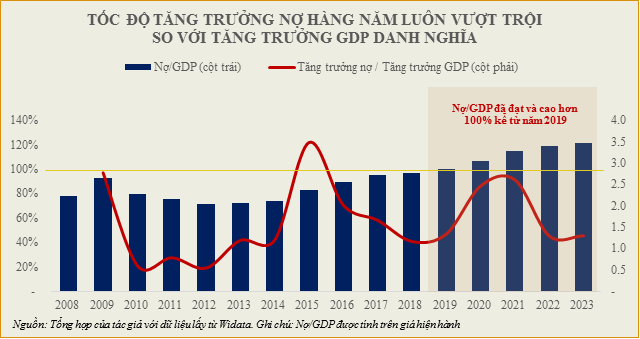

In response, Governor Nguyen Thi Hong stated that Vietnam has a unique characteristic in that the demand for investment in production and business activities heavily relies on capital and credit from banks. Currently, the credit balance index to GDP is over 120%, so the State Bank must be very cautious in its credit management. To address capital issues, the State Bank has advised the Government to strengthen capital sources for businesses and people.

Capital for production and business includes self-owned capital, bank loans, and direct and indirect foreign investment or debt. If businesses are capable of borrowing and repaying foreign capital on their own, there is a legal framework for that. She suggested that businesses and people consider finding suitable capital sources. Organizations and individuals must also meet the conditions and standards to be eligible for loans, and most importantly, they must have the ability to repay.

“For businesses and people to have the ability to repay, they must have feasible business projects and plans, which require support and solutions from many related ministries and sectors, such as market solutions, legal advice, and product solutions, and guarantees,” said Ms. Hong. The State Bank will strive to implement credit support solutions while controlling inflation.

‘The safety of the credit system must come first’

Delegate Ho Thi Minh raised concerns about some banks rushing to increase credit growth and the potential risks associated with providing credit for real estate growth.

Governor Nguyen Thi Hong replied that the State Bank’s management objective is to control inflation, stabilize the macro-economy, and ensure the safety of the banking system. “The safety of the credit system must be given the highest priority because if the credit system is at risk, there will be significant consequences for the economy,” she said.

Therefore, for many years, the State Bank has used credit limits as a regulatory tool, implemented since 2011. Vietnam’s peculiarity is that it relies heavily on the banking system for capital, so there were times when credit growth exceeded 30%, and in some years, it even reached over 50%, causing risks and consequences for the banking system. For example, some banks mobilized short-term capital but lent it for medium and long-term purposes. The State Bank has applied credit limits based on the ranking of banks and their expansion capacity. The State Bank also regularly warns banks with high credit growth that may pose risks.

Regarding real estate credit, Ms. Hong reiterated that the State Bank does not prohibit lending to the real estate sector. Banks do not lend solely based on the repayment capacity of real estate businesses but also consider their ability to mobilize short-term or long-term capital sources. The State Bank stipulates that banks must not lend more than 30% of short-term capital for medium and long-term loans.

Why is there an Idle Budget of 800,000 Billion Dong Deposited at the State Bank?

The Governor of the State Bank of Vietnam revealed that funds deposited with the State Treasury, when not in use, are primarily held in large commercial banks. More recently, these funds have been transferred to the State Bank. Approximately 80% of the VND 1 quadrillion is now deposited with the State Bank.

The Rising Tide of Bad Debt: A Major Challenge for the Banking Sector

The sharp rise in non-performing loans in Q3 2024, coupled with a decline in lending, presents a significant challenge for the banking industry. This worrying trend is a red flag, indicating that without swift and effective action, the banking system could be facing substantial financial risks in the near future.

The Market’s Dour Outlook on Gold Prices as “Risk-On” Assets Reign Supreme Post-Trump Victory

Last week’s markets were dominated by the US Presidential election, and the precious metals sector was no exception, as expected. What was surprising was the pace of the volatility and the aggressive sell-off in gold, which has left market participants pondering the yellow metal’s future direction.

The Currency Financial Market Stability

According to a report by the Ministry of Planning and Investment, the economy in October and the ten-month period showed a strong recovery despite ongoing challenges and difficulties. Economic and social activities rebounded quickly after natural disasters and floods. In October, several international organizations upgraded their growth forecasts for Vietnam in 2024, predicting it could be the highest among ASEAN+3.