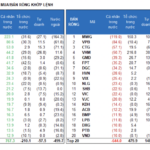

The central exchange rate between the Vietnamese Dong and the US Dollar, as announced by the State Bank of Vietnam today, stands at 24,278 VND per USD, a decrease of 5 VND from the previous day.

With a permitted fluctuation margin of 5%, commercial banks are allowed to trade within a range of 25,492 VND per USD as the ceiling and 23,064 VND per USD as the floor for today.

The reference exchange rate for USD at the State Bank’s Trading Center is currently set at 23,400-25,450 VND/USD (buying – selling).

Free-falling USD value. Photo: Nam Khánh |

Commercial banks have adjusted the USD selling and buying rates downward today.

In terms of selling rates, commercial banks unanimously decreased the USD value by 6 VND from yesterday’s listing, all pegging it at the maximum allowable rate of 25,491 VND/USD.

On the buying side, banks have also lowered their offers, with some reducing their buying rates by nearly 100 VND compared to the previous day’s opening rate.

Specifically, Vietcombank opened today’s trading session with a cash purchase rate of 25,121 VND/USD, marking a 46 VND drop from the previous day’s trading session (November 7th).

Similarly, BIDV decreased their buying rate by 6 VND, offering 25,191 VND/USD. VietinBank followed suit, reducing their buying rate to 25,145 VND/USD, a 76 VND decrease.

In the private banking sector, Techcombank slashed their USD buying rate by 98 VND, settling at 25,107 VND/USD.

Sacombank also joined the trend, offering a buying rate of 25,210 VND/USD, 90 VND lower than before.

Eximbank adjusted their cash purchase rate downward to 25,120 VND/USD, a 50 VND reduction from the previous day’s listing.

Following suit, the free market witnessed a sharp decline in USD buying rates after a substantial increase of 145 VND in the previous session.

Foreign currency exchange booths in the free market are currently trading USD at a range of 25,500-25,800 VND/USD (buying – selling). Compared to the previous session, today’s free market USD rates have dropped by 245 VND on the buying side and 45 VND on the selling side.

On the international front, the US Dollar stabilized after a significant decline yesterday following the US Federal Reserve’s decision to cut interest rates for the second time this year.

Hanh Nguyen

The Greenback’s Rally: USD/VND Hits All-Time Highs as Banks Push the Ceiling

The U.S. dollar index (DXY) hovers around a four-month high as markets react to Donald Trump’s decisive victory in the U.S. presidential election. This development underscores the pivotal role that political events can play in shaping global economics and currency dynamics.

The Financial Currency Market: A Stable Investment Haven

According to a report by the Ministry of Planning and Investment, despite facing challenges and difficulties, the economy in October and the ten-month period showed a strong recovery. Economic and social activities rebounded quickly after natural disasters and floods. In October, several international organizations upgraded their growth forecasts for Vietnam in 2024, predicting it could be the highest among ASEAN+3.

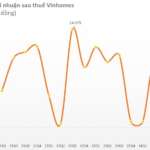

Unveiling the Mastery of Craftsmanship: Vinhomes’ Assets Surpass Half a Trillion Ahead of Vietnam’s Historic Stock Market Deal

For the nine-month period ended September 30, Vinhomes recorded a consolidated net revenue of VND 69,910 billion. The company’s consolidated after-tax profit stood at VND 20,600 billion.