SMC’s Annual General Meeting was held in April 2024 at the Phu My Factory, Phu My 2 Industrial Park, Ba Ria-Vung Tau Province. Photo: SMC

|

“Both domestic and international steel markets are facing numerous challenges, with steel prices and demand continuously declining. The instability in the real estate sector has also significantly impacted our business operations,” SMC shared in a document sent to the State Securities Commission and the Ho Chi Minh City Stock Exchange (HOSE).

The steel trading company has even intensified its efforts in liquidating assets and financial investments, along with focusing on addressing overdue debts. However, the situation has not shown substantial improvement.

SMC recorded notable profits in the first quarter of the year, mainly attributed to the sale of its investment in Nam Kim Steel Joint Stock Company (HOSE: NKG). Nevertheless, losses incurred in the following two quarters have pushed the company’s distributable profit after tax back into negative territory.

SMC’s shares have already been placed under warning and control by HOSE since April 10th of this year, due to consecutive years of losses and negative profit after tax from the audited consolidated financial statements in 2023.

|

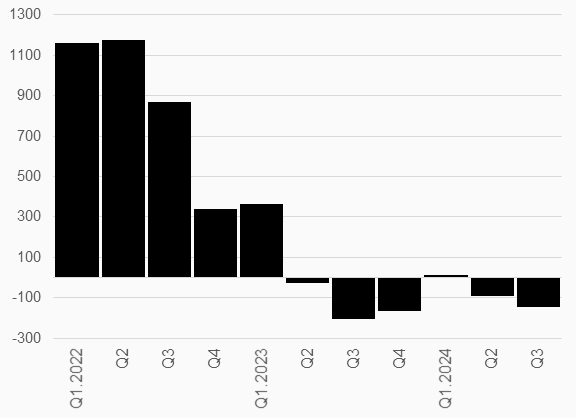

Negative Territory

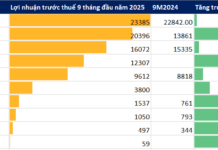

SMC’s profit after tax (consolidated) has eroded over the past two years Unit: VND billion

Source: VietstockFinance

|

Thua Van

The Surprising Surge of Penny Stocks: A Market Phenomenon

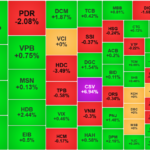

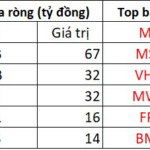

Liquidity saw a significant improvement during the afternoon session; however, funds did not largely flow into the blue-chip stocks. It was the mid-cap and small-cap stocks that witnessed a surge as the liquidity in the mid-cap group increased by 37% compared to the previous day, while the small-cap group witnessed a remarkable 44% increase, leaving the VN30 with just a 14% gain.

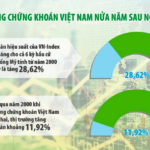

The Foreign Sell-Off: VN-Index Takes a Tumble

On November 6, the 47th US Presidential Election saw a victory for billionaire Donald Trump, sparking a surge in the Dow Jones Industrial Average of over 1,500 points. The S&P 500 and Nasdaq Composite also reached new record highs. The VN-Index witnessed a significant boost, climbing 15 points, while gold prices took a downturn. However, in subsequent trading sessions, the VN-Index extended its decline as foreign investors continued their selling spree, and gold prices unexpectedly rebounded.