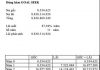

In today’s trading session (11/11), the State Bank of Vietnam announced the central exchange rate between the Vietnamese dong and the US dollar at 24,263 VND/USD, a decrease of 15 VND from last week’s closing level.

With a 5% margin, commercial banks are allowed to trade within a range of 25,476 VND/USD as the ceiling and 23,050 VND/USD as the floor for today.

The reference exchange rate for USD at the State Bank’s trading session remains stable, fluctuating around 23,400-25,450 VND/USD (buying-selling).

At commercial banks, USD rates continue to decline in both buying and selling prices.

Specifically, at the beginning of today’s trading session, Vietcombank set the buying and selling rates for cash USD at 25,085 VND/USD and 25,455 VND/USD, respectively, a decrease of 36 VND from last Friday’s (8/11) opening rates.

USD rates at commercial banks weaken. Photo: Nam Khánh |

Similarly, compared to the rates on the morning of 8/11, BIDV reduced their buying rate by 76 VND and their selling rate by 36 VND, resulting in buying and selling rates of 25,115-25,455 VND/USD.

VietinBank also adjusted their buying and selling rates for USD to 25,075-25,435 VND/USD, a decrease of 70 VND and 56 VND, respectively.

USD rates at private banks followed a similar downward trend.

Techcombank, compared to last week, lowered their buying rate by 50 VND and their selling rate by 36 VND, offering a buying rate of 25,057 VND/USD and a selling rate of 25,455 VND/USD.

Sacombank’s USD rates stood at 25,080-25,450 VND/USD (buying-selling), an 80 VND decrease in the buying rate and a 41 VND decrease in the selling rate.

Eximbank reduced their buying and selling rates by 40 VND and 15 VND, respectively, resulting in cash USD rates of 25,080-25,476 VND/USD.

In the previous week’s trading session, banks also adjusted their USD rates downward, with one bank reducing their buying rate by nearly 100 VND.

In contrast, USD rates in the free market moved upward. This morning, USD rates in the free market were quoted at 25,570-26,670 VND/USD, an increase of 50 VND in both buying and selling rates compared to the previous session.

Currently, the buying rate for USD at banks is approximately 500 VND lower, while the selling rate is about 200 VND lower than in the free market.

In the global market, the US dollar index (DXY), which measures the strength of the US dollar against a basket of major currencies, remained steady at the start of the week. At 10:19 am on November 11 (Vietnam time), the index stood at 104.98 points, a slight decrease of 0.01% from the previous session.

Hanh Nguyen

The Greenback’s Rally: USD/VND Hits All-Time Highs as Banks Push the Ceiling

The U.S. dollar index (DXY) hovers around a four-month high as markets react to Donald Trump’s decisive victory in the U.S. presidential election. This development underscores the pivotal role that political events can play in shaping global economics and currency dynamics.

The Greenback’s Turbulent Ride

The USD exchange rate has been surging across various banks and is now eyeing the peak of 25,450 VND per USD.