The State Treasury has bought enough US dollars necessary for bond payments. Photo: LE VU

|

Buyer – Seller

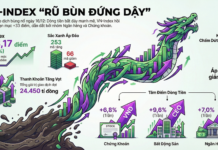

On October 23, 2024, the US dollar price in the unofficial market unexpectedly increased by 240 VND, bringing the increase since the end of September to 460 VND. But just a day later (October 24), the US dollar price in this market suddenly dropped by 300 VND. In the official market, the US dollar buying price of commercial banks also decreased by about 40 VND in the last session of the week (October 25) and the beginning of this week (October 28), while the selling price fell slightly – only by 10 VND. Meanwhile, the central exchange rate of the US dollar to the Vietnamese dong also decreased by 8 VND in these two sessions.

The cooling-down of the US dollar-to-VND exchange rate in both the official and unofficial markets is believed to be influenced by the State Bank of Vietnam’s (SBV) latest market intervention policy. On October 24, the SBV announced the plan to sell foreign currency at the rate of 25,450 VND/USD, marking the first sale since July. Previously, from mid-April to July this year, the SBV was estimated to have sold $6.4 billion from foreign exchange reserves.

Contrary to previous expectations about the possibility of the regulator resuming foreign currency purchases, the sharp increase in the US dollar in recent days, especially the tension in the official market, has forced the SBV to resume the policy of selling foreign currency. Affected by the international market, with the USD Index rising by 4.3% since the beginning of October, along with the resurgence of the gold market, the US dollar transaction price at banks has increased by 3-3.3% during the same period and approached the US dollar price in the unofficial market, which rarely happens.

|

It can be seen that in addition to the impact of the international market, the exchange rate in Vietnam from the beginning of October may also be partly affected by the State Treasury’s surging demand for foreign currency purchases. |

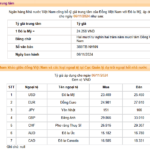

Contrary to the SBV’s announcement of foreign currency sales, on October 24, the State Treasury (ST) released a notice of its intention to buy foreign currency from banks, with a maximum volume of $240 million. This foreign currency will be purchased on a spot basis on October 25 and paid on October 29. The simultaneous timing of the announcements by the SBV and the ST seems to indicate that the SBV is providing foreign currency supply to meet the ST’s demand, reducing the pressure on the official market.

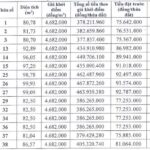

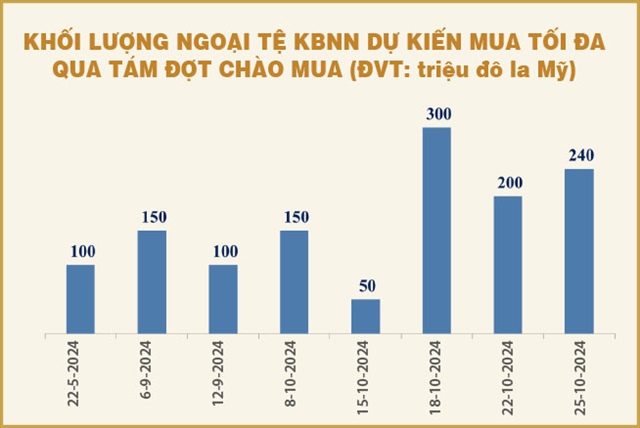

Statistics show that this is the ST’s eighth foreign currency purchase since the beginning of the year, including one purchase in May, two in September, and five in October. Based on the maximum volume stated in the ST’s notices, the corresponding amount of foreign currency to be purchased is $100 million in May, $250 million in September, and $940 million in October. Thus, in addition to the impact of the international market, the exchange rate in Vietnam from the beginning of October may also be partly affected by the State Treasury’s surging demand for foreign currency purchases.

The ST’s foreign currency purchase is likely to prepare funds for the payment of $1 billion in international bonds that will soon mature. Specifically, the $1 billion bond with a fixed interest rate of 4.8%, a term of 10 years, and issued in November 2014 will mature in November 2024. It is known that at the time of the bond offering, there was also a swap transaction of two government bonds previously issued in the international capital market, with maturities in 2016 and 2020.

Has the pressure subsided?

The current US dollar interest rate in the market is relatively high, as the US dollar base rate of the US Federal Reserve (Fed) remains at 5% after the first rate cut in September. Instead of continuing to issue new international bonds to seek foreign currency to repay the maturing bonds, Vietnam may have chosen to settle the 2014 bonds with domestic foreign currency sources and wait for a more favorable time to reconsider issuing international bonds.

|

Although this may have an impact on the domestic foreign exchange market, as reflected in the recent surge in US dollar prices at banks, with the ST having bought enough US dollars necessary for bond payments, the short-term pressure on the exchange rate may have passed. However, the exchange rate in Vietnam until the end of this year will likely remain unpredictable due to geopolitical and economic instability.

The upcoming US presidential election on November 5, 2024, will have an immediate impact. Currently, analysts believe that if Donald Trump returns to the White House, the US dollar could continue to strengthen due to policies that attract investment inflows into the US to create more jobs for Americans, while also increasing taxes on major trading partners, which could bring back inflation and make the Fed cautious about further rate cuts.

In fact, there are increasingly high expectations that the Fed does not necessarily have to cut rates quickly anymore, as inflation risks remain while the economy is still growing well. Notably, the Fed’s pace of policy easing, reflected in the number of rate cuts, has been slower than some other central banks, such as the European Central Bank (ECB), the Bank of England (BOE), the Bank of Canada (BOC), or even the People’s Bank of China (PBoC). Therefore, investors still prefer to hold US dollars, contributing to the appreciation of this currency.

Especially in the context of the escalating military conflict in the Middle East and the potential for a wider war, as well as potential geopolitical instability in other regions, many investors will seek safe-haven assets, including gold and the US dollar.

Given these impacts, the pressure on the domestic exchange rate may not end soon, especially when the international payment balance this year may face a return to deficit, despite the large trade surplus and positive foreign direct investment disbursements. Meanwhile, the solution of selling foreign currency to intervene in the market cannot be sustained for a long time, based on the current foreign exchange reserves, which are no longer as abundant as in the past.

Thuy Le

The Greenback Falls: Bank Rates and Free-falling Dollar Values

The US dollar weakened significantly against other currencies in the global market, causing a substantial drop in USD bank rates and the open market rates. Some banks lowered their buying rates by almost 100 VND, while the open market buying rates fell by over 200 VND.

The Financial Currency Market: A Stable Investment Haven

According to a report by the Ministry of Planning and Investment, despite facing challenges and difficulties, the economy in October and the ten-month period showed a strong recovery. Economic and social activities rebounded quickly after natural disasters and floods. In October, several international organizations upgraded their growth forecasts for Vietnam in 2024, predicting it could be the highest among ASEAN+3.